Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Investments & rentals

- :

- Re: I am splitting income rental on a property with my wife, I am using UCC to offset the income tax due. Should I Half the "UCC Start of Year" as turbo tax uses wholeamount

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am splitting income rental on a property with my wife, I am using UCC to offset the income tax due. Should I Half the "UCC Start of Year" as turbo tax uses wholeamount

Topics:

posted

November 6, 2019

12:02 PM

last updated

November 06, 2019

12:02 PM

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I am splitting income rental on a property with my wife, I am using UCC to offset the income tax due. Should I Half the "UCC Start of Year" as turbo tax uses wholeamount

As CCA is an optional claim, you have the choice of how much to claim, as well as which spouse takes the claim or both can claim it.

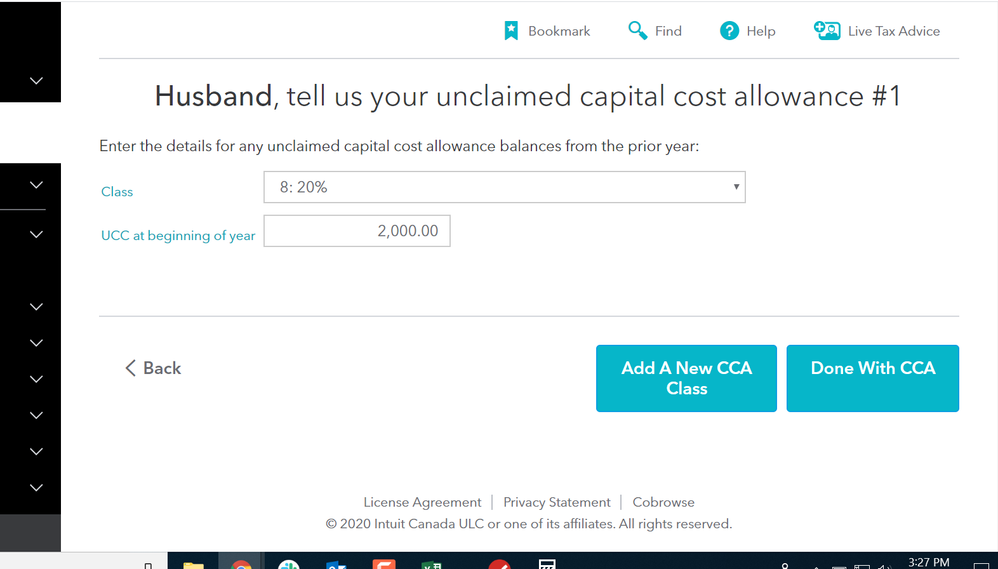

- If you choose to claim the entire CCA available for that particular class: Enter the entire UCC amount in TurboTax under your name and make the full claim. (Example, Class 8 has a UCC of $2,000. Enter $2,000 as your UCC amount and claim the entire $400 available).

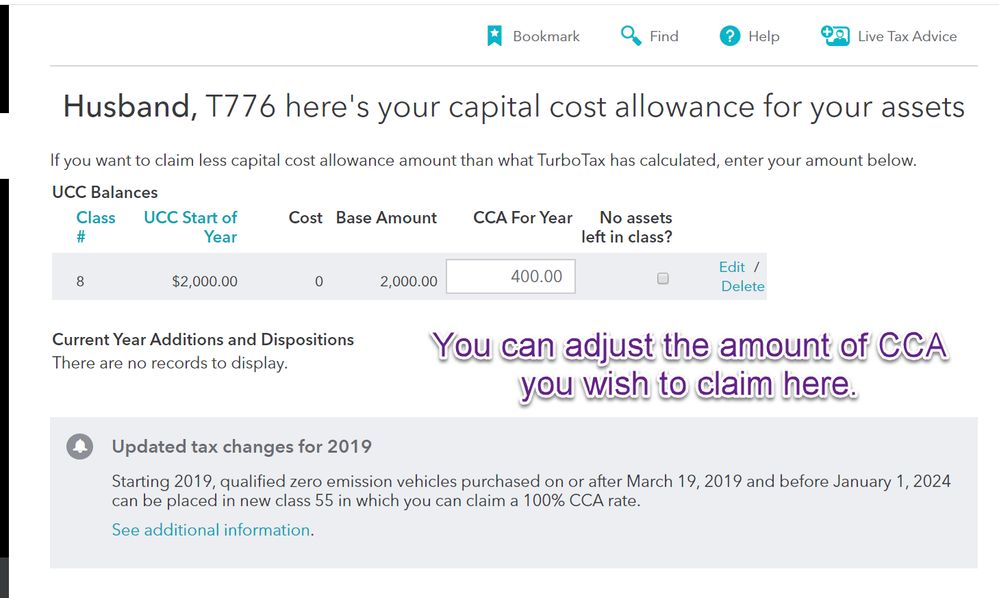

- If you choose to only claim 50% of the available claim: Enter 100% of the UCC amount in TurboTax under your name, then "edit" the amount to adjust the CCA you wish to claim.

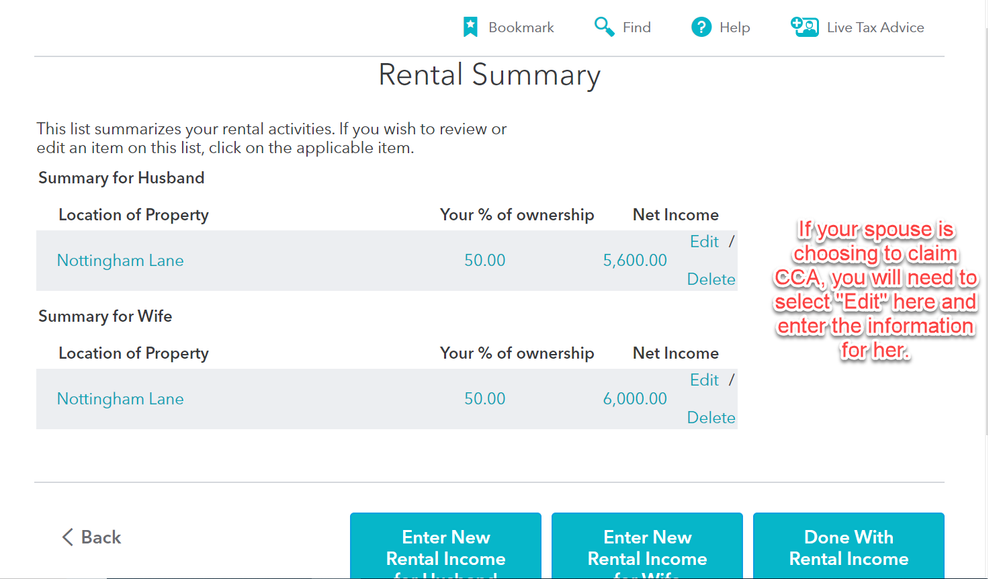

- If both spouses wish to claim a percentage: Adjust the UCC amount to the percentage each spouse wishes to claim. (Example: Both wish to claim 50% of the Class 8 amount, the UCC would be entered as $1,000 for each)

NOTE: You will likely have to do some editing or adjust the amounts in TurboTax Online if both spouses are claiming CCA in order to get the correct percentages.

You'll want to make sure at no time does your UCC amount exceed what is available. For example: If both spouses were to enter the $2,000 UCC for Class 8, you would, in fact, be doubling it.

January 27, 2020

12:58 PM

Related Content

m0rristhecat2021

New Member

jrwarscott

New Member

harnananc-gmail-

New Member

GaryFar

New Member

merike-vist

New Member