- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

After you file

@ LittleBluestem wrote:If it is required that I do it all after logging on to EFTPS.gov, then why is it that TurboTax Desktop asked me for a payment source and payment date for EFTPS during my original return preparation? Requesting that info and then - if what you suggest is correct - doing nothing with that info makes no sense to me.

Are you sure you are not confusing "EFTPS" with simple "EFT?" EFTPS is a service from the US Treasury that requires an account and verification at the EFTPS website. With such an account, one can pay several types of tax payments, file an extension, and other tasks.

EFT, however, is a generic term that just means "Electronic Funds Transfer." There are several types, but one common type of EFT is through the ACH (Automated Clearing House.) Direct debits and direct deposits commonly travel through ACH from bank to bank.

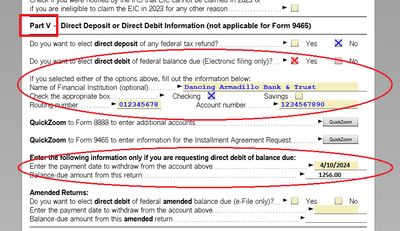

Since you are using the desktop version, there are a couple of ways to see what you chose. Go into Forms Mode, and in the left column list of forms choose "Info Wks." That brings up the Federal Information Worksheet. Scroll down to Part V, and see if your direct debit choice shows up there. Here's a sample image. Click to enlarge.

.

.

Also, while you are in Forms Mode, you can look at the Return Summary as well as the Filing Instructions. Those should also have information on how you chose to pay your balance due. Those are down near the bottom of the Federal list of forms.