- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Deductions & credits

@ jmarka wrote:I found it. I would like your thoughts on this. Some is repeat.

This 1099-MISC is oil and gas royalty and there is an amount in box 2, box 4 federal income tax withheld, and the applicable section for State. One the back of the form, written in by the company, is are columns labeled "Deductions" and "Production Tax" and "Net".

TT calculated an amount for "depletion". Is this included in the Deductions amount provided by the company? TT also provided a box for "Taxes" and I put the Production Tax amount in it.

I may need to call the company but please give me any thoughts you have. Thank you.

I'm a fellow user, not a tax person.

No, depletion is not a deduction taken out of your checks by the oil/gas company. Deductions are usually oil company expenses like marketing, transportation, compression, pipeline charges, etc. that they pass along to the royalty owner and take out of the checks. Depletion is an additional expense you get to claim in addition to the oil/gas company deductions and is a calculation. In the Premier Edition, for percentage depletion TurboTax should automatically calculate the depletion allowance and populate the depletion field. TurboTax likely took the gross royalty figure (Box 2) from your 1099-MISC and multiplied it by 15%. If you wish, you can perform that calculation and see if it equals the figure TurboTax arrived at.

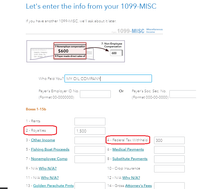

I'm not sure which "taxes" box you are referring to. There are a couple of different places where you could have entered the production taxes depending on which screens you encountered. Here are 2 images you may have encountered. If you entered the production taxes in the first image, then I believe it should also automatically show up already entered in the second image as well. NOTE: These images are from Online TurboTax. If you are using desktop software, the screens might look a little different. If you are referring to the first image, be sure you don't put the Federal or State withholding tax there. I've provided a 3rd image below which shows where the Federal withholding tax is entered.

.

.

Here's an image of the 1099-MISC entry screen you may have encountered where you can show the Box 4 Federal withholding and the state tax info. (I couldn't get the bottom part for the state info on the same image.)