How is my T4 slip affected by the CPP/QPP form updates (Schedule 8, Schedule 8QC, and RC381)?

The CRA has updated some forms related to the Canada Pension Plan (CPP) and the Québec Pension Plan (QPP). These forms include:

Schedule 8 (CPP Contributions on Self-Employment and Other Earnings)

Schedule 8QC (QPP Contributions on Self-Employment and Other Earnings)

Form RC381 (Inter-provincial Calculation for CPP and QPP Contributions and Overpayments)

This is important if your T4 slip from your employer has employment income in box 14 and a "0" or no number in box 26. Box 26 shows the earnings that were subject to CPP or QPP contributions.

Because of the CPP/QPP form updates, there are specific situations where you need to be careful about the relationship between box 14 and box 26. These situations happen when your T4 slip also has amounts in any of these boxes:

Box 16

Box 16A

Box 17

Box 17A

These boxes show the CPP or QPP contributions that were taken from your employment income.

Note: Before you continue your return, ask your employer to make sure the info on your T4 is correct. If they confirm it is, go ahead and enter the amounts that your T4 shows.

If you can't check with your employer by April 30, 2026, or if your T4 is incorrect and you won’t get an amended one by April 30, 2026, here are some possible scenarios that might help. These are only recommendations, and checking with your employer should be your priority.

Non-Québec scenarios (box 10 on your T4 doesn't show "QC")

