- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

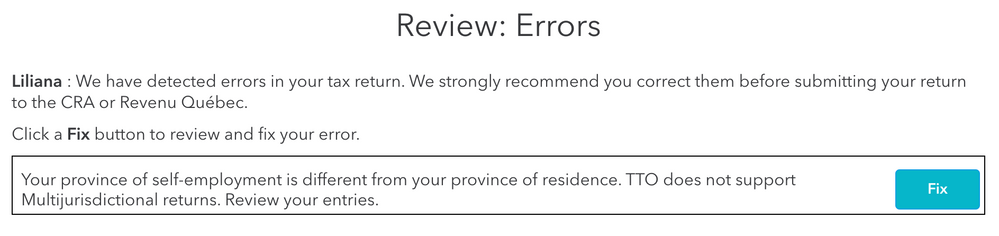

Fix error "TTO does not support Multijurisdictional returns"

Hi,

I tried to submit my taxes, but I got the error "Your province of self-employment is different from your province of residence. TTO does not support Multijurisdictional returns. Review your entries."

Checkbox on " I was self employed (freelancer, contractor, independent worker, professional, commission-based, farming, fishing)" is not checked and I have entered just T4 and T4E, no other T-slip. Can someone help me to fix this error? I'm using Turbotax online to submit my taxes for 2019.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

Unfortunately, this is not something that can be fixed in TurboTax. CRA does not allow many software versions, including TurboTax, to support the T2203 Form - Provincial and Territorial Taxes – Multiple Jurisdictions and NetFile.

They require that this form be attached to a paper filed return and mailed in. The form can be found here: T2203 Provincial and Territorial Taxes for 2019 - Multiple Jurisdictions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

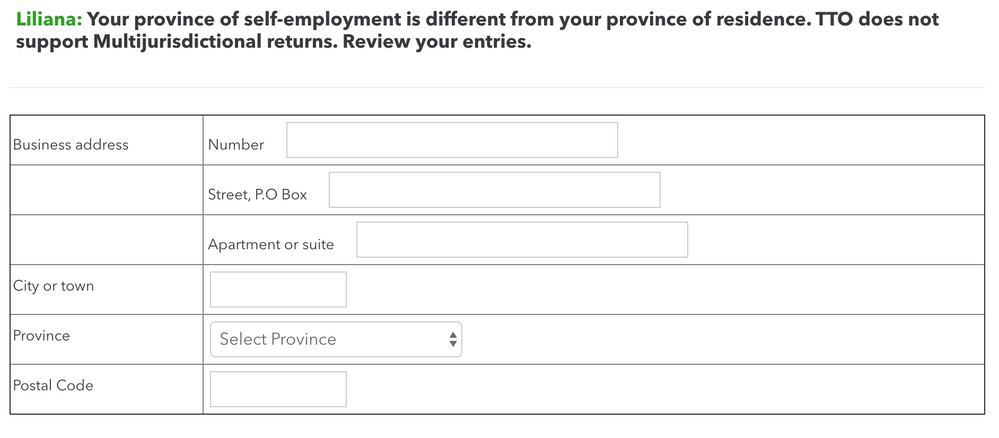

Thanks for your answer but I think I was not clear describing my issue. On my income section I have just T4 and T4E. I have no self-employment and I didn't check that box on wizard. When I try to submit, I get the error with the option to fix it and when I click "Fix" button I get to the page that is saying "Your province of self-employment is different from your province of residence. TTO does not support Multijurisdictional returns. Review your entries." and asks me for business address!!! Which Business address I an no self-employed. Why is asking me about it? Do I have anything checked, where should I look? I can't submit my taxes because of this error and I don't know where is coming from. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

Hi,

Due to that error, I can't NETFILE the return 2020. Any body can help me how to FIX that Error. Thanks so much.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

I got the same error and started all over again and was able to Netfile. Perhaps I had selected a box I wasn't supposed to select and unselected it... sometimes if you do that, it still keeps that information for some odd reason.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

I had the same problem. I went to Income > Self-Employment Profile, then checked "Professional, Commission, and/or Other type of business." When I "continued" through, there appeared a phantom business with an income of $0. All I had to do was delete that business, then go back to Income > Self-Employment Profile and uncheck "Professional, Commission, and/or Other type of business" again. Then I just went back to My Info > Get Started to make sure that "I was self-employed" was still unchecked. After that, I stopped getting the error. I hope that helps!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

I am struggling with this same problem but I am not able to click through any off the self-employment information without paying for the upgraded version. I am NOT self-employed and did not indicate I was at any time on this return? So confusing.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

after following the above steps(and if the program updated you to the self employed version because you checked off the business/professional box) you should be moved to businesses where you should delete the excess business. Press continue a couple times, making sure to say select you aren't reporting any income for a self employed business. Next go back to income>get started and continue through it all, then jump to review and file to see if errors gone.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

did a fix for you? this is happening to me and I can't get it to work.