- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- State tax filing

- :

- Re: Allocate New York State adjustments

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allocate New York State adjustments

Am in the same boat as the others. Wondering if you can offer any guidance?

Token number is: 1167392

Thank you!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allocate New York State adjustments

You will need to allocate the amount based on NY time. Please see answer above your question.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allocate New York State adjustments

Thanks for getting back to me! I read the above thread already and still do not understand what numbers I use to make the calculation. I lived in NYC for half the year, but I still don’t understand how to proceed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allocate New York State adjustments

If you lived in NYC for half the year and outside NY for half the year, then NY and NYC city want to tax the NY income while you were there. Let me make up numbers and scenarios

You lived in state A and made $30,000. You moved to NY and made $50,000. NY will show a total income of $80,000 and you mark that $50,000 was NY income.

If you run a business, it will show gross business income and you will mark the amount earned/ sold while in NY.

If you want to give an example for us to help, we are glad to but just allocate with nothing to go on simply means pull out your NY income for NY to tax.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allocate New York State adjustments

I am having this issue as well. "Your New York State Adjustments below must equal -$704." Token = 1172123.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allocate New York State adjustments

The NYS adjustment of 704 is for interest income on US government bonds.

See the picture below that shows how to allocate this negative adjustment based on the period of time you were a NYC resident. The number shown is to allocate 10 months out of 12 to NYC residency.

You can change the number as needed, such as if you did not receive this interest income equally throughout the year, and instead received the full amount or none of the amount while you were a NYC resident. However, no matter what is entered in the middle column to allocate to NYC, the left column must be -704.

Go back through your NY state return to work through the allocation again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allocate New York State adjustments

Hi,

I'm running into the same screen and don't know how to figure out what values to put in. My token is 1187376.

Thanks for any help you can provide.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allocate New York State adjustments

On the screen, Allocate New York State Adjustments, please enter the following to equal the sum of -1,288 that is required:

- NY 529 Plan: -1,800

- Interest Income on State & Local Bonds: 512

Once you enter your Total New York Adjustments (as shown in the screenshot below), please allocate the appropriate amounts to the NYC resident portion in the middle column.

If you have any further questions, please reply back and we will assist you further.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allocate New York State adjustments

Hi, I'm having this same issue. It seems users are providing their token, and tax experts such as yourself are looking up what the descriptions are for the adjustments that need to be made. When I get a message like this, such as "Your New York State Adjustments below must equal -$7023," on the TurboTax screen, how can I figure out what this number is composed of, and thus how to make the separation between NYC Resident and Total NY columns? I was a part-year NYC resident and a NYS resident the rest of the year. Thanks in advance for the tip!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allocate New York State adjustments

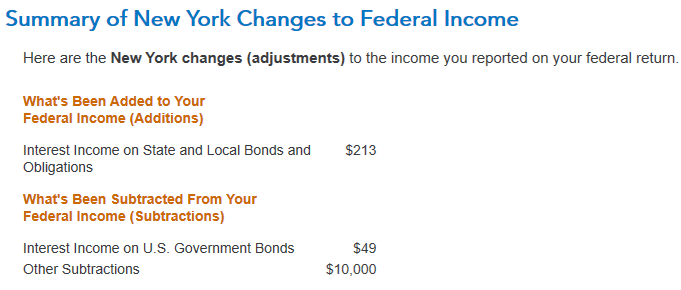

It depends. Your adjustments should appear in a summary screen like the screenshot below. This will appear as you prepare your NYS return. After you view your adjustments on this screen, you will need list each of the adjustments as a description, the full amount of the NYS adjustment, and then the portion of the adjustment allocated during the time you lived in NYC. Here is the screenshot I alluded to earlier.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allocate New York State adjustments

Hello,

I moved to a new state in 2023. I need help with the same issue that others are having. I don't know where this number came from or what to write in the description box.

My token is: 1218394

Thanks in advance!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allocate New York State adjustments

Thank you for your token.

The 2,182 is self-employment tax. Since you allocated 100% to NYS on a previous screen, I allocated 100% to NYC as I assume you ran this business while a NYS resident. I have attached a screenshot of the screen where you have to enter the allocation information.

Lastly, please change your NYC residency for 2023 from 01/01/2023 (not a 2022 date) to 10/01/2023. This will appear as an entry to be changed when you review the return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allocate New York State adjustments

Hi,

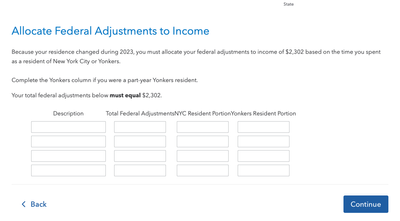

I lived in NYC from Jan.1st 2023 to August 17th. 2023. I moved to North Carolina where I lived the remainder of 2023. The message I received is:

| Because your residence changed during 2023, you must allocate your federal adjustments to income of $2,302 based on the time you spent as a resident of New York City or Yonkers. Complete the Yonkers column if you were a part-year Yonkers resident. |

| Your total federal adjustments below must equal $2,302. |

Please advise on what entered I should in the field boxes.

Token Number: 1230913

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

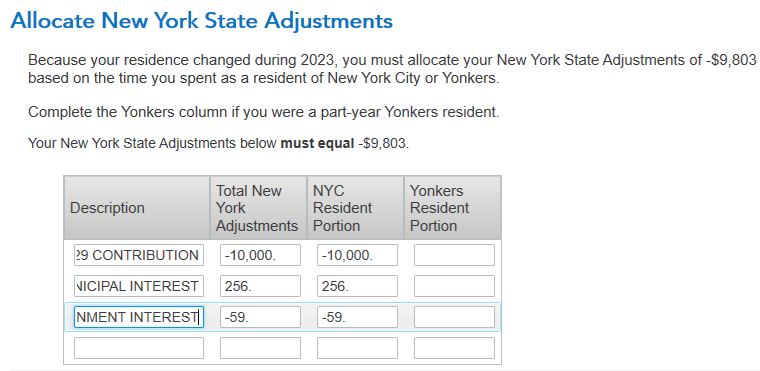

Allocate New York State adjustments

Having a similar problem with my 2023 New York taxes, my token number is 1230986.

For context, I lived in New York City for 10 months and then moved to New Jersey so my NYS and NYC residence period is the same. I have $10,000 in 529 contributions (which happened one-time while I was living in NY), $256 in interest income on state or local bonds, and $59 in interest income on US government bonds. I've adjusted the state/local bonds and US government bonds by 10/12 (to reflect the period of time I lived in NY) in the New York Additions Allocation and New York Subtractions Allocation part of the interview.

What confuses me is when I get to the Allocate New York State Adjustments section, it's showing -$9803 in Total New York Adjustments which is the exactly the same as (-$10000 + $256 - $59) as if I lived in New York State for the entire year. Since I lived in New York City for the same duration of time as I lived in New York State, is the NYC resident portion supposed to also add up to -$9803?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Allocate New York State adjustments

Allocating for the time period is great. You were NYC resident while in NY so the numbers would match. If you have simply moved to another part of NY, they would not match.

Instructions for Form IT-201 - Tax.NY.gov step 3 is to enter adjustments from federal return.

@edchen

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

theresa-chiang

New Member

ryanf312

New Member

ryan-herrera33-y

New Member

sssperling

New Member

aE

Level 3