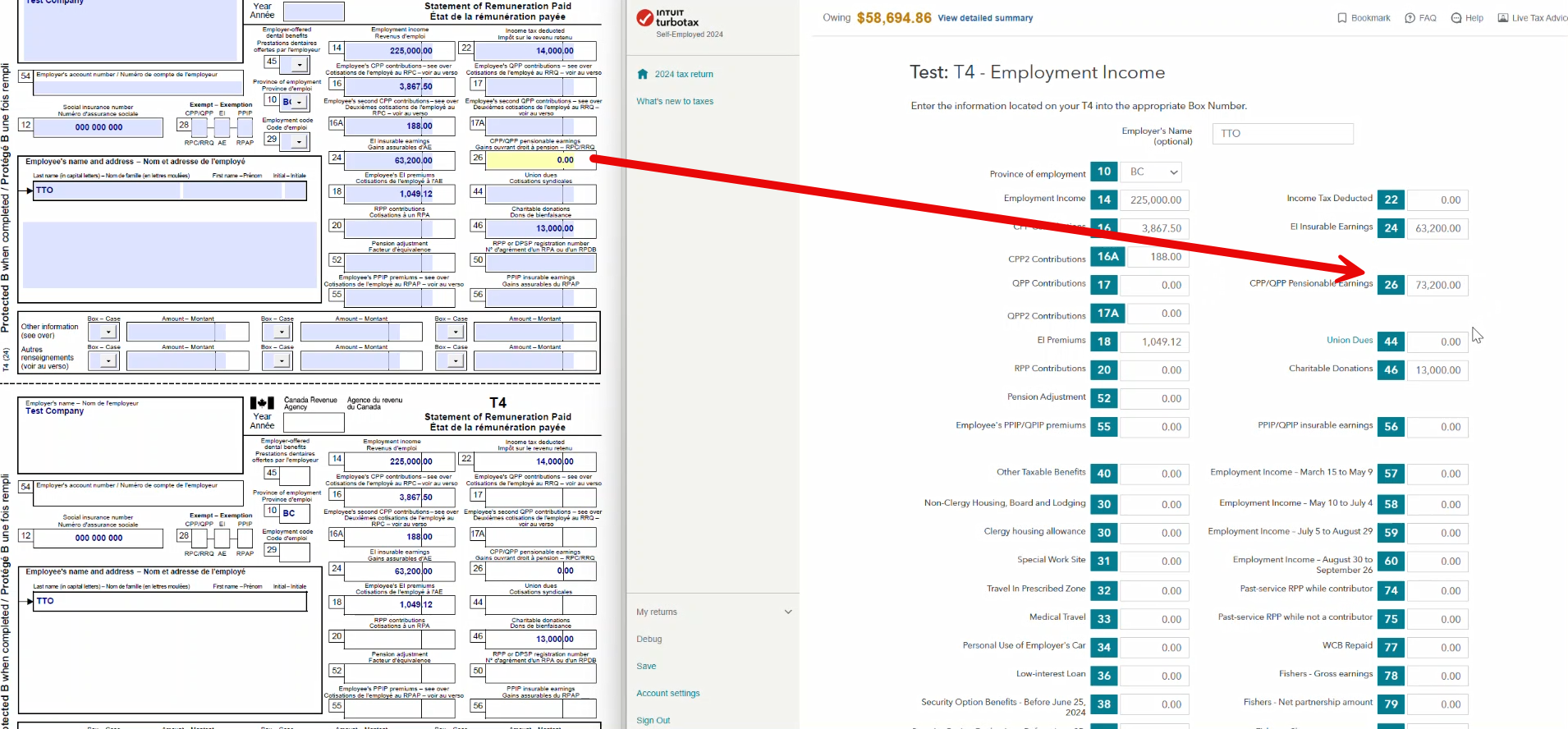

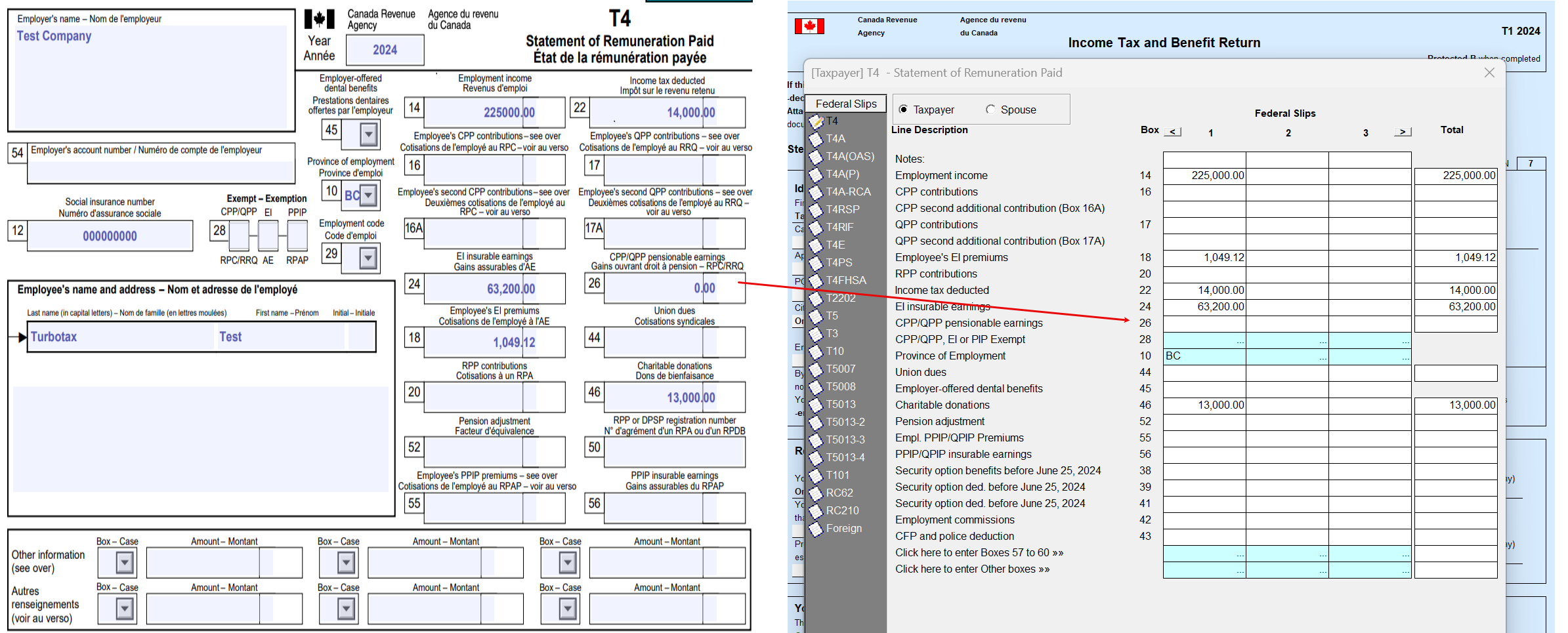

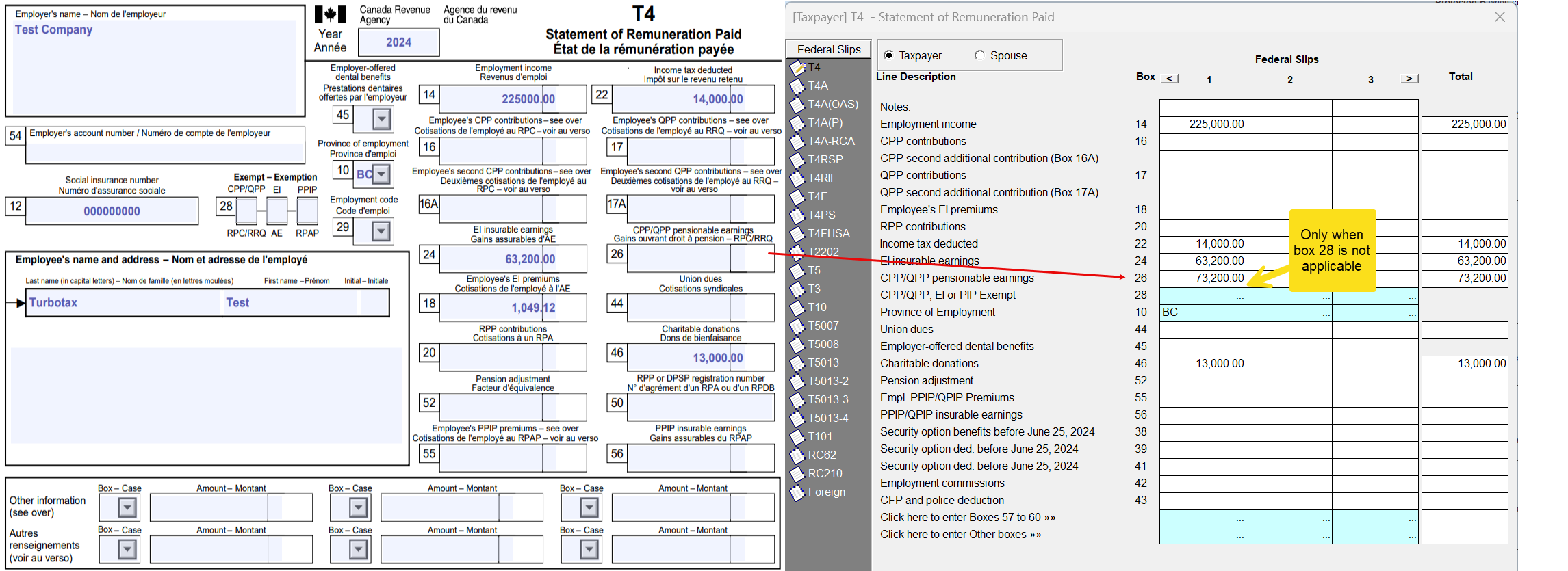

Scenario 1: Boxes 16 and 16A have amounts, box 26 shows "0", and box 28 is blank (no "X" for CPP).

What this means: CPP contributions were taken from your employment income (as shown in boxes 16 and 16A), but your employer put “0” in box 26.

What to do: Enter the same amount that’s in box 14 (your total employment income) into box 26 (up to the maximum $73,200). If your box 14 amount is higher than $73,200, you should only enter $73,200 in box 26.

