Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Investments & rentals

- :

- I sold shares in a small business this year, which resulted in capital gains. How do I apply for the Lifetime Capital Gains Exemption (LCGE) in TurboTax?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold shares in a small business this year, which resulted in capital gains. How do I apply for the Lifetime Capital Gains Exemption (LCGE) in TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold shares in a small business this year, which resulted in capital gains. How do I apply for the Lifetime Capital Gains Exemption (LCGE) in TurboTax?

As per the Canada Revenue Agency (CRA):

If you disposed of qualified farm of fishing property (QFFP), qualified small business corporation shares (QSBCS), qualified farm property (QFP), or qualified fishing property (QXP) you may be eligible for the LCGE.

If you disposed of qualifying property during the year and want to claim your exemption, you will need to fill out Form T-657, Calculation Of Capital Gains Exemption. The capital gain deduction will appear on line 25400.

To do so, you will need to know your:

- Proceeds of Disposition — The proceeds of disposition is the price you sold the property for, plus any fees associated with the sale.

- Adjusted Cost Base — The adjusted cost base is the price you paid for it plus any capital improvements that you made.

You will also need to know what portion, if any, of the exemption you may have used in the past. If you don’t know this information, you can contact the CRA and they will be able to provide this information. It can also be found on your CRA’s My Account online.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I sold shares in a small business this year, which resulted in capital gains. How do I apply for the Lifetime Capital Gains Exemption (LCGE) in TurboTax?

For claiming the LCGE in TurboTax software, please follow these steps:

- Log in to the TurboTax portal.

- "Continue" your tax return.

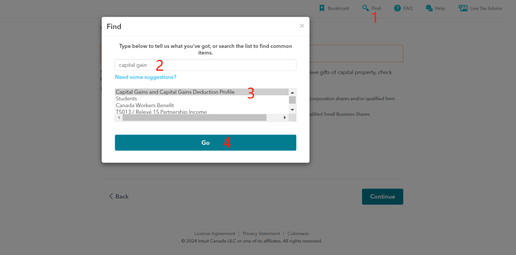

- In the top right corner of the screen, there is a Find icon. Click on it, enter "capital gains", choose "capital gains and capital gains deduction profile", then click on "Go".

- Choose "Sold stocks, crypto, bonds, real estate, other capital property, or sold qualified small business corporation shares and/or qualified farm property and you have a capital gain or loss to report".

Thank you for choosing TurboTax.

Related Content

MG5591

New Member

isindhu

Level 1

BrandonL14

New Member

BWHolden

Level 1

skl11

New Member