- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to fix the error message: "To accurately calculate your capital gains, you need to enter a date of disposition in 2024 on your T5008 slip(s)." I entered the dates?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

Are you using the online or desktop version? Check every T5008 slip entry to ensure that each transaction has a valid disposition date within the 2024 calendar year. Ensure that the date entered is in the correct format. Date of Disposition (dd/mm/yyyy).

I also recommend deleting the slips and reentering them. If you are using a desktop version, make sure it's up to date.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

Thank you for the reply. I am using the online version. I have more than 570 slips. reentering it manually is impossible. I used the connect to CRA and download the T5008 Slips as is from CRA account as reported by the broker. Also I manually checked all the files twice. Is there a way to delete the slips and reenter it from the CRA account?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

Yes, you can delete the imported slips from your online tax software and re-import them from your CRA account; however, with over 570 slips, you may encounter the same import issues as before.

Unfortunately, 570 slips from the CRA account cannot be imported. That's a large number of T-slips, which could cause a problem during importation. You must manually add all of the slips.

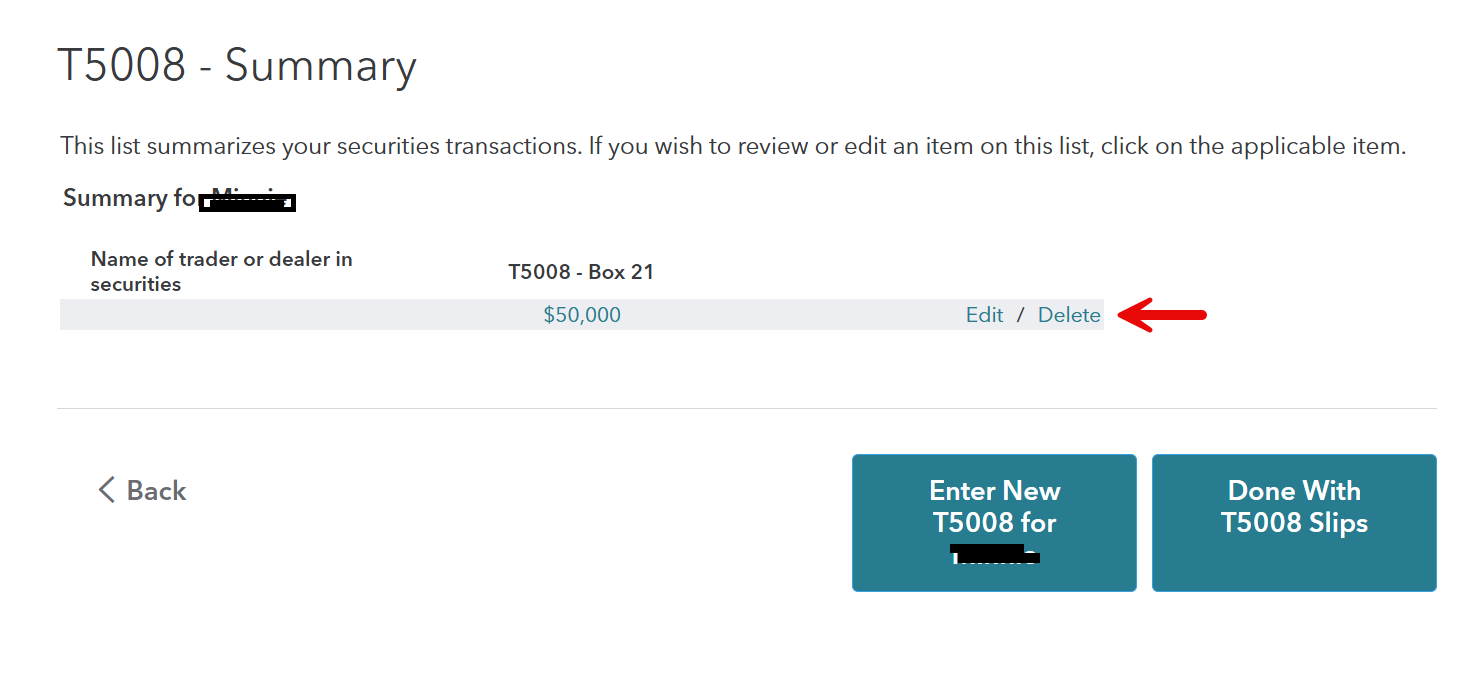

You may need to click an "Edit" or "View" button next to each T5008 entry and look for a "Delete" option.

Thank you for choosing TurboTax.