Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Investments & rentals

- :

- How to report income from rented out foreign property that was inherited?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

@TurboImpotDeanna I think the question is very simple. Can you explain how to enter the income amount from Real Property rental in FTC module in TurtboTax? Looks like @Vikas1 and I could not find a way to do that?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

@Vikas1 So what is your plan then? thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

I have no idea what your point here is. I am aware of those CRA forms, is there a way to do so through TurboTax? There should have been a way to edit FTC forms without having to create Foreign slips.

@soewitas1 I haven't decided what I am going to do. I don't want to let go of tax that I should get credit for in Canada.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

@Vikas1 I will keep trying to look for a way to solve this. Appreciate you let me know when you find a way. I agree we should report and get credit for it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

The above message was meant to demonstrate what forms need completing in TurboTax for the income to be admissible on your FTC, are the T5013 slip.

Unless you have not paid any foreign income tax on your income or property, then you may file with T776. The amounts on form T776 are not being processed for the FTC, therefore, if you have paid taxes on foreign income, perhaps the option of using this form is not adequate for your situation.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

@TurboTaxDeanna is T5013 valid only for US? TT doesn't seem to allow its use for countries other than the US.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

It is valid for all foreign income that you have filed and paid taxes in a foreign country and that you wish to claim FTC.

Tip: foreign income or profits taxes you paid on income sourced from a country other than Canada and reported on your Canadian return. Tax treaties with other countries may affect whether you are eligible for this credit.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

@TurboTaxDeanna I am not sure that an individual falls under partnerships, please refer to this:

https://www.canada.ca/en/revenue-agency/services/forms-publications/publications/t4036/rental-income...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

It would be more appropriate and simpler to report the net rental income (if greater than zero) on the Foreign Income slip as Other Income and the foreign taxes paid, if any. The form T776 is designed and used for rental income of Canadian properties.

The asset is still reported as a 'Foreign Property' on form T1135, if it is not used primarily for personal use.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report income from rented out foreign property that was inherited?

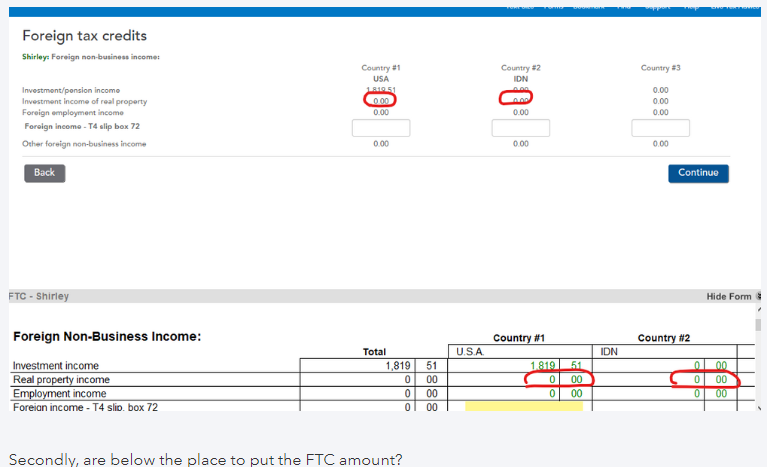

I need to report my foreign property rental income and associated tax payment to foreign government. I could not find a way to have the income to appropriate line (red circle). Could you please help?

Thanks.

Related Content

vinny8

New Member

nicholasaidan

New Member

Greg105

Returning Member

dadaniabc

New Member

joeftabah

New Member