- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Missouri State E-filing and online pay

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

I live in Missouri, and I filed my taxes online. I also chose to have the amount owed drawn out of my bank account. When I was finishing my filing, TurboTax said that I still need to mail in my voucher, even though I am paying by automatic withdrawal, and I filed online. (I will literally just be mailing a voucher that has sensitive information on it--our SS numbers--and no payment. All info will have already been received at the State level.)

Is this true, and why?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

@robynjonh @scottsorensen I've shared your post with TurboTax Moderators. They're on Pacific time, so it may be awhile before I hear anything. I'm wondering if the issue isn't with the MO site? Either way, I'll update you guys when I hear anything.

Thank you for your patience!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

Just be patient, for Missouri it takes 3-4 day after payment date for the transaction to show up on your bank account. I've seen this many times with my estimated and MO-1040 payments.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

@robynjonh That's just wonky. As long as your state return has been accepted and you're CERTAIN that you schedule payment of your state tax liability by direct debit, you can disregard the voucher. Sorry for the confusion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

In the same boat with no clear answer yet. The Missouri revenue website says that “electronic software cannot submit payment” so I am waiting to see if my payment goes through later this week before mailing the voucher.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

Hi there, and thank you! I guess according to the next reply, it might still be in question. As far as being certain about the direct payment, all I know right now is that the program asked me to re-enter my bank information while doing the State stuff, which I had already entered for Federal, and I had to check and re-check, so one would think it was going to work. If not, Intuit/Turbotax has a glitch they need to fix. I sure wish a Turbotax professional would see this thread as well!

Thanks for your input!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

Hi Scott,

Thank for your input! That is so annoying, right? I mean, we had to re-enter our bank information and re-check etc while doing our State stuff, so it would lead one to think it is a legit method...and I don't love the thought of sending something with both of our SS numbers in the snail mail in this day and age. It was different in the way back but now... So, I guess we will see!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

@robynjonh @scottsorensen I've shared your post with TurboTax Moderators. They're on Pacific time, so it may be awhile before I hear anything. I'm wondering if the issue isn't with the MO site? Either way, I'll update you guys when I hear anything.

Thank you for your patience!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

@Kat, Thank you so much! have a very blessed day! 😃

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

@robynjonh I HAVE had a blessed day! Thanks for the well wishes!

No word yet. I'll keep you posted.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

Okay, everyone:

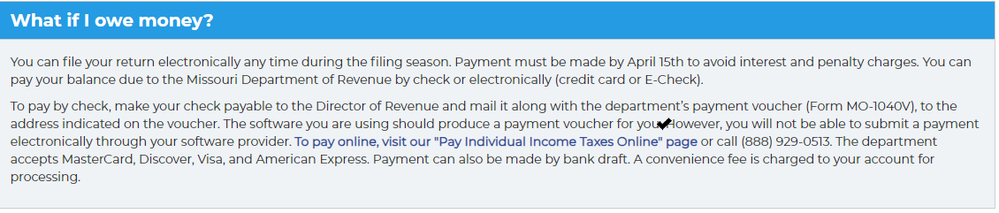

Based on this information from the MO Department of Revenue website, you won't be able to pay your MO tax liability electronically. You can pay with a check and voucher, or pay electronically using the MO website.

Here's the link to the FAQ page:

I'm also attaching a screenshot that answers the question, "What if I owe money?"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

@Kat @robynjonh Money just got deducted from my account and I have only submitted payment through TurboTax. I did not submit anything via the MO website yet. Did something change?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

@scottsorensen The deduction should indicate who made it. Who deducted $ and was it for the amount you owed for federal tax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

@Kat Hi Kat - it shows MO DEPT REVENUE STATE TAX and was in the exact amount of state tax owed. So it all appears correct. I haven’t figured out how to confirm with the state that payment was received, but it looks like all may be in order.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

@kat and @scottsorensen, well...having read these replies this morning I thought, "uh oh. I better check my account."

I, too, have had an amount withdrawn, and it is the correct amount--so that is great.

The not-great part is that in light of what we heard, I made an e-payment through the Missouri website over the weekend. So I am now wondering if it will be withdrawn twice. I sincerely hope not. We know that these things are not often without hassle.

Advice, @Kat ?

And also, I would say that either way, Intuit/Turbotax needs to follow up with this situation and make some corrections, because either way, they have presented it incorrectly. They either need to get rid of the pop-up window at the end of the process that says MO residents have to pay in another way, or they need to get rid of the part of the process earlier which has taxpayers inputting their bank information and re-checking it, since it would be irrelevant if not a valid way of paying. This hasn't taken an exorbitant amount of my time, but whatever time it did take, I REALLY could have been using for homework (full-time uni student for the 2nd bachelor's degree), housework (fully fledged adult) or business (self-employed)...and I don't have spare time! I literally did my taxes on my Spring Break, because that is when I have any time at all. So...I hope they fix this.

but anyway...thoughts on whether or not I will be paying double?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

In the same boat, I E filed my taxes today and set up automatic debit for both federal/State and received the “Important Print and Mail” voucher also. I started searching the forum and google, and Here I am. When I look at the Page 1 worksheet for both state and federal it clearly states the amount and date of debit with correct bank info.

I compared my 21’ returns to 20’ and on the same worksheets, I had to send a payment with voucher last year. I wonder if it’s a new system and turbo tax just didn’t work out all the bugs. I believe I’ll wait to see if the debit happens, I don’t want to double up and then have to deal with that Mess. I’ll follow up with my results.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Missouri State E-filing and online pay

@robynjonh @scottsorensen @Sjc123

What a mess!

I did share a screenshot earlier in this thread from the CURRENT FAQs at the MO DOR. I'm linking that page below. The FAQ clearly states that MO residents cannot make payment of tax liability through software providers. Clearly, however, you all have proven that FAQ to be in error. So MO should get their act together, right?

Oops! Edited to add the link I promised:

Here's my take: If you scheduled and completed your e-filing through TurboTax, and your state return was accepted, AND you scheduled direct debit of your MO tax liability, the payment was made. A couple of you have seen the direct debit on your bank statements.

Now, as to how MO will handle this overpayment:

If your check to MO DOR, or electronic payment clears the bank, I'd call the DOR to let them know the situation. They will check your account, and I'd expect a prompt refund of overpayment. Fingers crossed!

Meanwhile, I'll let TurboTax Moderators know that the software IS allowing electronic payment via the software. Maybe (?) TT can contact the state to update them.

@robynjonh So sorry this has taken so much of your very valuable time! I'm hopeful that this is resolved quickly for all of you.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

josephetc

New Member

josephetc

New Member

Jam89

Returning Member

mrnagle23

New Member

oram

New Member