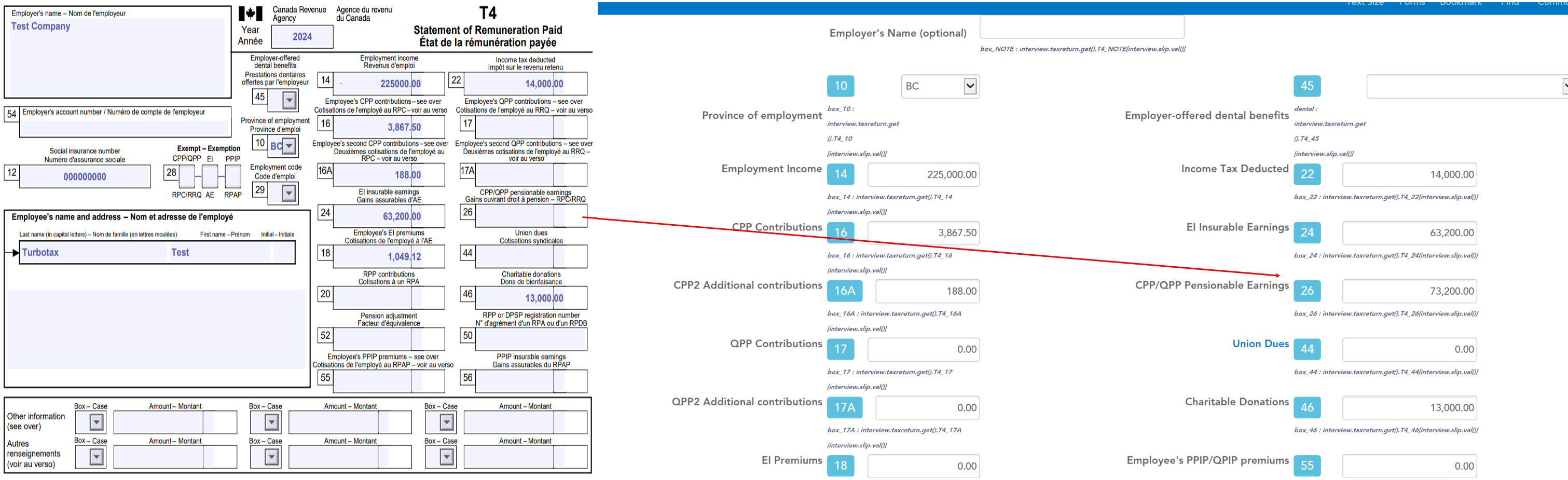

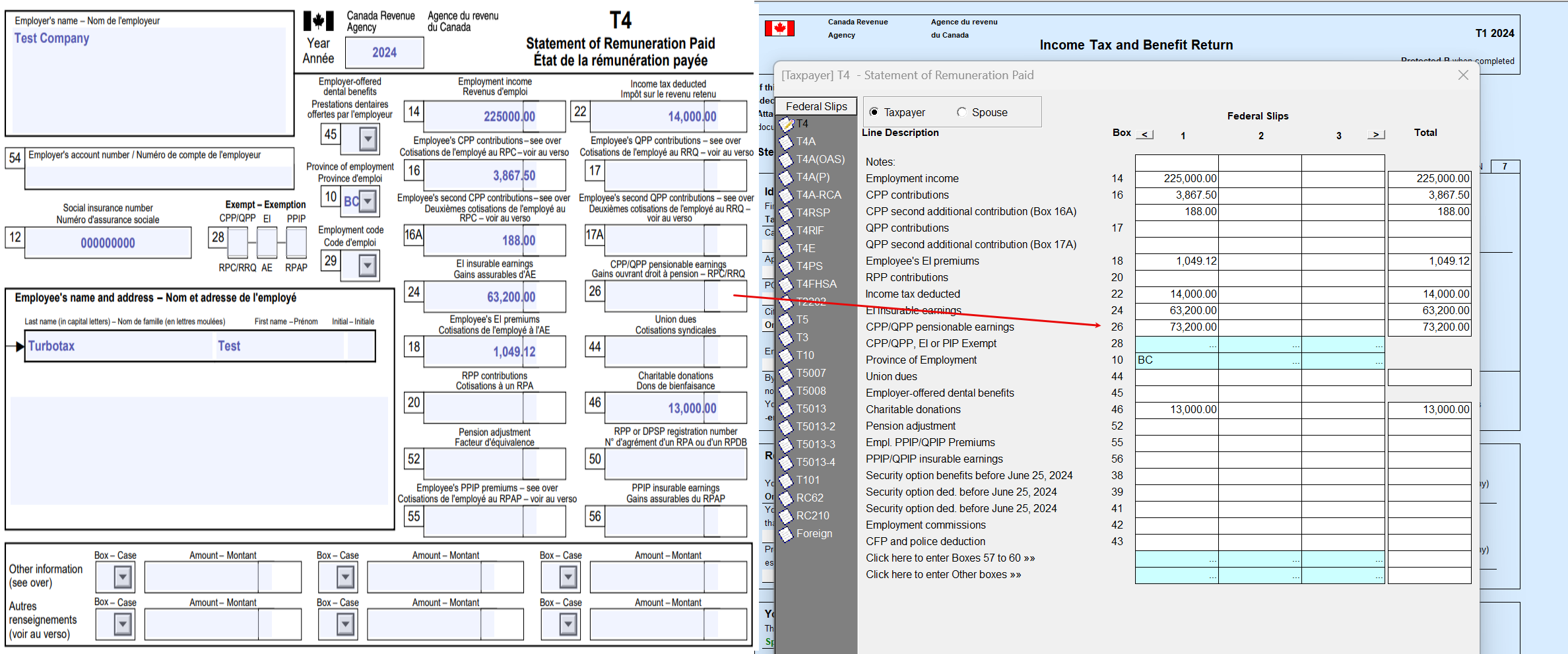

Scenario 1 in TurboTax Online

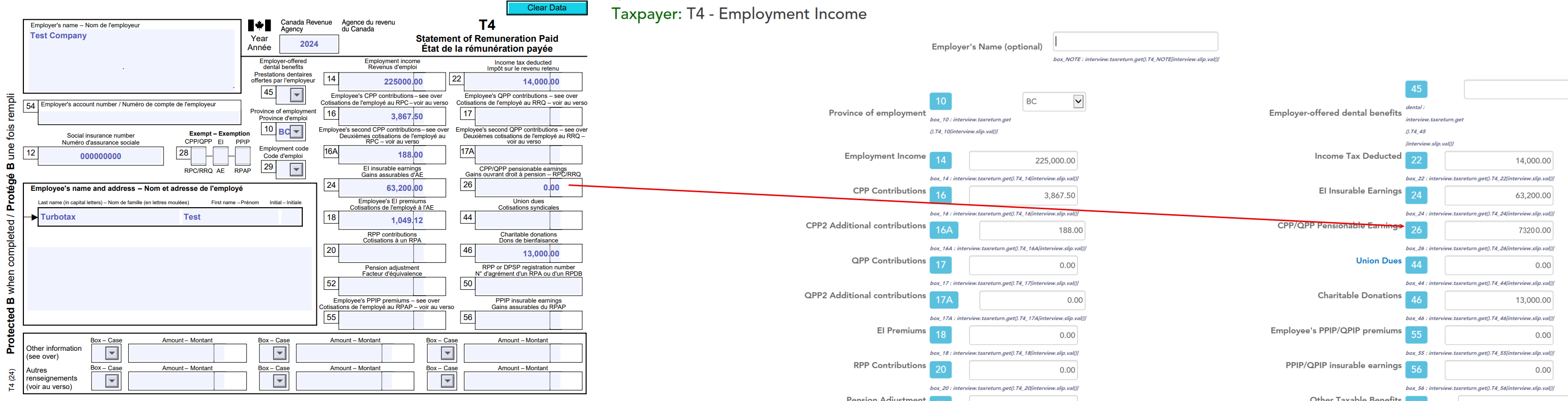

Scenario 1 in TurboTax Desktop EasyStep

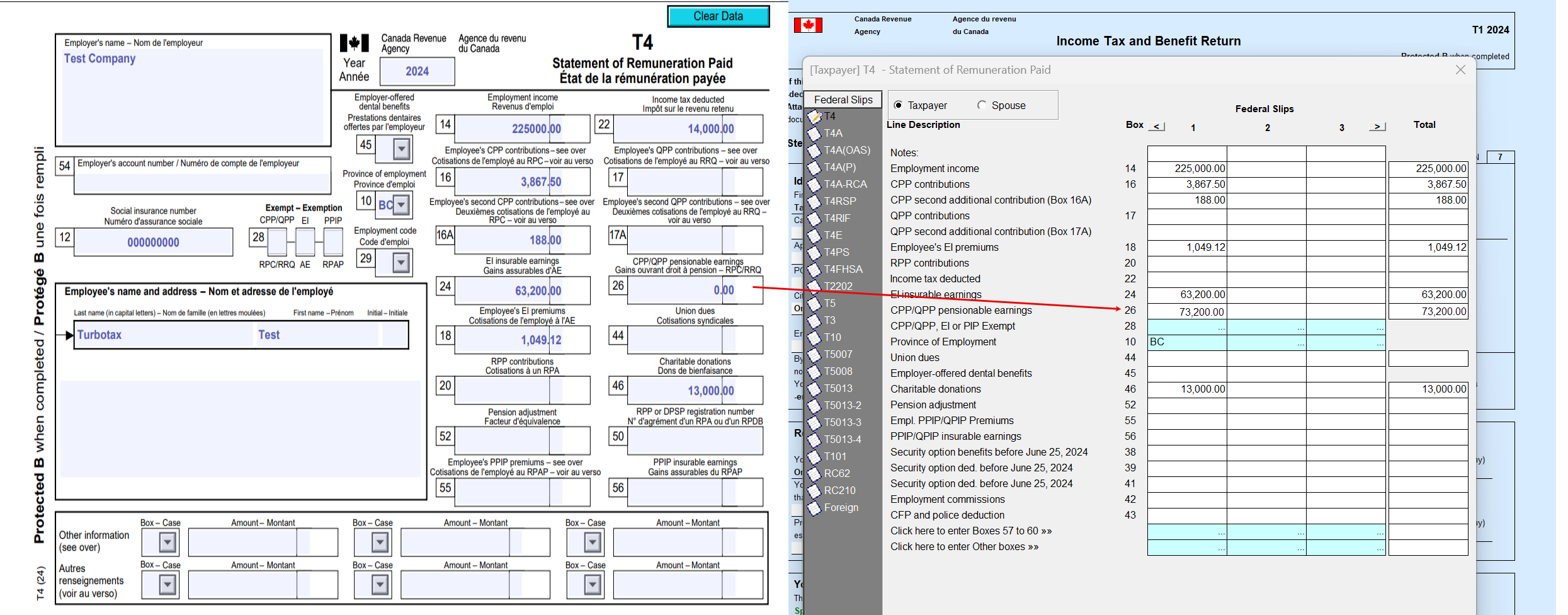

Scenario 1 in TurboTax Desktop Forms

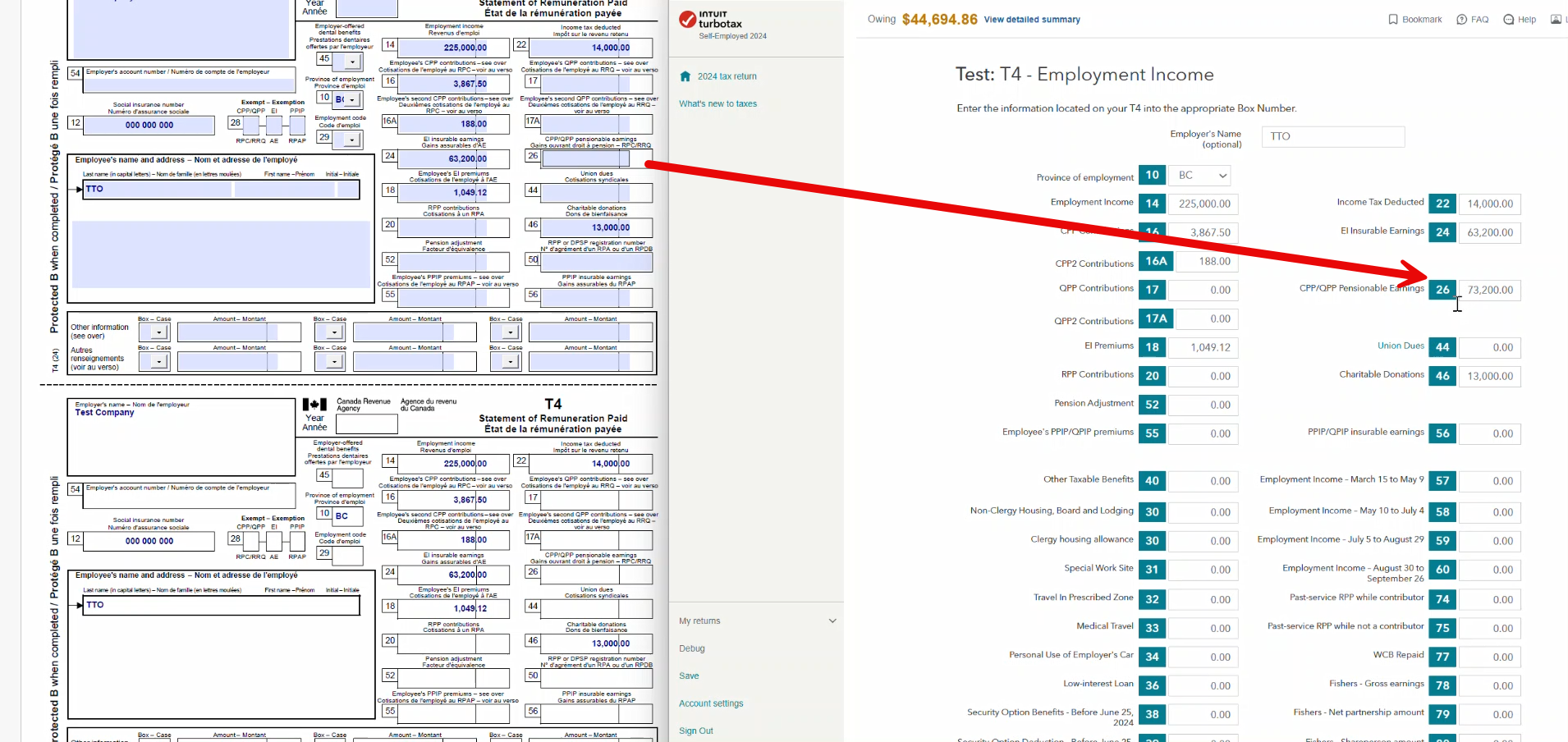

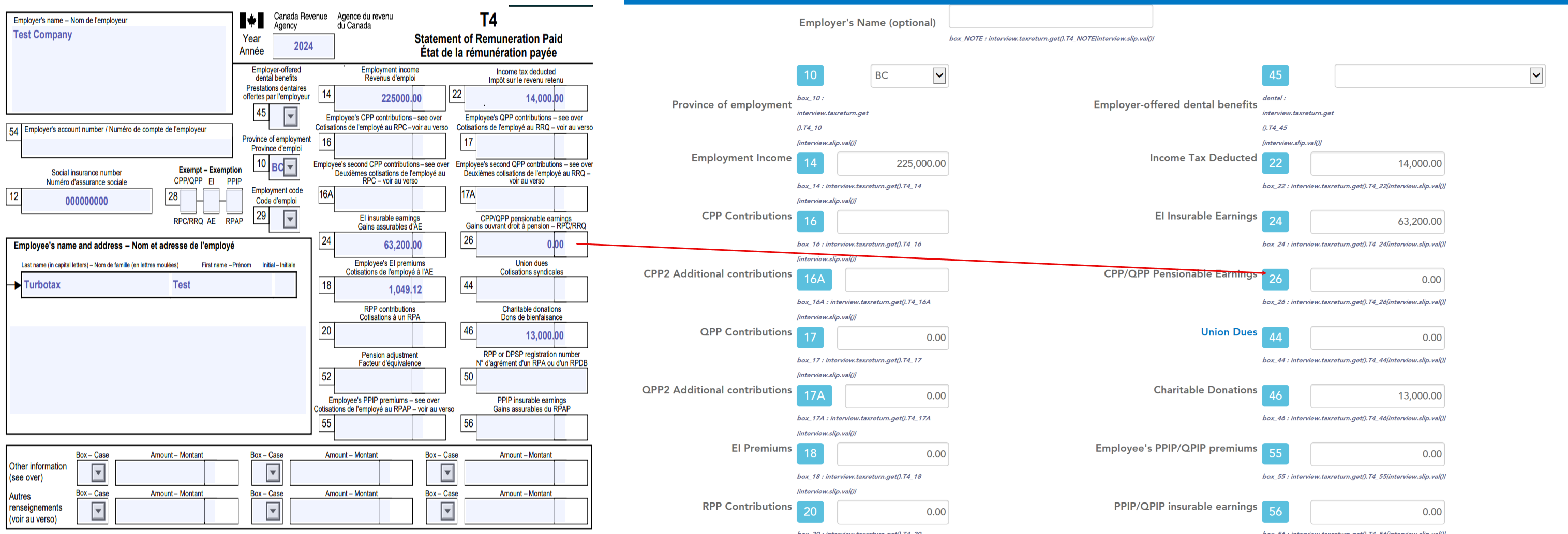

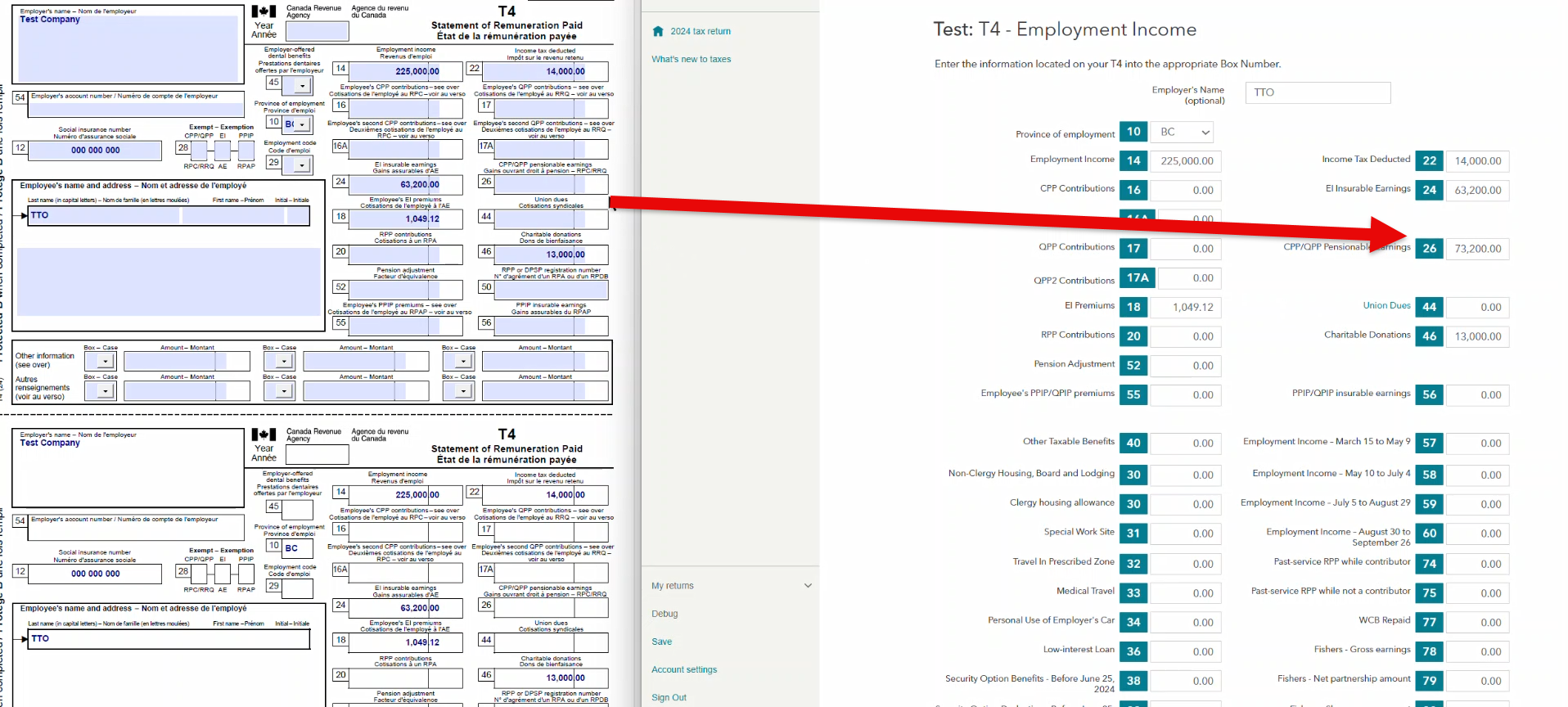

Scenario 2: Boxes 16 and 16A have amounts and box 26 is empty (no "0").

What this means: CPP contributions were taken from your employment income (as shown in boxes 16 and 16A), but box 26, which should show your pensionable earnings, is empty.

What to do: Enter the same amount that’s in box 14 (your total employment income) into box 26 (up to the maximum $73,200). If your box 14 amount is higher than $73,200, you should only enter $73,200 in box 26.

Scenario 2 in TurboTax Online

