Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Investments & rentals

- :

- Where do I enter my annual rent for my primary residence?

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my annual rent for my primary residence?

Topics:

posted

April 6, 2021

5:59 PM

last updated

April 06, 2021

5:59 PM

2 Replies

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my annual rent for my primary residence?

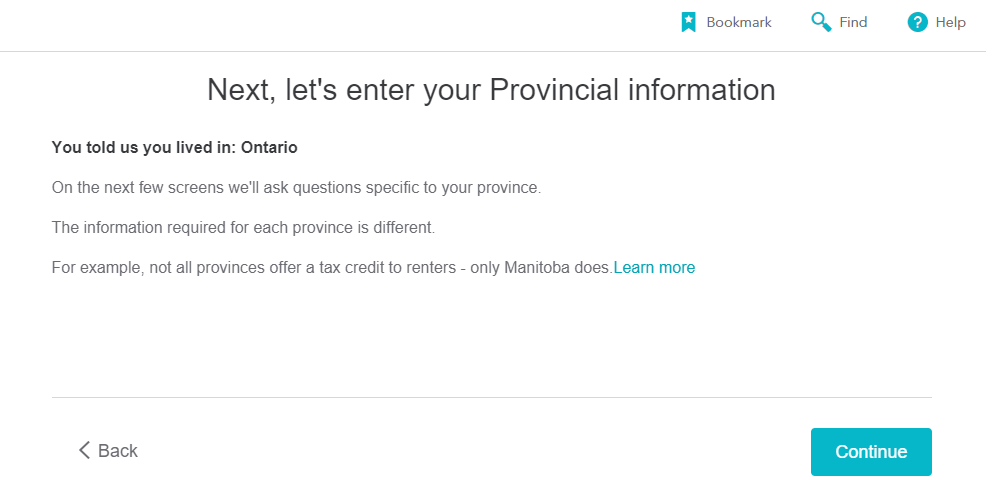

If you are in a province that has a rent credit/deduction, you will find it in the Provincial part of the interview. To go there, select Provincial>Get Started from the left side menu, and continue from there. Depending on your province, it will appear in different locations within that section.

April 7, 2021

12:25 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my annual rent for my primary residence?

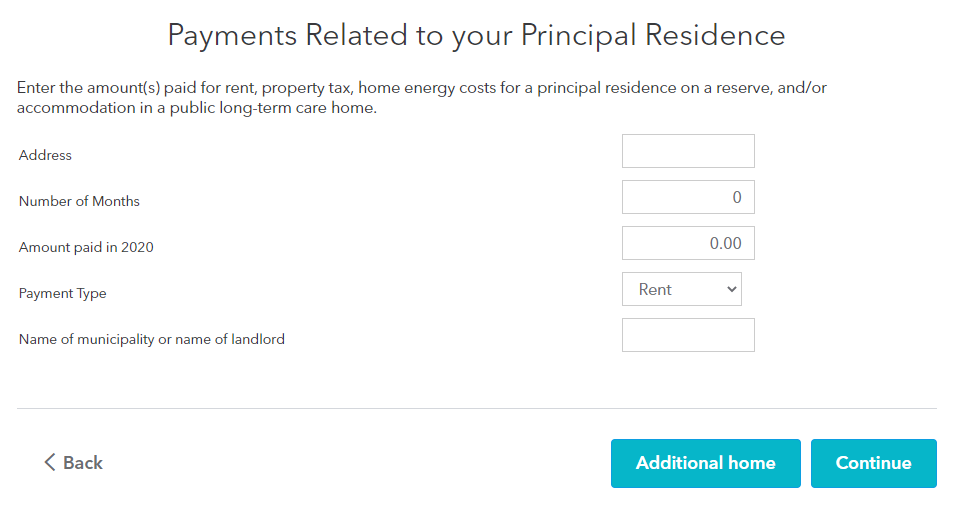

To enter your rent paid, please follow the steps below:

- Sign in to your Online account.

- Locate the Left-side panel of categories.

