- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why did my age related oersonal exemption decrease by $1300 this year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

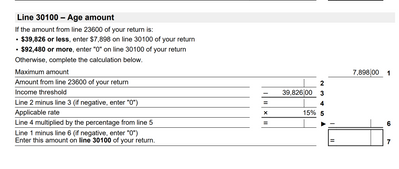

Hello, we appreciate your question. The federal age amount is calculated with consideration of your net income (CRA23600). The maximum federal age amount is $7,898 for the 2022 calendar year. The respective credit is clawed back if your income exceeds this year's threshold of $39,826. Please review the age amount reconciliation, it is reported on the other credits worksheet or T1WS, depending on the platform you are filing on.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

Hello,

You must have had more income this year than last year. For tax year 2022, if your total income exceeds $39,826 your age amount will be reduced as your income increases until it is $0. You will have to make $92,480 before your age amount will be reduced to $0.

Please see attached image of the calculations for the Age Amount.