- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

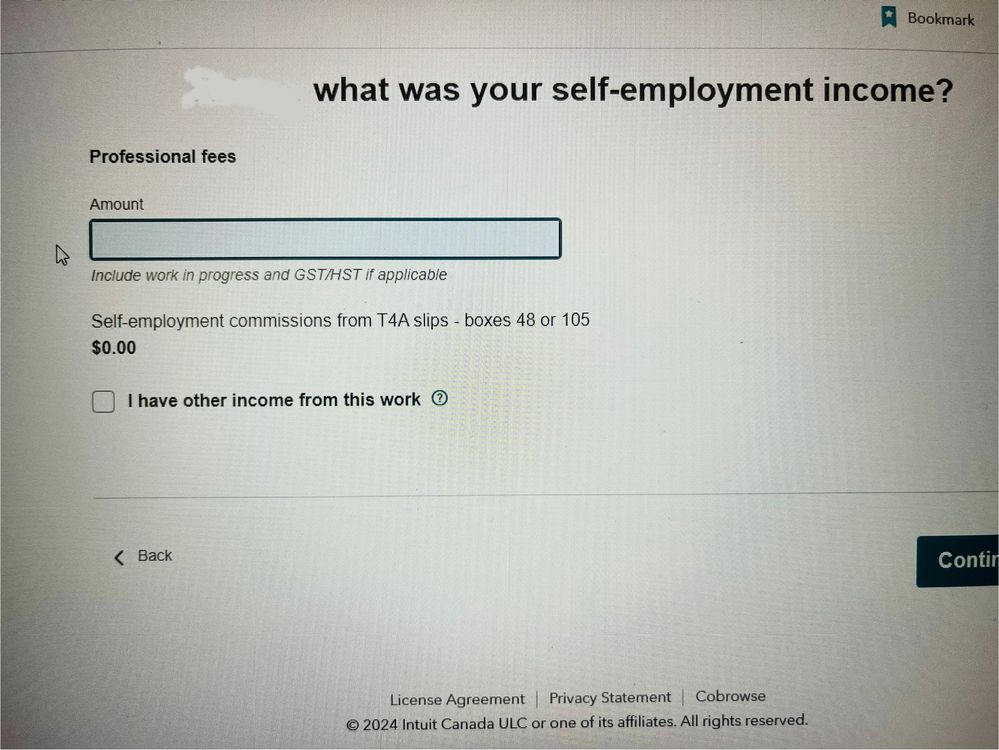

What is the amount that I should input in Professional fees? It's located in the self-employment section. Does it refer to Total Income, Gross Income or Net Income?

My quickbooks reports doesn't include the GST collected. What should I do if I actually collected less than 5% of those 'professional fees' ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting started

As per the CRA:

Professional fees (includes legal and accounting fees)

Deduct the fees you incurred for external professional advice or services, including consulting fees.

You can deduct accounting and legal fees you incur to get advice and help with keeping your records. You can also deduct fees you incur for preparing and filing your income tax and GST/HST returns.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting started

It refers to the amount input here

thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting started

Neither, you are to enter your professional fees as TurboTaxBrenda mentioned above and your work-in-progress. As per the Canada Revenue Agency (CRA) As a professional, your income normally includes the value of your work-in-progress (WIP). WIP is goods or services that you have not yet finished providing at the end of your fiscal period.

If you need more help here, we believe your best option is to contact our telephone support team for further assistance, as they have the option to view your screen to help you navigate. To contact them, please follow this link: Contact Us. When asked if you wish to receive an email say NO then say "speak to a representative" then hold the line.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting started

So where do I enter in my gross income re: self employment then?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting started

As per our TurboTax article: Guidelines for Reporting Self-Employment Income

Report your self-employment income on separate lines for each source by entering your gross income and net income in lines 13500 to 14300 of your income tax and benefit return. These amounts are calculated by using the T2125 Statement of Business Activities form which is a part of your personal income tax return. Your gross income is what you have earned before any expenses are deducted. Your net income is what is left over after deducting expenses.

To Enter Self-Employment income (T2125 - Business Statement) in TurboTax Online:

1. In the upper-right corner of your screen, select Find (magnifying glass).

2. In the Find window, type in “self” and select “Self-Employment”. Click the “Go” button.

For more information from TurboTax: Self-Employment and Rental Income Centre

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting started

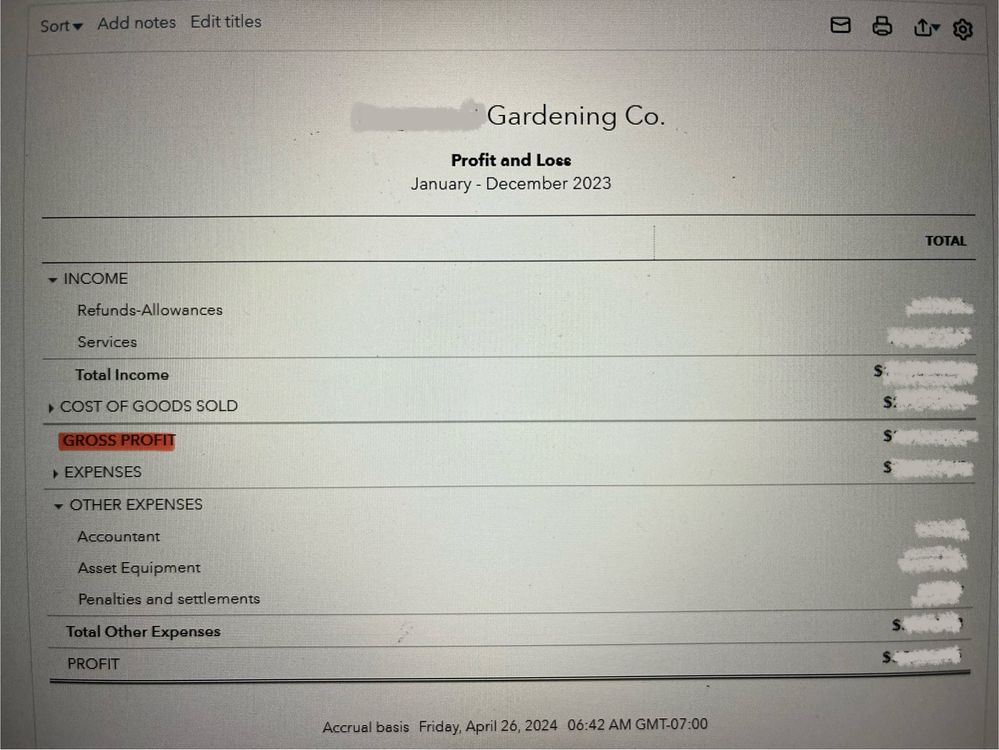

In my Quickbooks P&L report shows,

Gross Profit equals Total Income minus Cost of goods sold

Is this the amount you are referring as Gross Income above?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Getting started

As you have already purchased Assist & Review, we suggest you contact them for further clarification, by clicking on the Live Help icon at the bottom right of your return: How TurboTax Live Assist & Review Works - Do Your Taxes with Expert Help

More information about A&R: How to use TurboTax Assist & Review.

Thank you for choosing TurboTax.