- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Investors & landlords

- :

- Re: Schwab 1099-b error with less than 10000 transactions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schwab 1099-b error with less than 10000 transactions

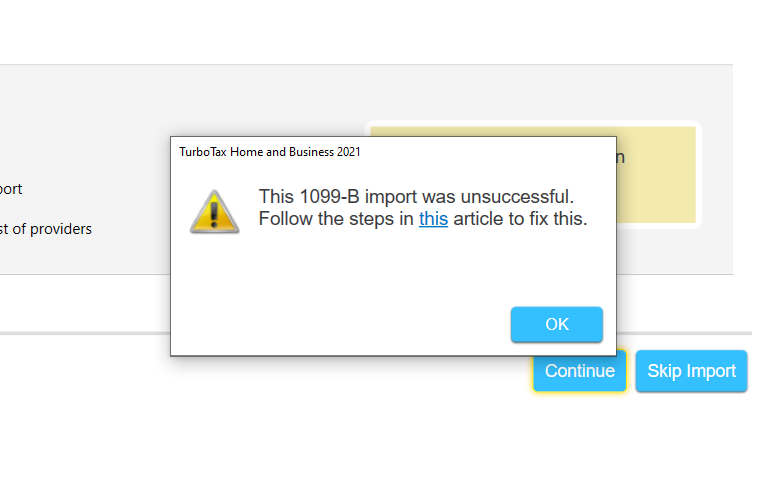

I have an issue connecting my TurboTax home and business desktop app to Schwab to import my 1099-b. i spent many hours on the phone with support to explain the issue and troubleshoot. Eventually, i got help with second tier support and a case opened to fix the issue. This week i received an email saying the issue has been fixed. But when I try to import the Schwab 1099-b I now get a new error : "This 1099-B import was unsuccessful. Follow the steps in this article to fix."

That article only says if you have more that 10,000 transactions, Turbo tax cannot import, but i checked and i have less that 10k transactions, so should be able to import the 1099-b.

The alternative offered to use the summary amounts is not feasible as it asks me to send my statement with individual transactions to the IRS and that is several hundred pages. How can get this fixed or get a refund of my turbo tax cost?

I had a similar issue last year and had to be on support for several hours, but eventually TurboTax had an update with a fix.

I have seen some suggestions to use Tax Act , as that program allows you to attach a pdf of the 1099-b and you don't have to mail the statements.

Does anyone know if Tax Act can import the current year tax form i have already completed with TurboTax so i don't have to reenter everything I already entered in TurboTax into Tax Act?

I have read that Tax Act can import tax returns from a pdf of the return. but i am not sure if tax act will import the current year tax return from a pdf.

Thank you

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schwab 1099-b error with less than 10000 transactions

The issue should be fixed. To ensure your software is working properly after the fix, please check for updates or update manually using the steps listed here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schwab 1099-b error with less than 10000 transactions

thanks for your help, but this didn't work either. I updated the application manually by downloading the update file per the instructions.

I am not sure where to go from here.

I filed an extension as I am getting a refund, so hopefully after the busy part of the tax season is over, I can actually speak to a rep again and get this sorted out or get a refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schwab 1099-b error with less than 10000 transactions

Here is a work around since there are two possibilities. One, there is a transaction limit, you may exceeding the 2,000 transaction mark. Second, On all returns, 1099-B Quick Entry Table Cost/Basis input is giving an error for values above 21,474,836.47.

Instead, you can manually type in a summary of one or all 1099-B forms. You can enter 4 lines and cover the form(s).

Enter the totals for each:

- short term covered

- short term non-covered

- long term covered

- long term non-covered

When you enter summary data only, you are required to send a copy of your 1099B to the IRS. Once you submit your electronic copy, TurboTax prints out a cover letter and instructions on where to send a copy of your 1099B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schwab 1099-b error with less than 10000 transactions

thanks for your reply.

No, this wont work, that was my original issue, i have 800 pages of transactions and not feasible to mail hard copy to the irs, i need the product to do its job and work properly.

Thank you

I'm looking for a fix to import all my transactions. if tt cant do that it doesn't work for me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schwab 1099-b error with less than 10000 transactions

If you are using TurboTax online, you can upload a pdf copy of your 1099-B, to follow-up on the comments from @AmyC, but you will probably need to compress the file size of your 1099-B given the number of pages. TurboTax online can upload a file size up to 4 MB.

At least for the 2021 tax season, uploading a pdf file is not an option in TurboTax CD/download.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schwab 1099-b error with less than 10000 transactions

You’re kidding right? This happening still in Feb 2023!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schwab 1099-b error with less than 10000 transactions

Ditto on "A transaction limit in 2023???" - I have 4 accounts with 1099s and 5 IRAs at Fidelity - 1 account likely has more than 10,000 transactions but all imports fail so I'm stuck with manual entry for all accounts - how do I get my money back???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schwab 1099-b error with less than 10000 transactions

Can you try to follow the steps in the FAQ link provided below and see if this resolves your issue? If not, please respond back here and let us know:

How many stock transactions can TurboTax handle?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schwab 1099-b error with less than 10000 transactions

The link is a poor work around. Manual entry for INT, DIV and ST Covered, ST Uncover, LT Covered and LT Uncovered, some with additional Checkboxes for each of four 1099s as well as 5 IRAs is a huge time sink and fraught with potential errors. TurboTax's advantage is the time-saving automation- that's gone now.

Additionally, its only 1 account that exceeded the 10000 transaction limit but because that one 1099 fails, all other imports are aborted as well. Why not allow the other 8 imports to continue? Why is there still a 10,000 transaction limit in the year 2023???

The knock-on effect is that I cannot efile completely and have to hardcopy print-out (304+5+9+4)=324 pages of PDF and USPS mail to the IRS - that will cost at least $20 in postage + time just to send my 1099s. Why can't we attach the PDF to the efile?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

skyfx

Level 2

sadesai

Level 2

Tom in Raleigh

Level 4

louis-stilp

Level 2

amxmag

New Member