- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Get your taxes done using TurboTax

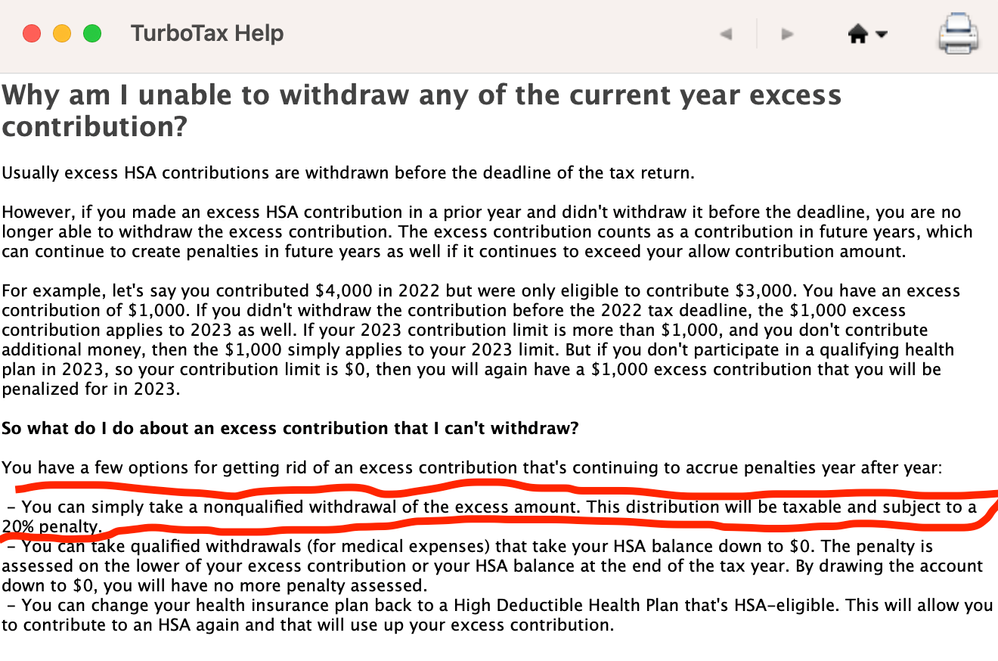

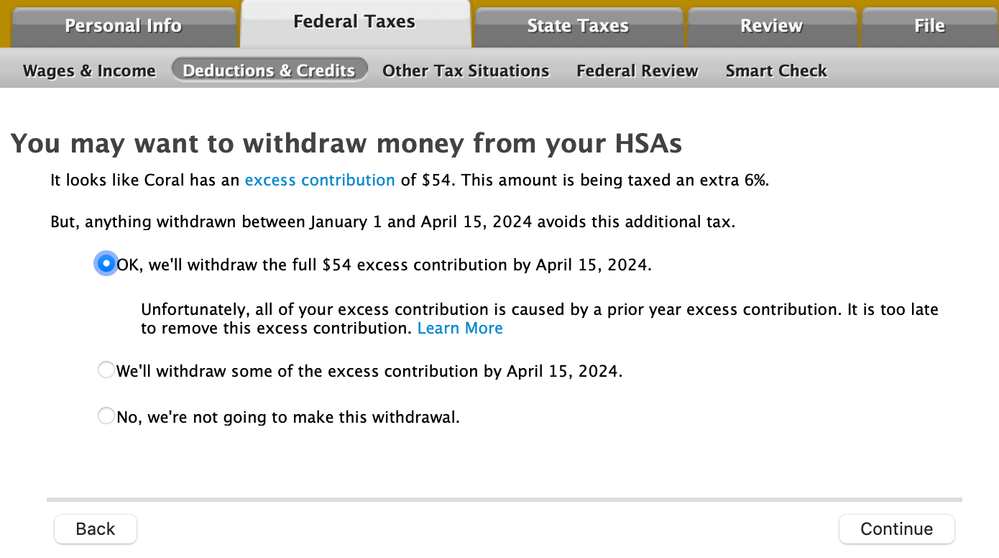

(1) So it sounds like doing excess contribution removal is going to be more head ache in the future, it's why you recommend doing non-qualifying withdrawal instead. I found detailed explanation of this in Turbotax help as shown below (with recommended by you option highlighted).

1b) Or should I choose option 3 since we are not removing the excess withdrawal directly? (if so, how Turbotax 2024 will know not to ask about these $54 excess?)

1c) Can my wife withdraw more than excess plus interest in order for this to work? I don't think we can figure out interest reliably, so I'm guessing significantly larger sum than the interest (say, $75) should cover it, right?

Working on your questions for question (2) now...