To not claim CCA this year, you just have to leave it to zero, and you will be able to claim it next year.

Thank you for choosing TurboTax.

It doesn’t let you zero it out. Anyways figured out I can go to forms and select override field to change it to zero

Your TurboTax Canada software is really poorly designed.

How come does it force me to claim CCA deduction for rental income if I know that this isn't in my best long-term interest considering my personal situation?

There's no way to prevent the software from claiming CCA except by going into the T776 form and forcing a zero in the CCA claim. Then your software doesn't let me e-file and I have to mail a phone book size return. It's incredibly disappointing as you've been told for years it's an issue and it still isn't fixed!

Wait say what ??? I’ve always claimed CCA so it’s never been an issue. This year is the first year I don’t want to claim CCA so I zeroed it out manually.

are you saying that will prevent from net filing ? Unfortunately I can’t test it out until they fix schedule 3 locked form, but if that is the case, then I better start redoing my taxes on a different software cuz I am not about to mail out this huge package.

@milly101 You should be able NETFILE even if you have overridden your CCA claim to make it zero. This is one of the few cases where you can override and still NETFILE your return.

That's great then. Last year when I forced a 0 into the CCA claim for rental income I couldn't e-file and had to paper file because of this.

Just wanted to update that I was able to Netfile with having adjusted CCA to zero. So if there was issues in previous versions, this is no longer the case with TT24

@milly101 Glad to hear that, and thanks for the update!

I have overridden my CCA to adjust the CCA that turbotax automatically populates, but my wife and I have shared ownership of the properties. I am claiming my full CCA and my wife is zeroing out her portion of the CCA. She is able to netfile, but I am not. My override shows that I am only using half (my portion) of the available CCA, otherwise turbotax would deduct the full CCA available, which includes the portion of the CCA that my wife didn't use. So, it looks like turbotax only lets you netfile if the CCA is zeroed out with one owner.

Turbo Tax has NOT fixed the CCA override / NetFile submission. Yes, you can override the your CCA claim. However, once you do so attempts to netfile your return fails due to the override. You must mail in your returns ($13.50).

I override my CCA claim and was able to netfile with no issues, it was fixed with the latest update.

As of 5 minutes ago, I am still not able to NETFILE with the CCA override.

@jfs0110 You can override (F2) and would be able to Netfile.

Where to you go to override the CCA. thanks, Stuart

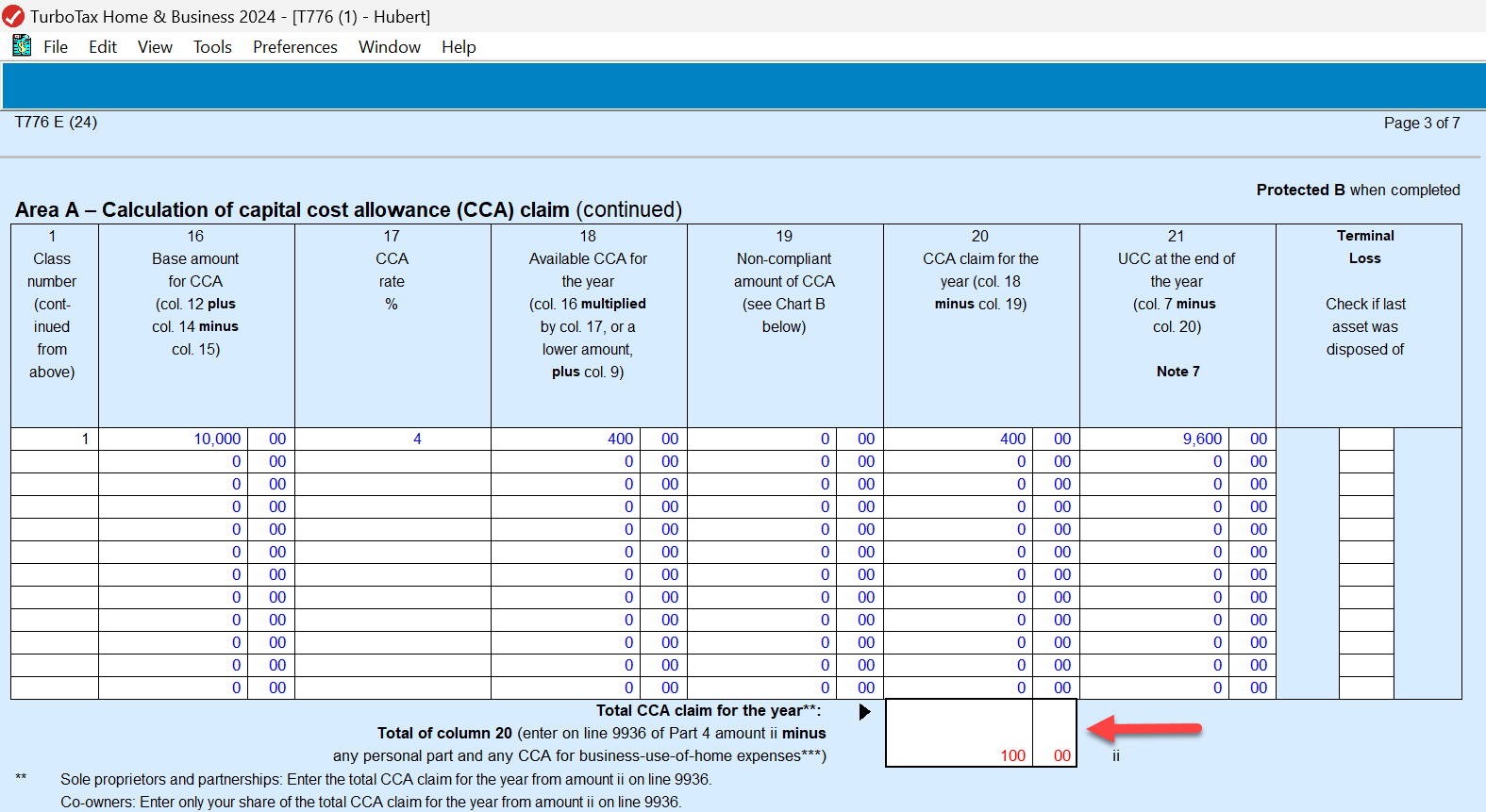

To override the amount of CCA that you are claiming, click once into the total box in column 20, then select Edit > Forms Override from the top menu. You should now be able to change the amount.

You should be able NETFILE even if you have overridden your CCA claim to make it zero. This is one of the few cases where you can override and still NETFILE your return.

Except it wouldn't let me Netfile with the override as I showed you with my previous screen shot. Also, for 2025, TP-128 Quebec rental property forms do not calculate the CCA properly. Specifically, column 16 is supposed to add columns 12+14 and subtract column 15 and populate a CCA % rate in column 17. It does neither of those things and therefore real estate depreciation is not included for Quebec and creates a delta reported on the CRA 776 forms. Is this a bug that will be fixed soon?