Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Troubleshooting

- :

- Troubleshooting

- :

- Re: There is still a bug on Schedule 11. The form the way it...

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error on Schedule 11? Should line 6 read - subtract line 4 from line 5? If income is greater, the higher the deduction for tuition, which doesn't make sense.

On schedule 11 - I noted that if I enter an income of $5,000 for my son he has no deduction for tuition fees. But if I enter an income of $16,000 he can claim over $2,000 in fees.

Are the calculated fields on Schedule 11 - calculating the appopriate fields from other worksheets?

Thank you.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error on Schedule 11? Should line 6 read - subtract line 4 from line 5? If income is greater, the higher the deduction for tuition, which doesn't make sense.

The wording for line 6 in TurboTax comes directly from the CRA form: https://www.canada.ca/content/dam/cra-arc/formspubs/pbg/5000-s11/5000-s11-18e.pdf

The tuition credit is non-refundable, so you only get the credit if you have taxes payable. So the lower the income the student has, the less likely he will get the credit. Any remaining tuition will carry forward to future years.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error on Schedule 11? Should line 6 read - subtract line 4 from line 5? If income is greater, the higher the deduction for tuition, which doesn't make sense.

I spoke to the CRA and they confirmed that this should be a user definable value, perhaps default to the tuition total, but with the ability to change the value if desired (or put zero there). Doing this then allows me to have a value for line 17 or 18 as desired. PLEASE FIX THIS!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error on Schedule 11? Should line 6 read - subtract line 4 from line 5? If income is greater, the higher the deduction for tuition, which doesn't make sense.

There is a bug with the product. Per CRA student with tuition credits can apply credits to income and/or carry forward to a future year and/or transfer to a spouse/parent/grandparent.

No issues doing this with Turbotax Standard in prior years but in 2019 Turbotax created their own rule and decided to apply all credits to the current year income.

Called Turbotax support and was told a system review was required at my cost. Will have to seek an alternative to Intuit Canada products.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error on Schedule 11? Should line 6 read - subtract line 4 from line 5? If income is greater, the higher the deduction for tuition, which doesn't make sense.

The tuition amount has to be calculated in the student return first for a reason. The student has to complete schedule 11 to calculate if they have any taxable income in which he/she will need to use a portion or all of the tuition amount against. If the student has a taxable income and needs to use the tuition amount to reduce the tax liability to zero, the student will not be able to carry it forward or transfer it to a parent or grandparent. This is what the first portion of the schedule 11 is for.

If the student did not use all of the tuition amounts against their income --> unused portion --> they can either carry it forward or transfer it. This is calculated in the second portion of schedule 11.

Please check the CRA link on how to file for tuition and education amount;

I hope this was helpful

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error on Schedule 11? Should line 6 read - subtract line 4 from line 5? If income is greater, the higher the deduction for tuition, which doesn't make sense.

What Turbotax is doing (at least the - Standard CD and Download - version picked up at Costco) is claiming ALL of the tuition (past and current years) to current year and the REFUND IS ALMOST 5K.

Per the CRA website - I should be able to claim some from current or past years to reduce amount owing to zero. When amount owing is zero any combination of the following is applicable:

- Transfer some (up to 5k) from current year tuition to a spouse or parent or grandparent

- Claim some for current year to get a refund

- Transfer some to claim in subsequent years

However the Turbotax tool is claiming all, and none of the fields in schedule 11 (e.g. line 10) is editable. Same for easystep, after completing T2020 - it's saying 0.0 eligible for transfer.

That is not happening with another vendor product - the transfer is allowed. It is possible that there is an error with the Turbotax product as other people have reported the same issue in this forum. The problem is repeatable and hopefully can be fixed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error on Schedule 11? Should line 6 read - subtract line 4 from line 5? If income is greater, the higher the deduction for tuition, which doesn't make sense.

You almost got it.

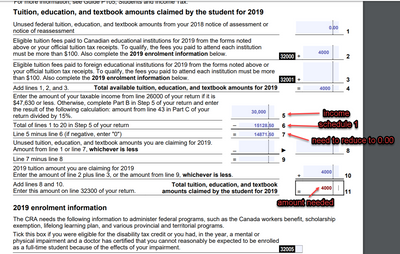

Acording to schedule 11, CRA requires you to reduce the non-refundable tax credit to zero, NOT the taxes to zero. Which means it is very common to get a huge refund if you have a current or carryforward amount. You will understand it from schedule 11:

Line 5 is your income Line 6 is your non-refundable tax credits (without your tuition)

Line 7 is the difference between Lines 5 and 6 (no negative amounts) You will need to use your current and unsued tuition amount to bring Line 7's value to zero:

- You apply your unused tuition amount first (Line 1) > report on Line 8

- Then you use from your current tuition amount (Line 4) >report on Line 10

- The total amount used is reported in Line 11.

You will not be able to carry forward or transfer any amounts until you bring Line 7 to zero first.

Then you can use section B of schedule 11 to determine the unused or transfer amounts.

What might have happened in the past with your prior tax returns, is that you didn't have enough income to produce an amount in Line 7 > your Line 7 was always zero or with low amount> Therefore, you were able to transfer or carry forward your tuition amount. Please check the example below for clarification:

I hope this was helpful

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error on Schedule 11? Should line 6 read - subtract line 4 from line 5? If income is greater, the higher the deduction for tuition, which doesn't make sense.

Can you refer me to this rule at CRA, the only one I have been able to find is the following;

"minus the amount you used to reduce your tax owing".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error on Schedule 11? Should line 6 read - subtract line 4 from line 5? If income is greater, the higher the deduction for tuition, which doesn't make sense.

This is from Turbo Tax help;

"Students may transfer a maximum of $5,000 of the current year’s federal tuition amount minus how much they need to reduce their federal tax owing to zero."

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Is there an error on Schedule 11? Should line 6 read - subtract line 4 from line 5? If income is greater, the higher the deduction for tuition, which doesn't make sense.

Here is the Canada Revenue Agency link you were looking for.

Federal Income Tax and Benefit Guide – 2021 Completing your return (Step 5) see Line 32400 – Tuition amount transferred from a child or grandchild

Thank you for using TurboTax.

Related Content

kath_rich

New Member

nightowl2

New Member

natividadperezcreo

Returning Member

supermancsm

New Member

chowwill

New Member