What is the new Enhanced CPP, and how does it affect me?

Starting in 2019, a number of changes to the Canadian Pension Plan (CPP) took effect. These changes, originally announced in June 2016, gradually increase the contribution rate for employees by 1% from 2019 to 2023.

Some other highlights of the new legislation can be found here:

Contribution rate changes

If you have pension earnings between $3,500 and the original earnings limit, the following chart helps to illustrate these ratings increases and when they take effect:

Note: If you already started receiving pension benefits prior to 2019, these changes don't apply to you.

Benefit increases

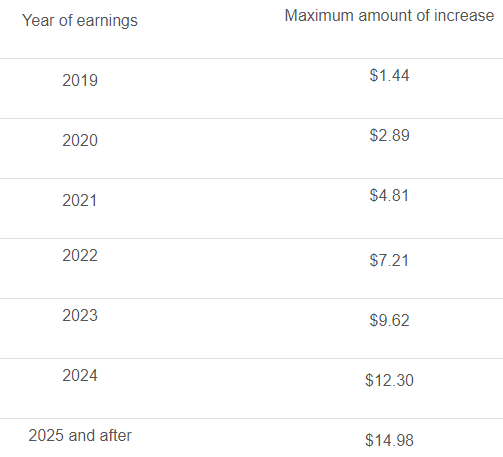

Beginning in 2019, pension benefits gradually started to increase in amount as well. Refer to the following chart to reference the change in your monthly age-65 pension payments, and when these increases take effect:

Yearly Additional Maximum Pensionable Earnings (YAMPE)

Another key change to the CPP starting in 2024 is a higher ceiling for earnings on which contributions will be required, called your Yearly Additional Maximum Pensionable Earnings, or YAMPE. Phased in over two years (a 7% increase in 2024 and a 14% increase in 2025), to an estimated maximum of $61,400 and $65,400, respectively.

These earnings will then be known as second additional pensionable earnings, and will combine with the original Year's Maximum Pensionable Earnings (YMPE), to form a total contribution rate of 8% (4% company contribution + 4% employee contribution).

Drop-in provisions

In addition to the rest of the CPP changes in 2016, two amendments or “drop-in provisions” were added to the tax legislation in 2018 as well. These additions are as follows:

If you have no pensionable earnings due to child rearing (for a child up to age 7), you can drop-in earnings instead, calculated as an average of your earnings in the 5 years before the birth of your child.

If you have no pensionable earnings because you were eligible for a CPP Disability pension, you can drop-in earnings as well, calculated as an average of 70% of your earning in the 6 years prior to the onset of your disability.