- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

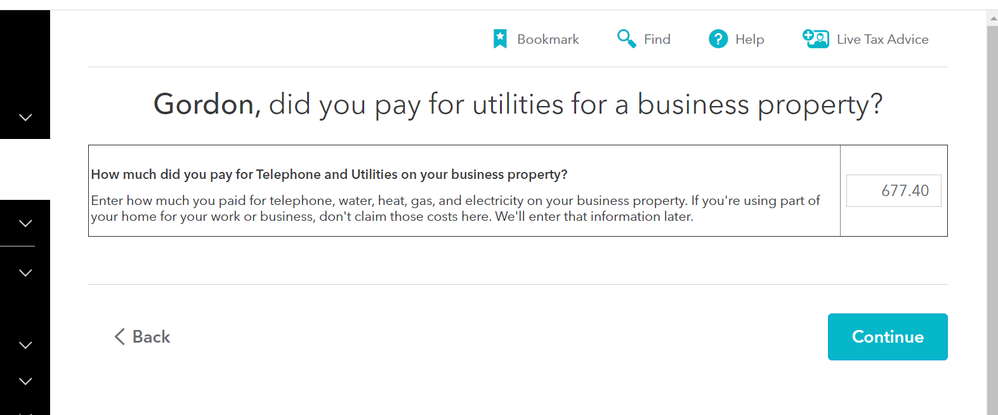

If you are self-employed, record any costs that you incurred that helped you earn any self-employment revenue on Form T2125, Statement of Business and Professional Activities. To find Form T2125 click on Income then click on self-employed. You will then have to answer some questions and go through some pages, once you get through them you will get to Form T2125 where you can enter your information. There will also be a page where it will ask if you paid for any telephone and utilities you may enter your prorated amount here or in the appropriate category.

April 8, 2021

11:21 AM