- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why can I not record my RC210 Canada Worker Benefit Advance through Turbotax - there is no recognition of this statement in your system

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Seniors and students

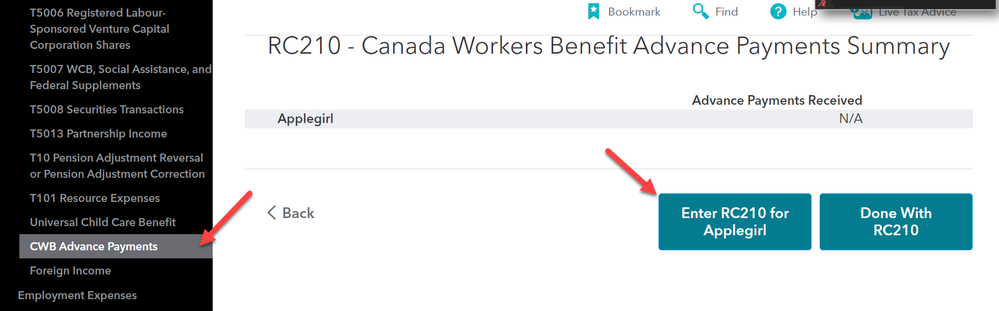

Please view the image below taken in the TurboTax Online software. When inside your return go to the left side menu and click on Income then T-Slips then scroll down and you will see the CWB Advance Payments you need to click on. This will open the RC210 screen where you can add the information.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Seniors and students

Do you input the total basic advanced CWB provided on the RC210 form from CRA in both fields on TurboTax or just one? (See image below). There are 2 fields on Turbotax and I don't know if to only enter in one field.

RC210 - Canada Workers Benefit Advance Payments

Enter the amount of Canada workers benefit advance payments received in 2023. |

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Seniors and students

If you received the Canada Workers Benefit (CWB) as a disability supplement, you should enter it in the corresponding box. If you did not receive it as a disability supplement, then you should enter it in the first box. Your RC210 would indicate if it was a disability supplement.

Thank you for choosing TurboTax.