Scenario 2 in TurboTax Desktop EasyStep

Scenario 2 in TurboTax Desktop Forms

Scenario 3: Boxes 16 and 16A are empty and box 26 shows "0".

What this means: No CPP contributions were taken from your employment income (as shown in boxes 16 and 16A) and box 26 also shows "0."

What to do: Keep box 26 as "0."

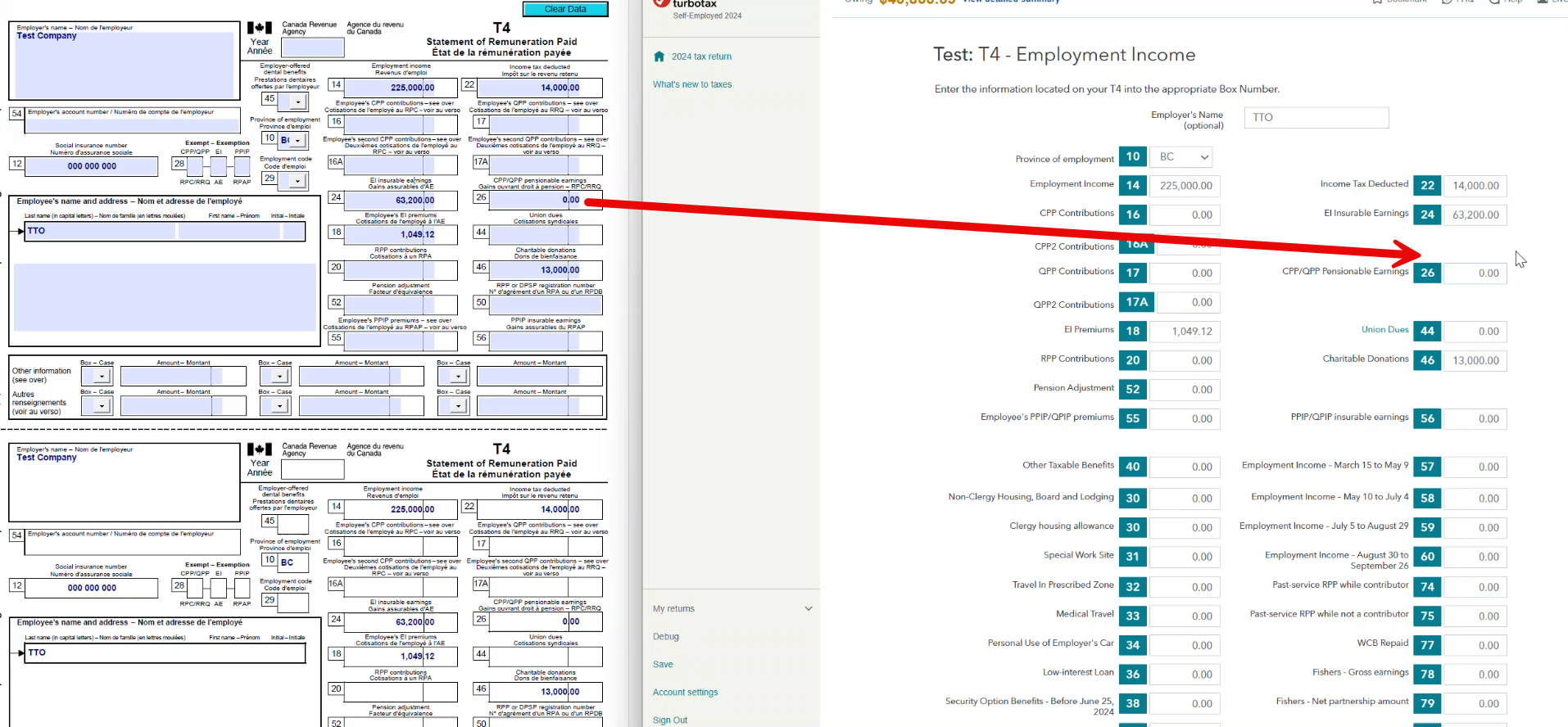

Scenario 3 in TurboTax Online

Scenario 3 in TurboTax Desktop EasyStep

Scenario 3 in TurboTax Desktop Forms

Scenario 4: Boxes 16, 16A, and 26 are empty (no "0") and box 28 is blank (no "X" for CPP).

What this means: CPP contributions were taken (boxes 16 and 16A are empty) and box 26 is also empty.

What to do: Enter the same amount that’s in box 14 (your total employment income) into box 26 (up to the maximum $73,200). If your box 14 amount is higher than $73,200, you should only enter $73,200 in box 26.