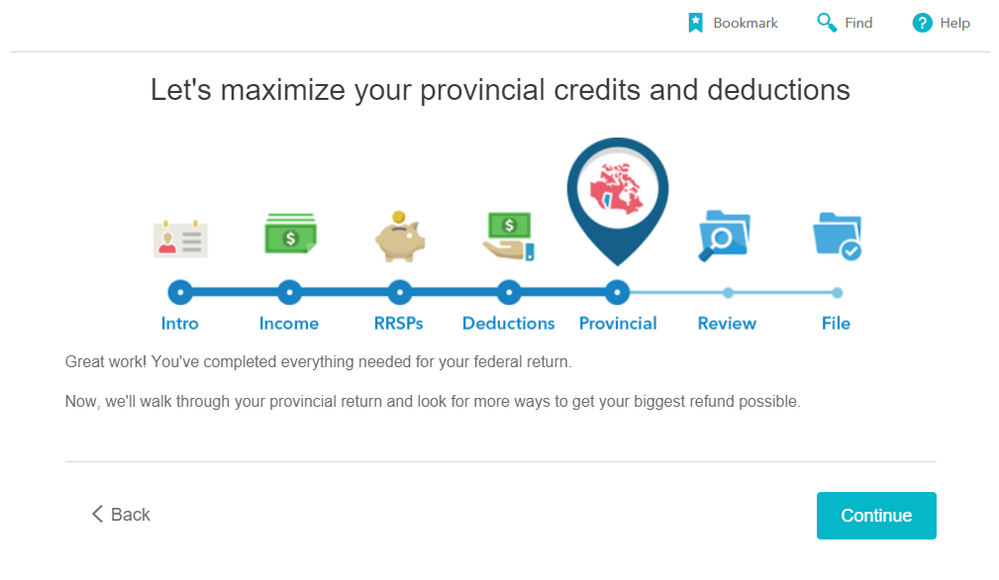

- Click on the "Provincial" tab.

- Click "Get Started".

- Click "Continue".

Click "Continue".

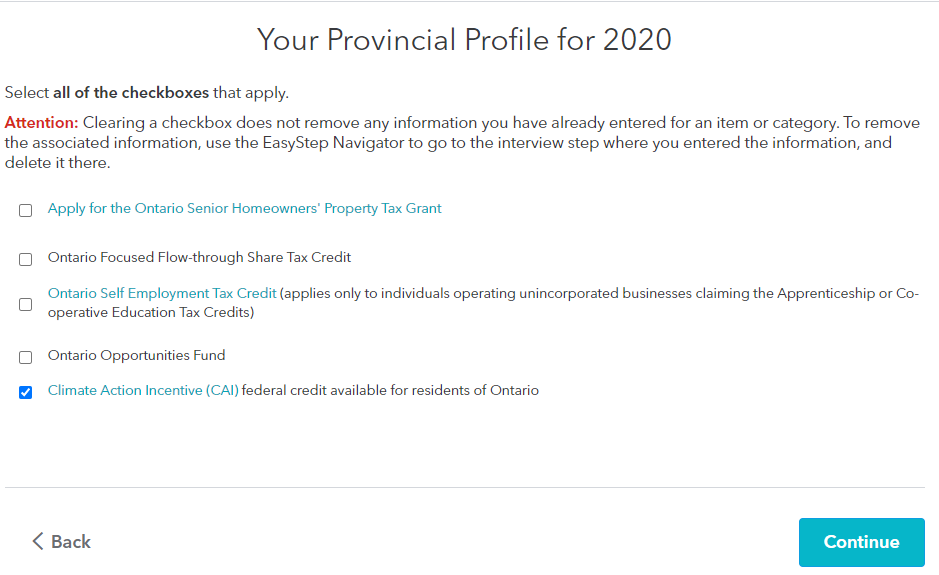

- Select any of them that applies to you; "Climate Action Incentive (CAI) federal credit available for residents of Ontario" is already chosen for you.

-

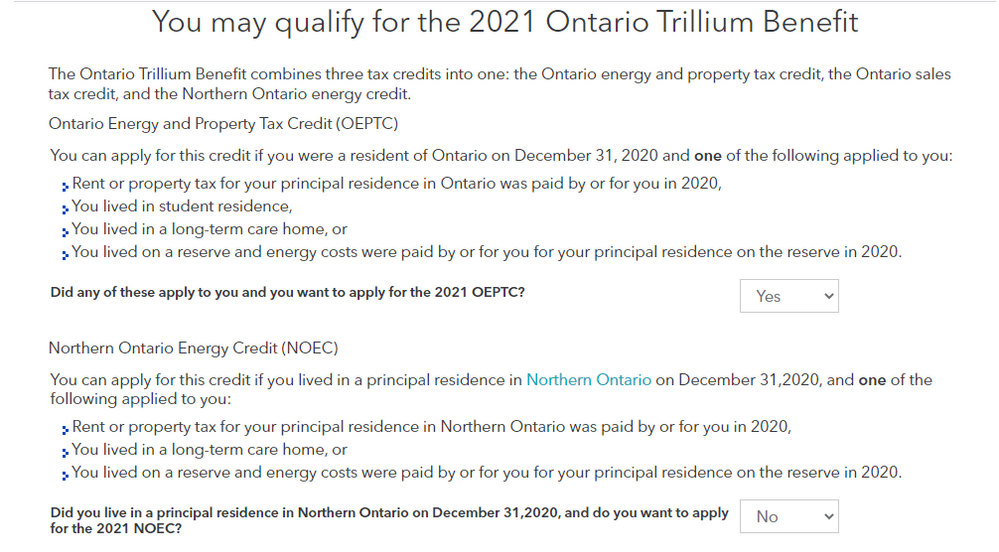

Select the first option as "YES" and the second option "YES" if you live in Northern Ontario and click "Continue".

- Enter the details accordingly and select the payment type as "Rent".

-

Click "Continue" and proceed accordingly.

Thank you for using TurboTax.

April 8, 2021

3:34 PM

Related Content

joeftabah

New Member

kimberlyfargo

New Member

denman99

New Member

dacountryguy

New Member

jmorchyk

New Member