Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Seniors & students

- :

- Why would the age amount for someone 75 years old with income below the 2023 threshold of $98,000 not show as $8,396?

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why would the age amount for someone 75 years old with income below the 2023 threshold of $98,000 not show as $8,396?

posted

March 25, 2024

6:42 PM

last updated

March 25, 2024

6:42 PM

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Why would the age amount for someone 75 years old with income below the 2023 threshold of $98,000 not show as $8,396?

As per the Canada Revenue Agency (CRA):

You can claim the age amount if you were 65 years of age or older on December 31, 2023, and your net income (line 23600 of your return) is less than $98,309.

If your net income was:

- $42,335 or less, claim $8,396 on line 30100 of your return

- more than $42,335, but less than $98,309, complete the chart for line 30100 on the Federal Worksheet to calculate your claim

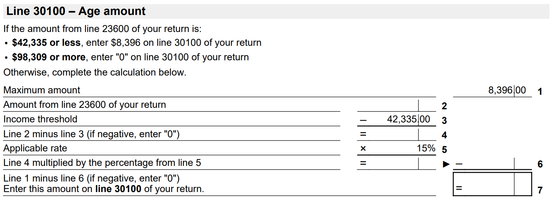

The CRA provides a formula in the Federal Worksheet to calculate the reduced amount as follows:

Therefore, the maximum amount you can claim under the age amount is $8,396. However, if your net income exceeds $42,335, the eligible amount will be reduced.

Thank you for choosing TurboTax.

March 25, 2024

7:46 PM

Unlock tailored help options in your account.

Related Content

Pryders

New Member

airfield42

New Member

jruhym

New Member

rick_a_schwartz

New Member

marc21

New Member