- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Foreign Tax Credit on dividends

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit on dividends

Tax year 2023. Where do you enter the foreign tax paid on a dividend?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit on dividends

You can enter the foreign tax credit or deduction in the same location. Follow the steps below.

Both the credit and the deduction are entered in the same place. Here's what you do:

Note: If your TurboTax navigation looks different from what’s described here, learn more.

- Open (continue) your return in TurboTax

- Enter all your foreign income in Wages & Income if you haven't already

- Select Search, enter foreign tax credit and select Jump to foreign tax credit

- Or go to Deductions & Credits, and select Start next to Foreign Tax Credit under Estimates and Other Taxes Paid

- When you reach the screen Do You Want the Deduction or the Credit? select the option you prefer for your situation

- If you select Take a Credit:

- Select Continue on the next screen, then select No to fill out Form 1116

- When you reach the screen Country Summary, select Add a Country

- Answer the questions about your foreign income, taxes, and expenses on the following screens

- When finished, you'll be taken back to the Country Summary screen. If you have income from other countries to enter, select Add a Country. Otherwise, select Done

- Answer the questions on the following screens until you reach your Foreign Tax Credit Summary. If you’re finished with this section, select Done

- If you select Itemized Deduction:

- Enter your foreign taxes paid on the next screen. These should show up in the Deductions & Credits section of your tax return, under Other Deductible Expenses

For reference please see Where do I enter the foreign tax credit (Form 1116) or deduction?

When entering the dividends, you can also check 'My form has info in other boxes' to enter the Box 7, Foreign tax paid.

[Edited: 03/20/2024 | 6:30 AM PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit on dividends

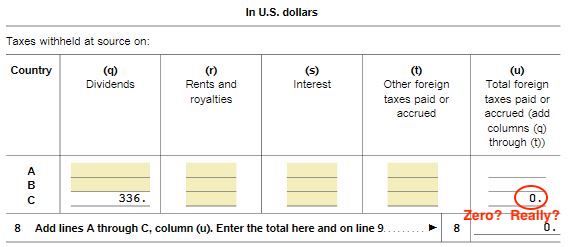

@DianeW777 I have a question about how this works in Turbotax Business for a 1041 trust tax return I'm preparing as fiduciary. I took an extension for this year to try to sort some things out, this being one of them. The trust is eligible for a $336 foreign tax credit based on dividend taxes withheld at source. But when I go to declare distributions of the trust's income to the beneficiaries, the foreign tax credit disappears and goes to $0.00.

This would make sense if the credit were divided proportionally among the beneficiaries (which is what's supposed to happen), but nothing about it appears on the beneficiary K-1s that Turbotax generates, nor on the accompanying Statement A's. So I have no idea what Turbotax is doing here. Is it reducing the total taxable income by the amount of the credit prior to figuring the taxable distributions, but without showing it? Or is it just throwing the credit away when distributions are declared?

In any case, shouldn't it generate a Form 1116 or other documentation for each beneficiary concerning their share of this credit?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Garbanzor29

Level 2

faxianjhuang

Returning Member

wwood12

New Member

Extirpator

Level 1

gmangesh

Level 2