- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Deductions & credits

- :

- Foreign Tax Credit

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

Per IRS, "You can choose whether to take the amount of any qualified foreign taxes paid or accrued during the year as a foreign tax credit or as an itemized deduction. You can change your choice for each year's taxes".

I have $650 in foreign taxes paid from 1099-DIV. This puts me over the $600 MFJ exception from not having to file form 1116. Form 1116 reduces my FTC by half. Can I choose to only take $600 in foreign taxes paid as a credit and ignore the remaining $50 which then removes form 1116 from my tax return?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

No. According to the IRS instructions here you can be exempt from the Foreign Tax Credit limit when the tests below are met. It appears tests 2 and 3 are applicable; all your qualified foreign taxes as reported on 1099.

- Your only foreign source gross income for the tax year is passive income, as defined in Publication 514 under Separate Limit Income.

- Your qualified foreign taxes for the tax year are not more than $300 ($600 if filing a joint return).

- All of your gross foreign income and the foreign taxes are reported to you on a payee statement (such as a Form 1099-DIV or 1099-INT).

- You elect this procedure for the tax year.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

This then creates some dilemma regarding FTC carryovers.

1. Since carryback of one year is mandated, can I apply less than the total carryover so not to trigger form 1116 in 2021? If not, then triggering form 1116 in 2021 will produce additional carryovers (which then cascades to a whole bunch of prior years).

2. If I sell some foreign stocks to reduce my 2023 foreign taxes paid on form 1099-DIV to sub $600, any carryforward then puts me back over $600. That seems like an unintended consequence. Am I stuck here until my entire carryforward is used up?

It looks like the best answer here is to choose to deduct foreign taxes paid in 2022, not claim any FTC for the year and then sell some foreign stocks to reduce foreign taxes paid to sub $600 in 2023.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

If you make the election to claim the tax credit without filing a form 1116 to avoid the foreign tax credit limitation then you cannot carry forward or back from or to any foreign taxes from the year. However the carryovers for other years are unaffected and the 10-year clock continues.

Here is the IRS reference (see the general instructions section and also the line 10 instructions "Restrictions").

So if you do not make the election to claim the foreign tax credit without filing the form 1116 in 2022 and you have credit which you can carryback to 2021, but 2021 was a year you made an election to claim without a form 1116, then you cannot carryback to that year. So the rest is carryforward for up to 10 years.

For tax year 2023, if the foreign taxes paid and shown on 1099s is below 600 (MFJ) not including any carryovers then you can make the election for 2023 and none of the carryforwards are used and continue forward. The 10 year limitation still applies starting with the year an 1116 was actually filed showing the carryover amount.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

I don't remember who told me this was ok, my problem was the mutual fund did not report the income by country, so I just took the credit up to this limit, might have been $200 back then, don't remember the requirement about terrorist etc. not sure how I could determine that without the countries etc.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

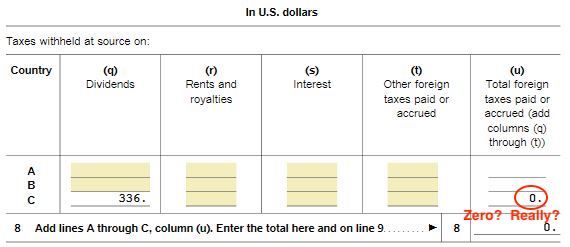

@DMarkM1 I have a question about how this works in Turbotax Business for a 1041 trust tax return I'm preparing as fiduciary. I took an extension for this year to try to sort some things out, this being one of them. The trust is eligible for a $336 foreign tax credit based on dividend taxes withheld at source. But when I go to declare distributions of the trust's income to the beneficiaries, the foreign tax credit disappears and goes to $0.00.

This would make sense if the credit were divided proportionally among the beneficiaries (which is what's supposed to happen), but nothing about it appears on the beneficiary K-1s that Turbotax generates, nor on the accompanying Statement A's. So I have no idea what Turbotax is doing here. Is it reducing the total taxable income by the amount of the credit prior to figuring the taxable distributions, but without showing it? Or is it just throwing the credit away when distributions are declared?

In any case, shouldn't it generate a Form 1116 or other documentation for each beneficiary concerning their share of this credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

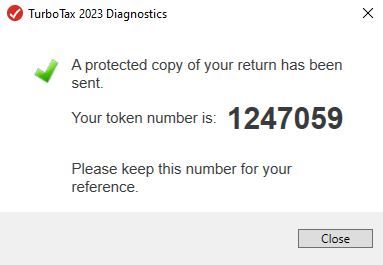

It would be very helpful if you would like to send us a “diagnostic” file that has your “numbers” but not your personal information. If you would like to do this, here are the instructions:

TurboTax CD/Download:

If you like, you can send a copy of your return that will be scrubbed to eliminate your personal data by using these steps:

- Click on Online in the top left menu of TurboTax CD/Download for Windows

- Select 'Send Tax File to Agent'

- Write down or send an image of your token number and state then place in this issue.

- We can then review your exact scenario for a solution.

- Please also tell us any states included in the return. This is necessary for us to view the return.

We will then be able to see exactly what you are seeing and we can determine what exactly is going on in your return and provide you with a resolution.

Please @DMarkM1 and I will be notified.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

@DMarkM1 Thanks for the help! The token number is 1247059. The trust is domiciled in Texas, so no state return. Below is an image of the token.

After doing some more research, it sounds like the proportionate pass-through share of the foreign tax credit should appear on the beneficiary k-1s as Box 14, Item B. But this does not appear in what Turbotax generates. I could try to just manually add it in, but that might create an error? See discussion of Line 14 B here: https://support.taxslayerpro.com/hc/en-us/articles/[phone number removed]-Schedule-K-1-Form-1041-Ded...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

Apparently the forum garbled my Taxslayer link, so let's try this instead: https://tinyurl.com/yv24ydby

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Foreign Tax Credit

Yes, box 14 code B is correct for the foreign tax credit. Two items for you to include the foreign tax credit.

1. You need to know and report/include the amount of your box 1 dividends that were taxed by the foreign countries. You should be able to get that number from your supplemental pages for the 1099-DIV.

2. I see you already started a form 1116 for passive income you will be linking to that form.

- In "Forms Mode" open the 1099DIV with the foreign taxes in box 7

- Scroll down to the box 7 section

- Double click in the "a" box and link the form 1116 you already started

- Select Column "B" in the "b" area

- Enter the amount of foreign source dividends in the box

- Enter "Various" in box 8

- Now when you open the K-1s you should see box 14 populated and Code B will be the foreign taxes

- You can check the K-1 worksheet box 14

- You can check the form 1116

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

dmraye

New Member

reeree1121

New Member

AJSR111

New Member

Brack

New Member

peepeepoopoo417

Level 1