Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Getting started

- :

- I live in Québec but work in Ontario. How does the program account for this? What do I need to do to make sure this is taken into account in my tax report?

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Québec but work in Ontario. How does the program account for this? What do I need to do to make sure this is taken into account in my tax report?

posted

Saturday

last updated

April 19, 2025

7:28 AM

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I live in Québec but work in Ontario. How does the program account for this? What do I need to do to make sure this is taken into account in my tax report?

You simply need to enter Quebec as your province of residence on December 31st, and when you enter your T4 slips, if the province is Ontario, you will need to choose the province of Ontario. If you do not have a Relevé 1 slip from Quebec, you simply skip it.

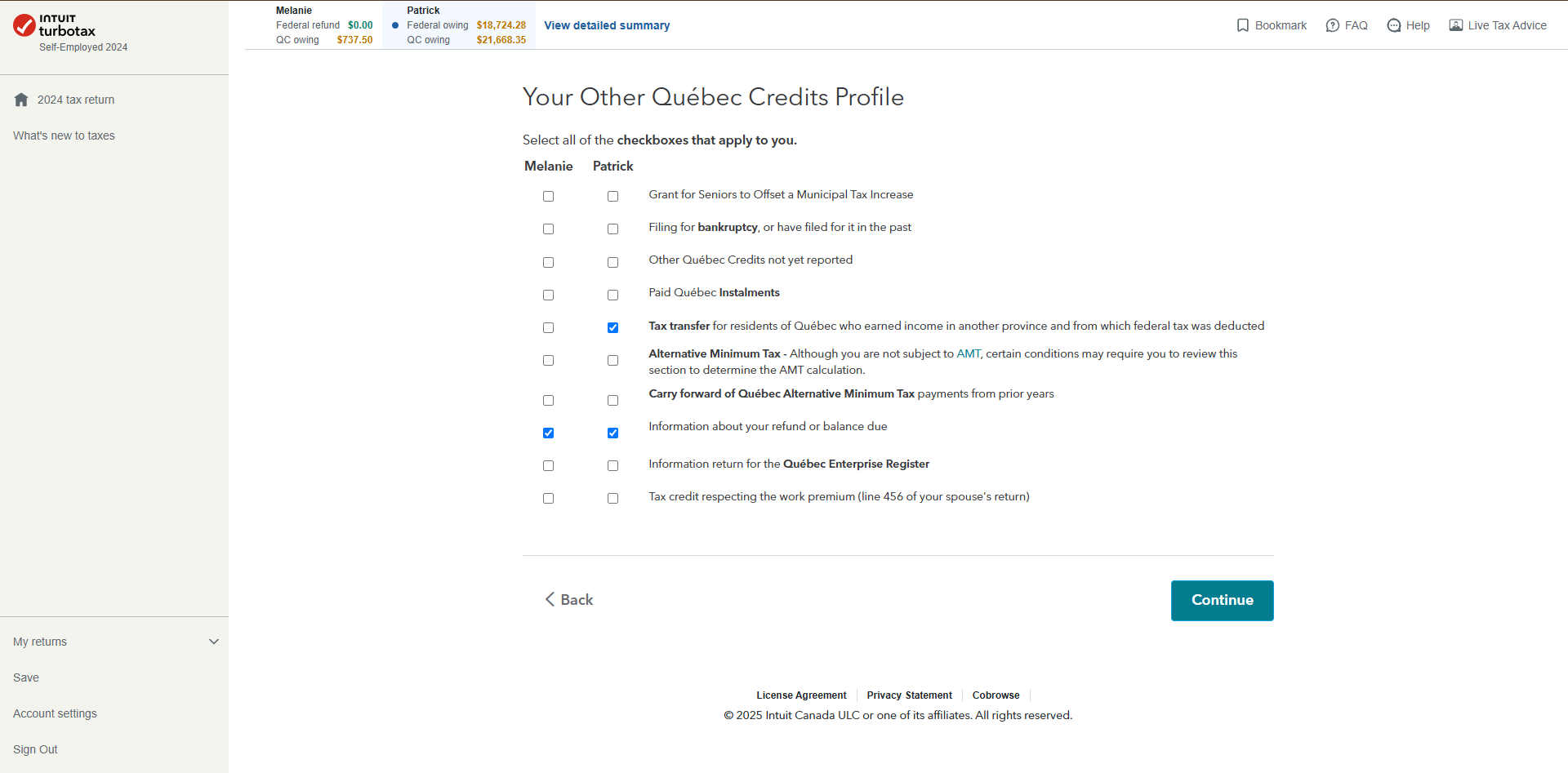

You can transfer to the Province of Quebec up to 45% of the income tax shown on information slips issued to you by payers outside Quebec. In the provincial section under Other Quebec Credits, check the box that says "Tax transfer for residents of Québec who earned income in another province and from which federal tax was deducted".

Thank you for choosing TurboTax

yesterday

Related Content

shanjey33

New Member

shanjey33

New Member

ARD58

Level 1

leeallard77

New Member

belgacemali15

New Member