Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Filing, printing, post-filing

- :

- Filing

- :

- Claiming Trade Tools on TurboTax

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming Trade Tools on TurboTax

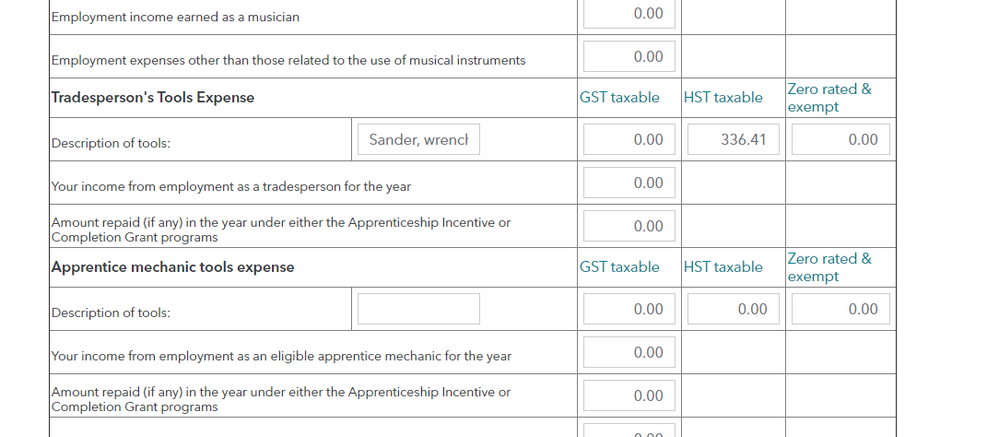

On the "Other Employment Expenses" page under "HST taxable" should I enter just the amount I spent on HST on my tools, or the total cost of the tools? I have entered an amount of $336.41 (the HST only) and nothing has changed on my return. If it is supposed to be just the HST entered on this line, is there somewhere else I am supposed to enter the full value of the tools? If not, would there be another reason that I am not seeing a change?

Thankyou for your time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Claiming Trade Tools on TurboTax

In my experience all HST rebates and such are done separate from the tax return, so not sure why they are asking you for the HST...

My guess is only tools that you were charged HST on qualify to be entered there.

I understand them to be asking for the total amount that is taxable with sales tax, so the $100, not the $13.

But I don't know!

Also most of my 'tools' go through the CCA process (depreciated over time), but I'm not a tradesperson so it seems to be different for you!

Related Content

kinsuntse

Level 1

s.la.teague@gmai

New Member

Jkramer0451

New Member

loadpoi

Returning Member

boxlight

Level 1