- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

Yes, I would suggest waiting to submit your taxes. Our team is working on it as we speak. It shouldn't be too much longer. We will advise you as soon as the issue is corrected.

Thank you for your patience.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

I just wanted to confirm it’s fixed? It looks fixed on my end but wanted to make sure before I submit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

Can you please go through your expense section to make sure you see all the amounts that were entered and if yes, you can continue.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

Where do you input the vehicle as a "new addition" and the "fair market value".

I only see fields to input the "CCA"?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

You will add your new vehicle under vehicle expenses.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

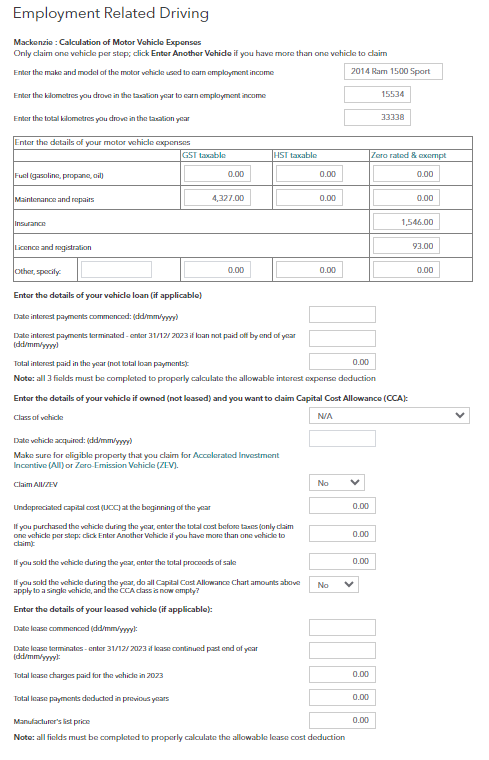

I have owned the vehicle since 2014, but just started using it for business use in 2023. Where in turbo tax do I add in the vehicle for CCA, and how do I calculate it for the first year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

At the top you will write Dodge Ram, then under date vehicle acquired you will write the date you started using it. The UCC at the beginning of the year is where you will enter the fair market value of your vehicle at that time.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

Where can i find the amount of UCC from my last years return? I know i claimed some depreciation, but i forget the exact amount i claimed last year. Also, i switched jobs and worked a portion of the year in a non-commission role and then back to outside sales, commission work. Do i re-enter the amount as fair market value at the time since my car likely depreciated during the time i wasnt working as a commission sales person?