Scenario 4 in TurboTax Online

Scenario 4 in TurboTax Desktop EasyStep

Scenario 4 in TurboTax Desktop Forms

Scenario 5: Box 16A, has an amount, box 16 is empty, and box 26 is empty (no “0”) or has an amount.

What this means: CPP contributions were taken and only Box 16A has an amount.

What to do: Remove the amount that’s in box 16A and enter that amount in box 16 instead.

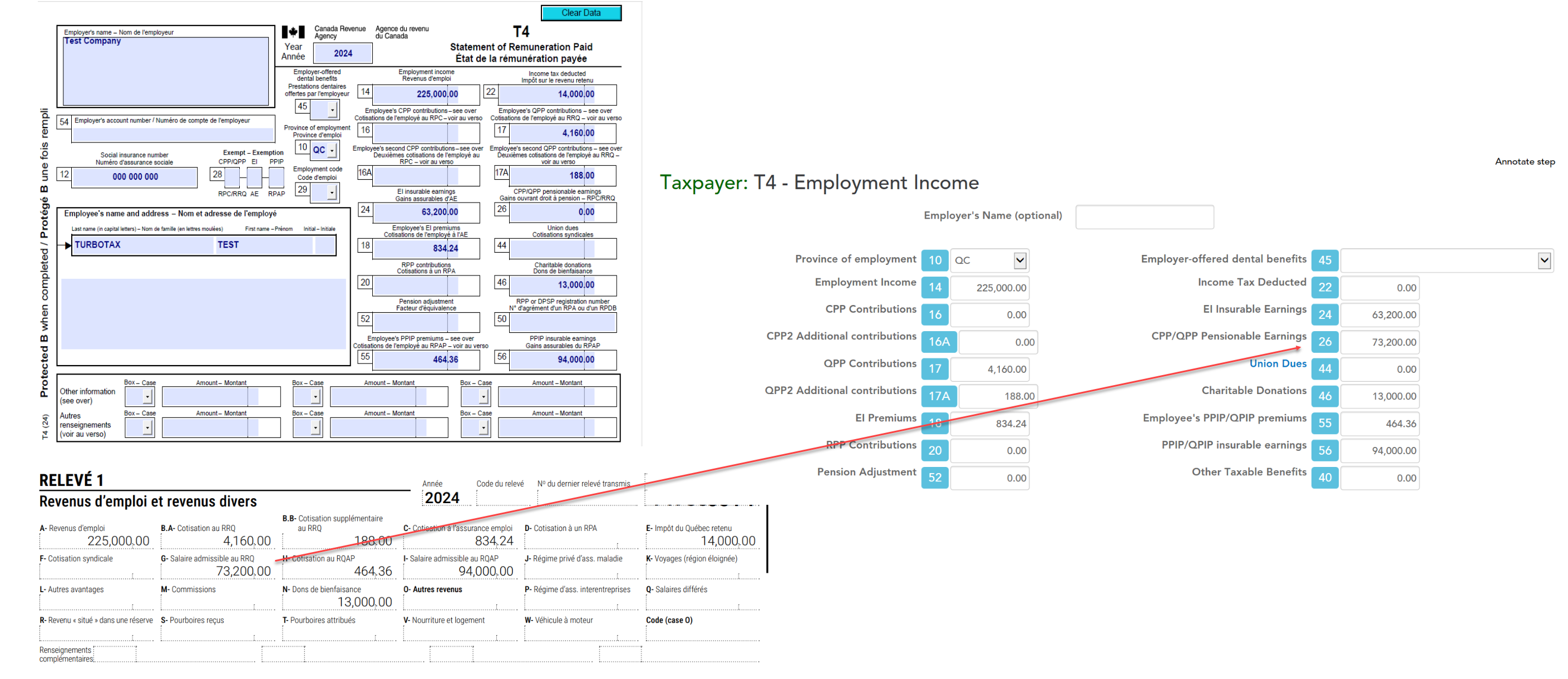

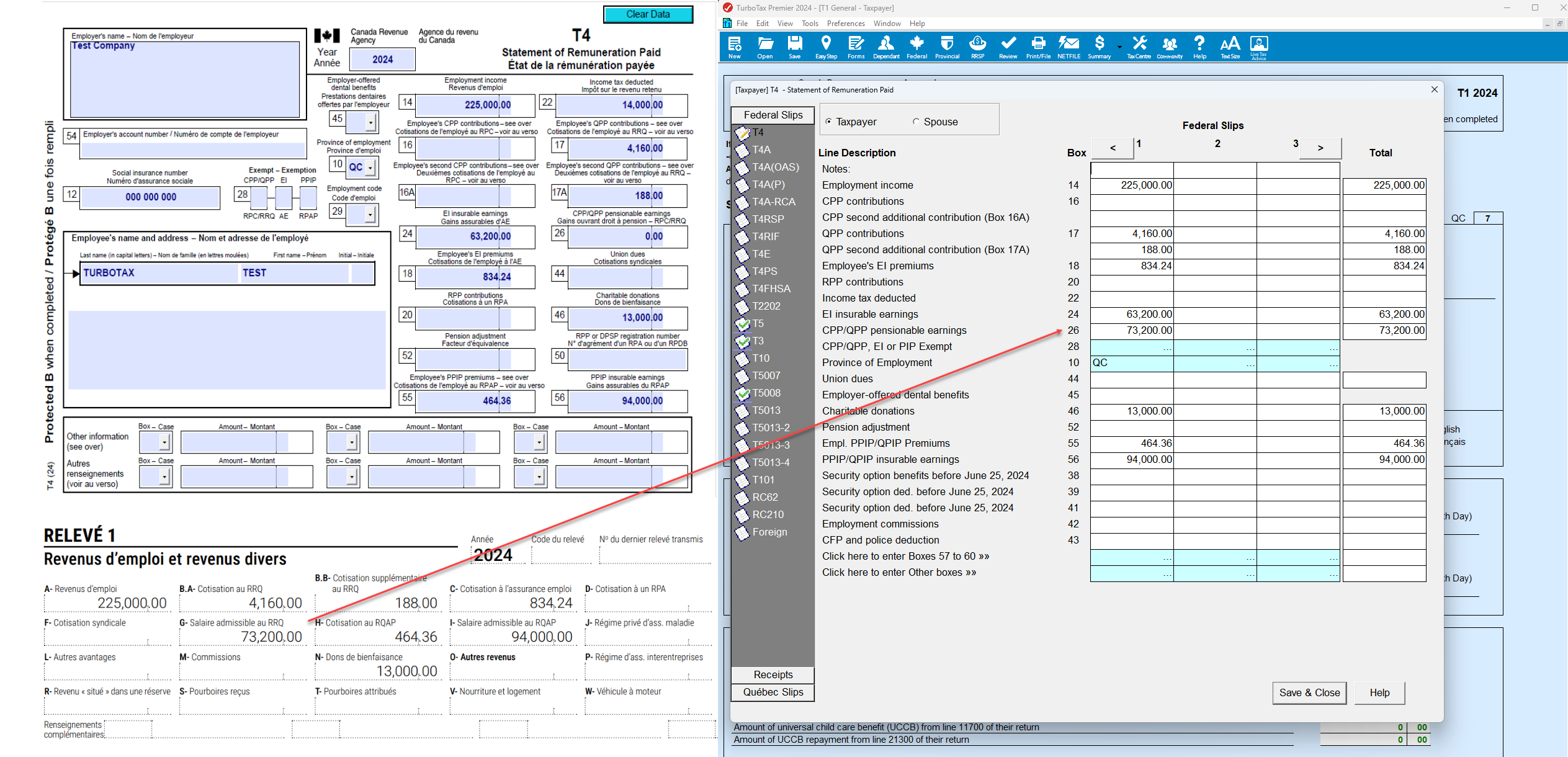

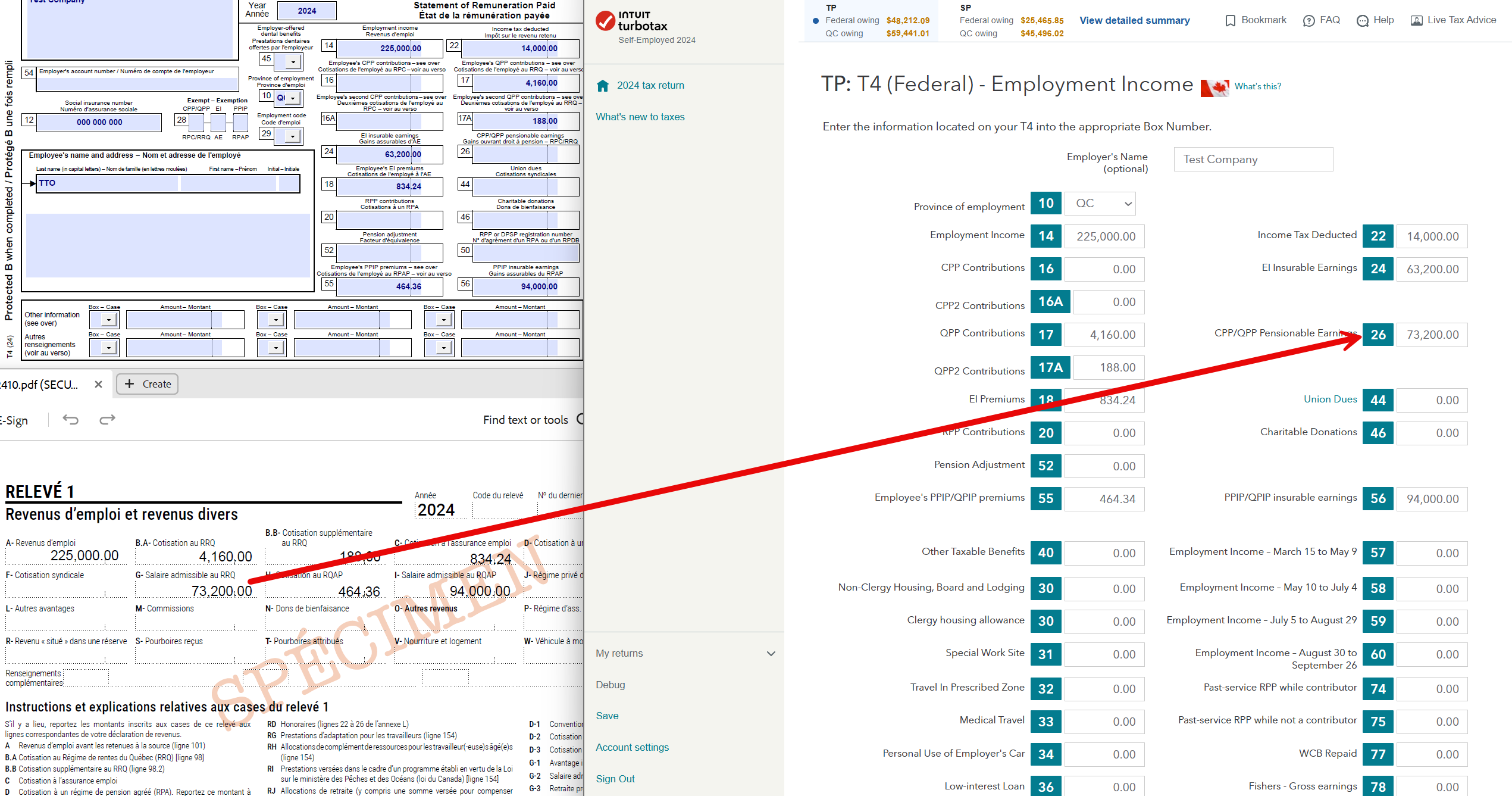

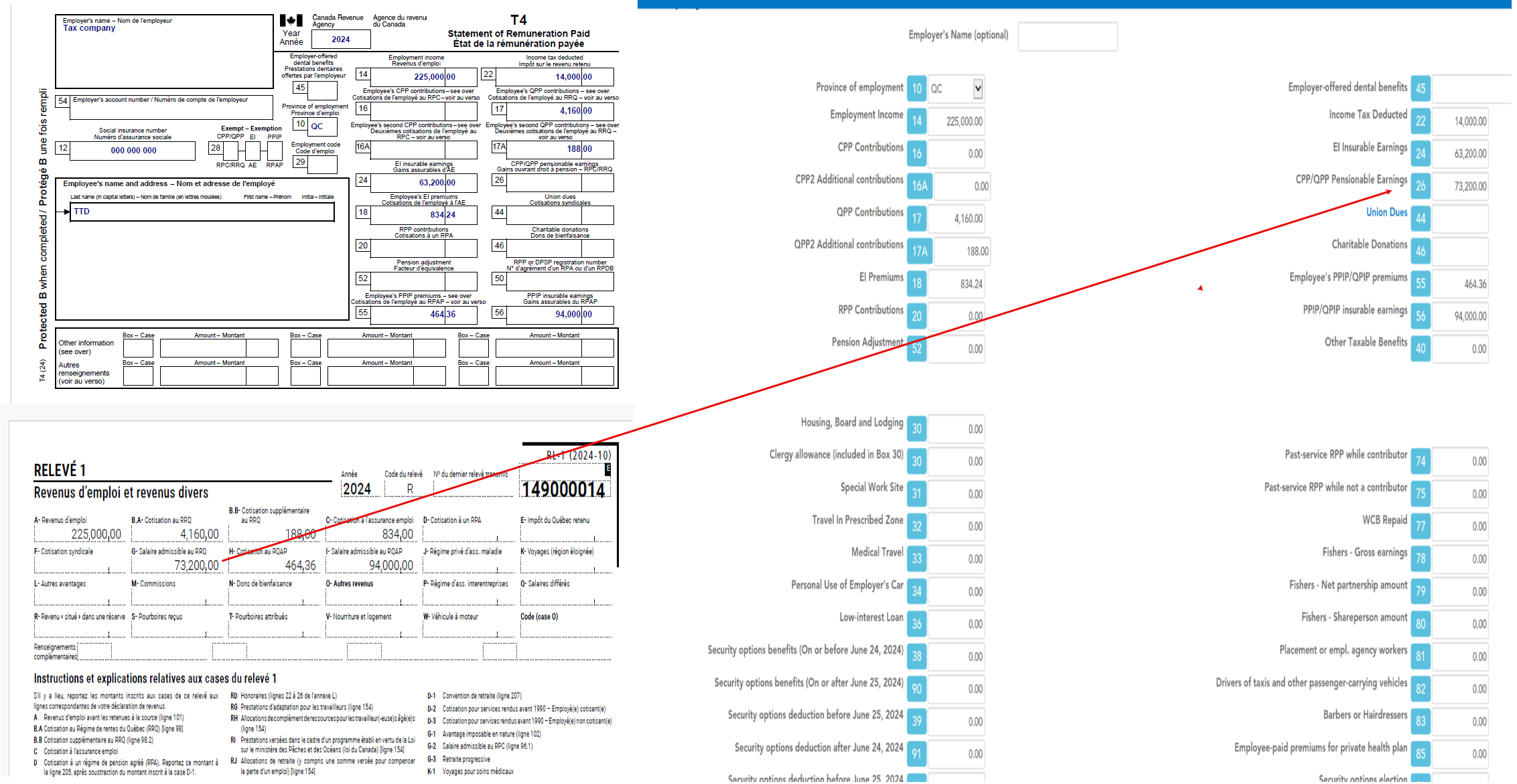

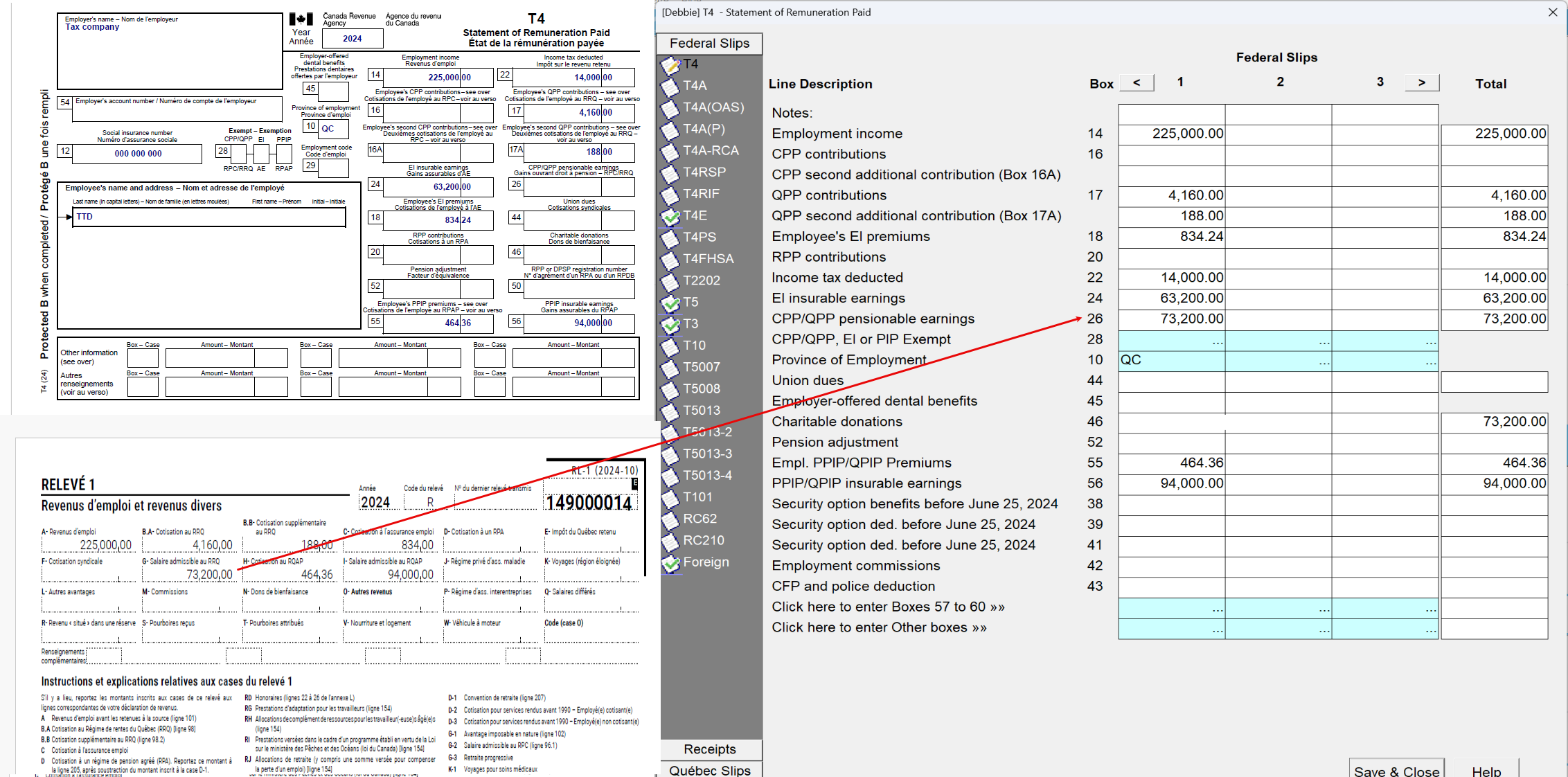

