Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Self-employed

- :

- Re: How do I enter self employment income I earned from a business I own in USA as a self proprie...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employment income I earned from a business I own in USA as a self proprietor?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employment income I earned from a business I own in USA as a self proprietor?

You will need to fill out the T2125 in your return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employment income I earned from a business I own in USA as a self proprietor?

Is T2125 slip same as the "foreign slip" under the income section? I am not seeing a T2125 slip anywhere. and the Self Employment section seems like it is for a Canadian business but my business is in USA.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employment income I earned from a business I own in USA as a self proprietor?

Can someone please verify if indeed I will be using T2125 for foreign self employment income? Although I am a resident of Canada, the business is not registered or conducted in Canada.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employment income I earned from a business I own in USA as a self proprietor?

Hi, thank you for using Intuit turbotax Live Community

I can confirm that sole proprietors must report their income and expenses on form T2125. This income is subject to federal tax, calculated on schedule 1. There is also provincial/territory tax based on the location of the business as discussed by the Canada Revenue Agency (CRA) :

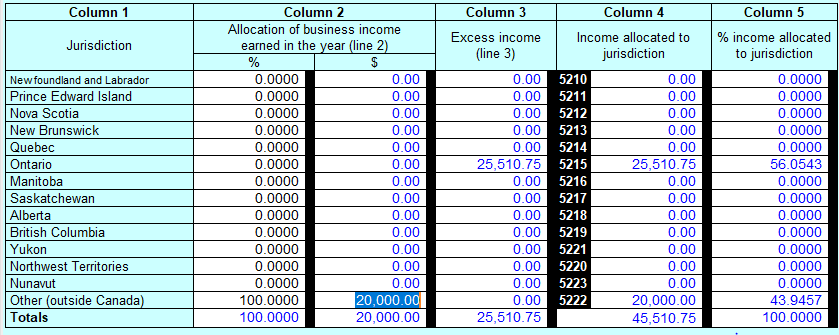

To indicated where the business has a permanent establishment outside of the province of residence, form T2203 is used to allocate the net income from T2125 to the correct jurisdiction. Outside of Canada is option as shown in the snippet of the T2203 shown below, (here $20,000 net income from T2125 is allocated to outside of Canada:

If you require further information for your specific scenario consult the CRA information provided.

Hope this helps

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employment income I earned from a business I own in USA as a self proprietor?

Thank you for providing such a thorough response. However when I am trying to do my tax return at Turbotax.ca and there is only an option fill in a "foreign slip". I have tried to fill it in through the "self employment" section but I am being asked to provide a Canadian address for business but that is not possible since the business is located in the USA and no portion of the business gets conducted in Canada. How do I get through this "business location" stage? (I am assuming by filling out the "self employment" section I am using T2125).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employment income I earned from a business I own in USA as a self proprietor?

You will need to input a Canadian address in TurboTax and then manually change it once you have printed it out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employment income I earned from a business I own in USA as a self proprietor?

If I have to change the business address to foreign manually, does that mean I have to mail the return instead of e filing?

And how do I get to form T2203 to allocate my self employment income to a foreign source? I am not seeing that option in Turbotax and when I search for form T2203, nothing comes up.

Thank you for your help in advance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter self employment income I earned from a business I own in USA as a self proprietor?

Yes, you will need to print and mail your return to the Canada Revenue Agency.

Related Content

Blueorange78

Returning Member

laural-taxfile

New Member

Smorgy

New Member

icaguilar1000-gm

New Member

rcosta

New Member