Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Getting started

- :

- 2019 Taxes: Non-resident Spouse

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Taxes: Non-resident Spouse

In 2019 I married a non-Canadian. He still lives in the UK. He has no Canadian income or other financial ties to Canada. I am not supporting him financially.

I have entered 000 000 000 as his SIN and indicated he is a non-resident. For the question "Was [spouse]'s net income for 2019 zero?" what should I say? The question does not clarify whether it wants net Canadian income only or net income from any source. In 2019 he did have UK earnings but zero Canadian earnings. The income field indicates "Net income from [spouse]'s 2019 federal tax return (Line 23600)". He doesn't have a federal tax return so Line 23600 does not exist for him. Likewise, he does not have a Line 68360 of T1206.

So, should I answer "no" because he earned money in the UK but then leave these fields as 0.00 since he has no federal tax return? Or answer "yes" because his Canadian earnings were zero?

I have answered the next question, "Are you claiming spousal amount?" as No since he is not financially dependent on me.

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Taxes: Non-resident Spouse

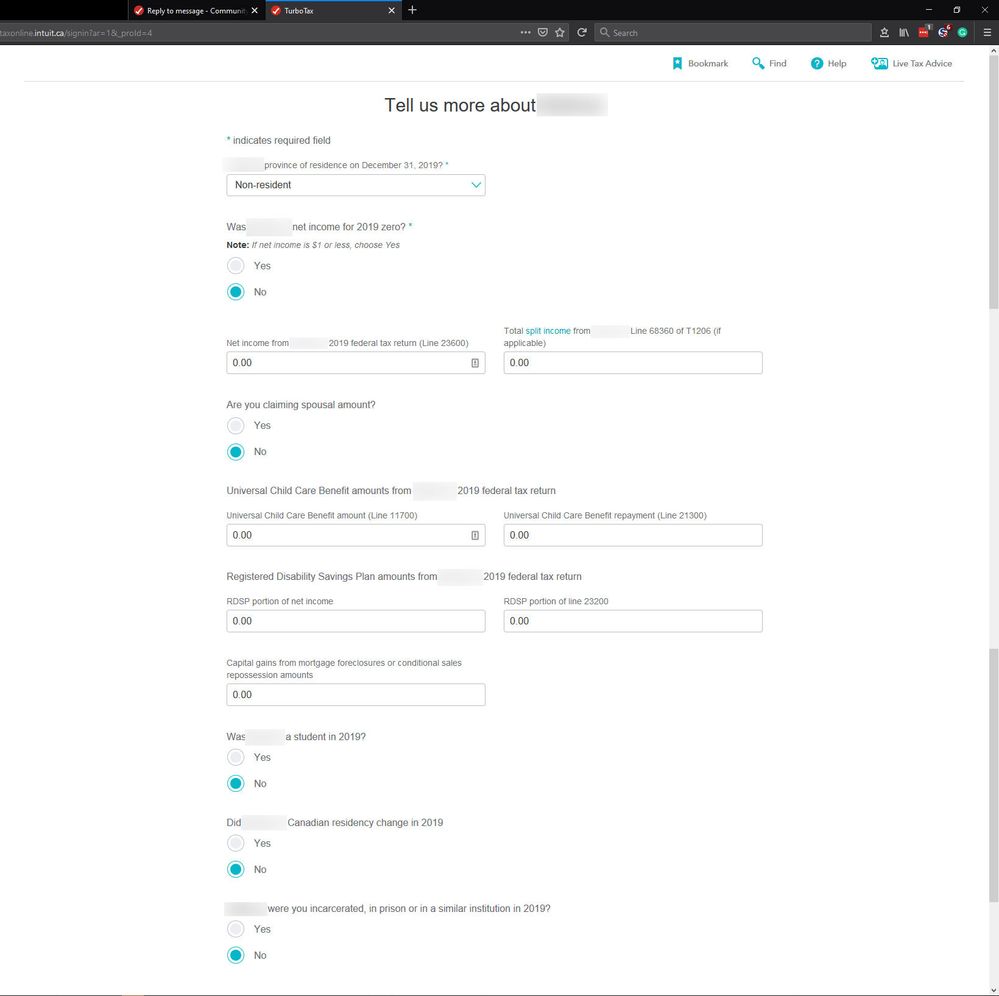

I have attached a screenshot hopefully to have a clear understanding of your situation. Your spouse is a non-resident, never worked in Canada and do not have any Canadian Income. So yes zero for his federal income. The other question while you lived with your spouse outside of Canada what was your spouse income?"Their net income while you were living outside Canada". If you never lived outside of Canada then the answer is zero. Hope this brought some clarity to the matter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Taxes: Non-resident Spouse

Thanks for your reply. I would like to double-check though because your screenshot does not look like what I see when filling out my return in TurboTax. There is no question about net income while living outside Canada on my return.

You said, "So yes zero for his federal income." This is not clear. Do you mean I should tick the "Yes" option under "Was [spouse]'s net income for 2019 zero?", or do you mean I should tick the "No" option and leave the displayed fields as 0.00, as shown in my screenshot below?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Taxes: Non-resident Spouse

Could someone please offer some clarification on how I should proceed? I would love to get my taxes done. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Taxes: Non-resident Spouse

Did you ever get an answer to your question?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Taxes: Non-resident Spouse

No, you can see no one else replied.

Either way, his Canadian income was zero and he had no Federal return for this country so the amounts would have been zero regardless.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Taxes: Non-resident Spouse

Thanks, I'm in the same situation. It is unclear. My spouse's net income (in his country of residence) was not zero. But if I select "no" in answer to the question, then it requires I enter a net income from his federal (Canadian) tax return, which doesn't exist. The only way I can enter zero in this box is by selecting "yes," his net income was zero. By default, I'm assuming the "net income" question is referring to Canadian income, although it is not clear.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2019 Taxes: Non-resident Spouse

It has been two years since this question was asked and they still have not made any clarifications nor fixed it. I'm have the same problem and there is zero info other than this page.

Related Content

ddmarshall2016

New Member

davesuzuki

New Member

adam-sockett

New Member

fessell810

New Member

jgreene3

New Member