- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Box 105 - Which box for full time student?

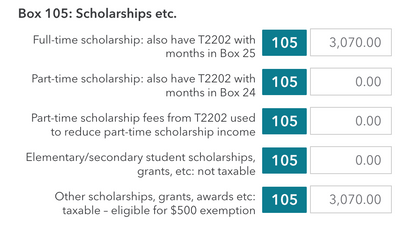

I was a full-time student for 8 months in 2022 and received a scholarship/grant from my school, I believe I do meet the criteria for the taxable bursary exemption, but the system automatically inputs the grant as a taxable income line 105 with the eligibility for $500 exemption. Do I input the grant as a full-time scholarship or as an "Other Scholarship grant" that is taxable?

Topics:

March 20, 2023

12:00 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Seniors and students

Use the one for "full time scholarship T2202 with months in box 25"

May 1, 2023

12:09 PM