Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Self-employed

- :

- Re: Corporation - filing T2 short as an inactive corporation. Do I need to complete the Schedule 1 as I have no Net Income (Loss)?

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Corporation - filing T2 short as an inactive corporation. Do I need to complete the Schedule 1 as I have no Net Income (Loss)?

The Schedule 1 was printed with the T2 Short Return - can I ignore this and not include as it's an inactive corporation with no income?

Topics:

posted

November 29, 2019

7:34 PM

last updated

November 29, 2019

7:34 PM

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Corporation - filing T2 short as an inactive corporation. Do I need to complete the Schedule 1 as I have no Net Income (Loss)?

Hi, thank you for using Intuit turbotax Live Community

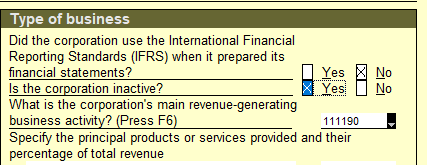

You can indicate a corporation is inactive by checking a box in the Type of business section of the info tab:

Hope this helps

December 2, 2019

9:34 AM

Related Content

SB98

Level 1

poissonn

New Member

Ryan113

New Member

emirabecu

New Member

randygmorse

New Member