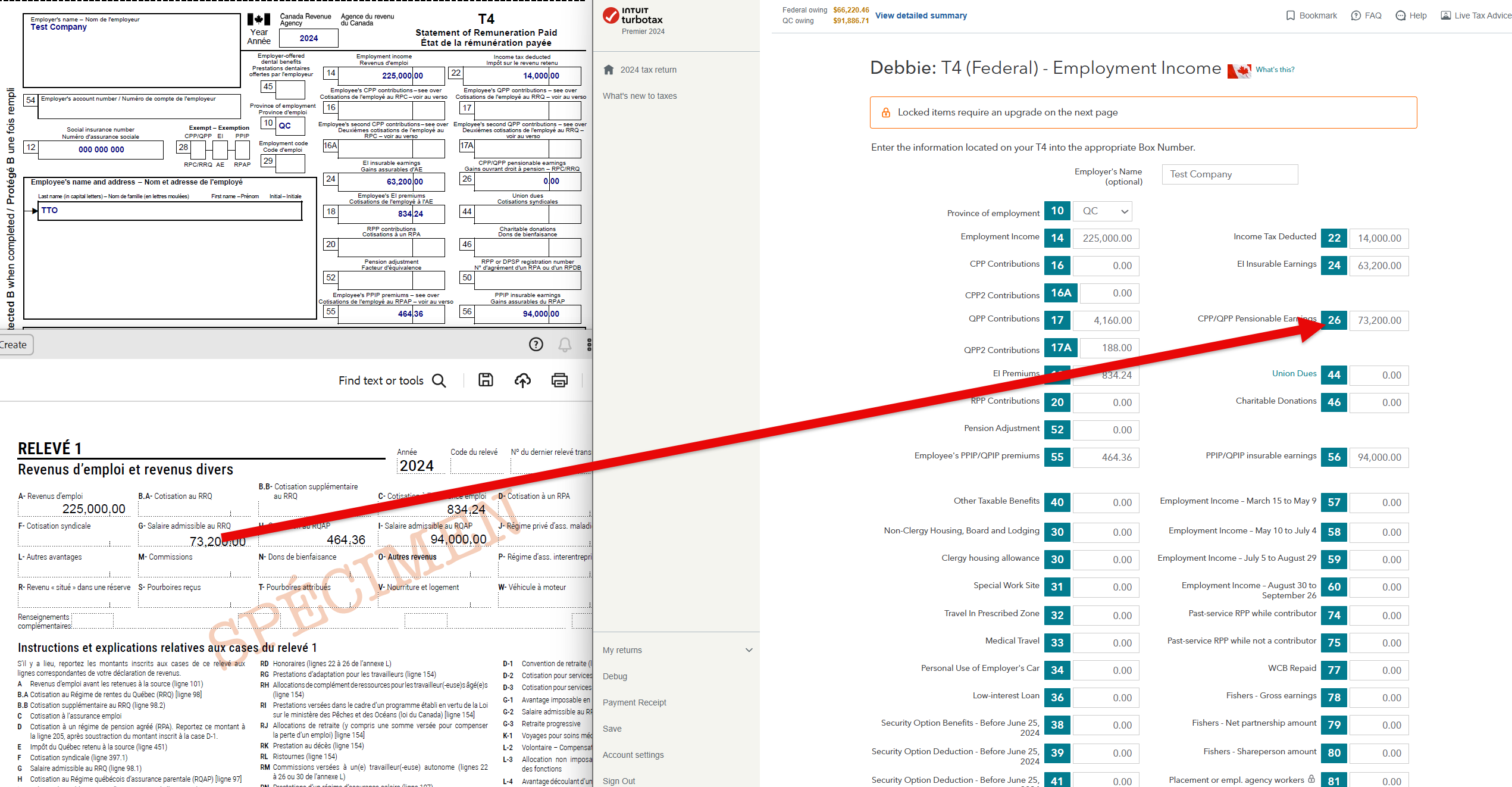

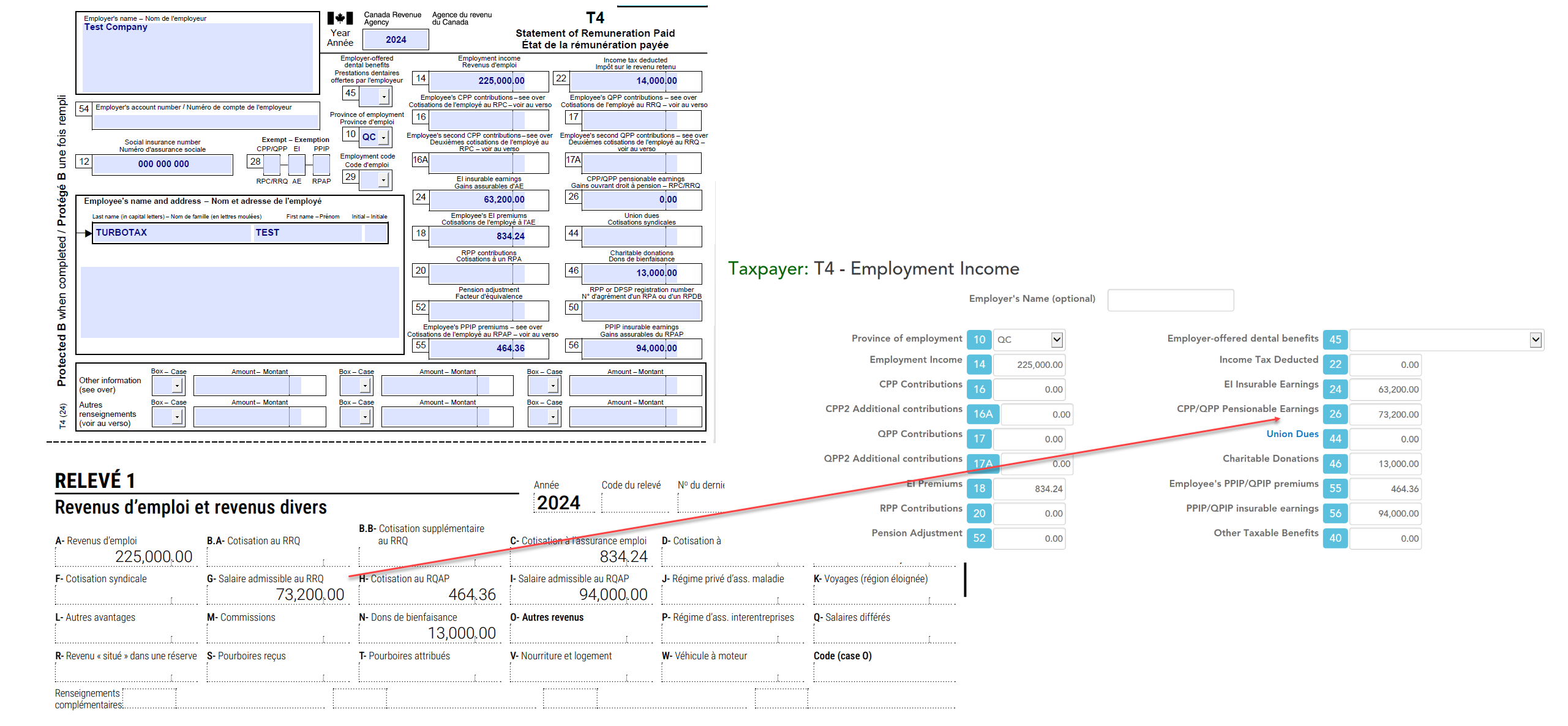

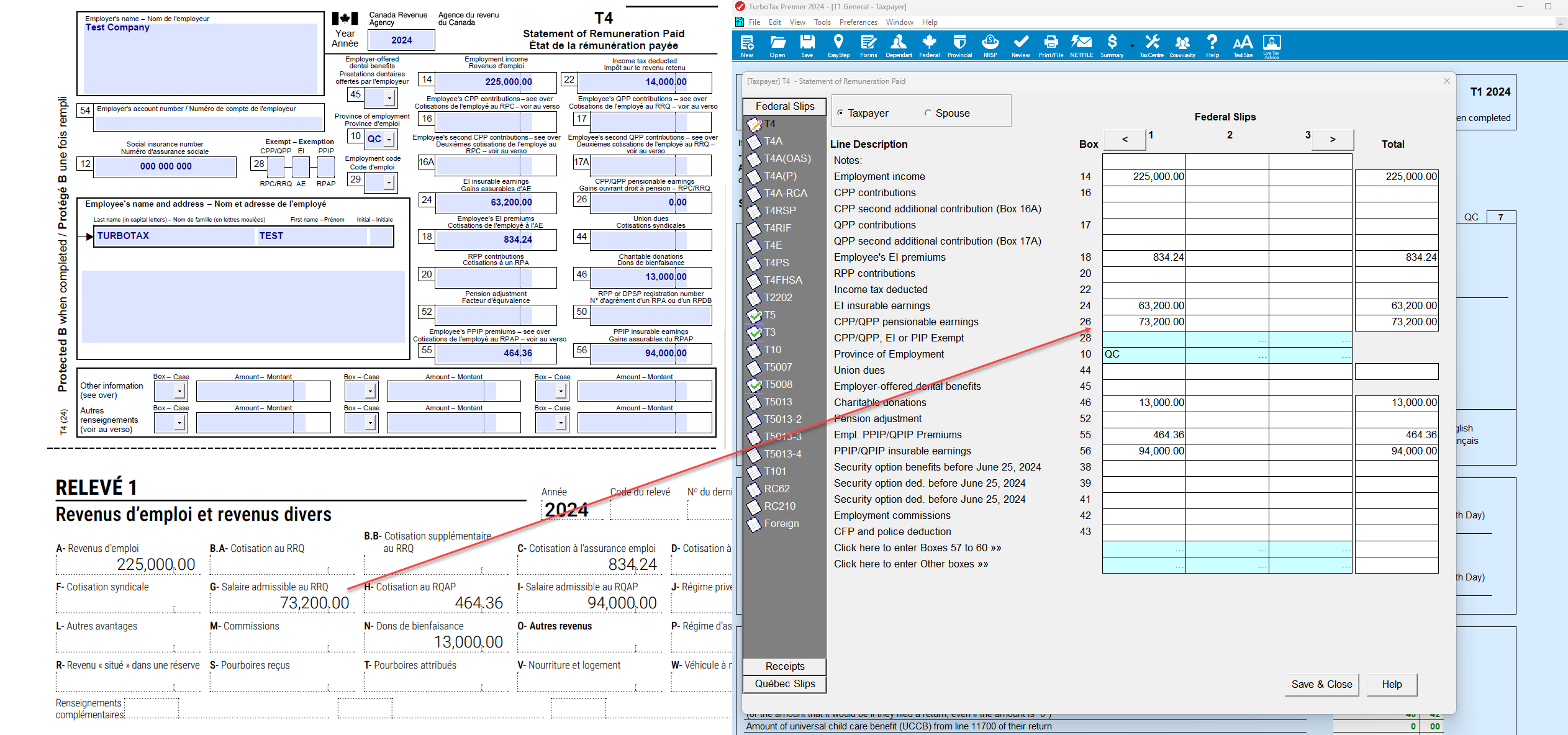

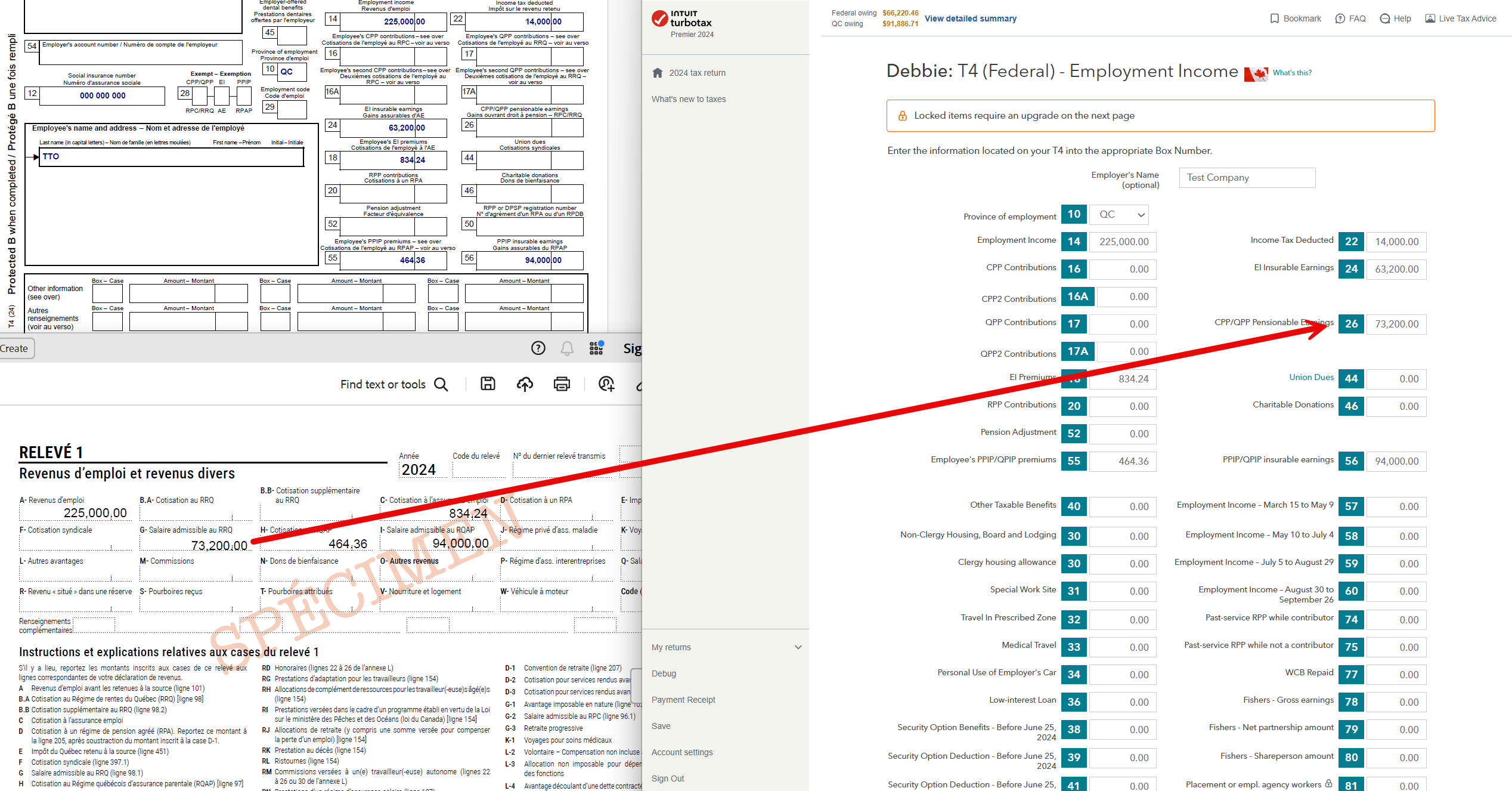

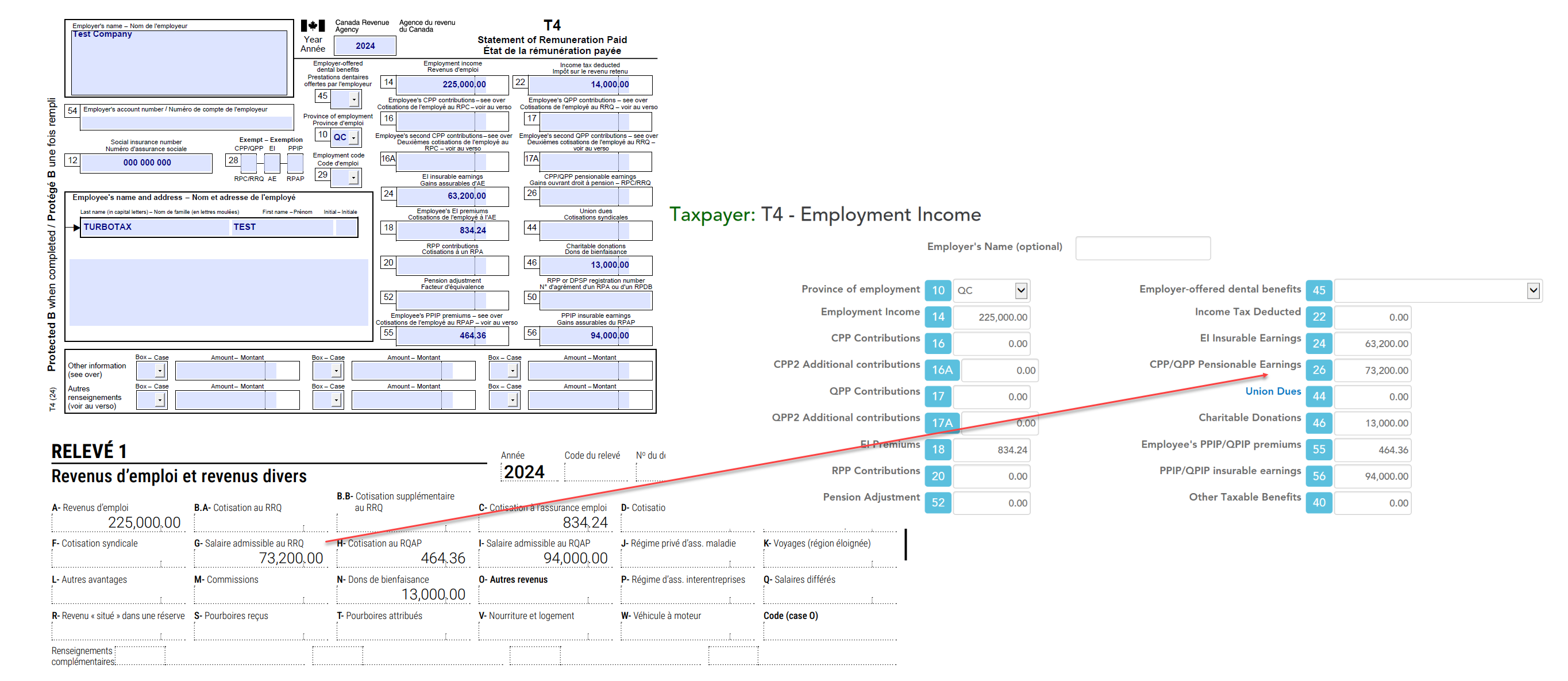

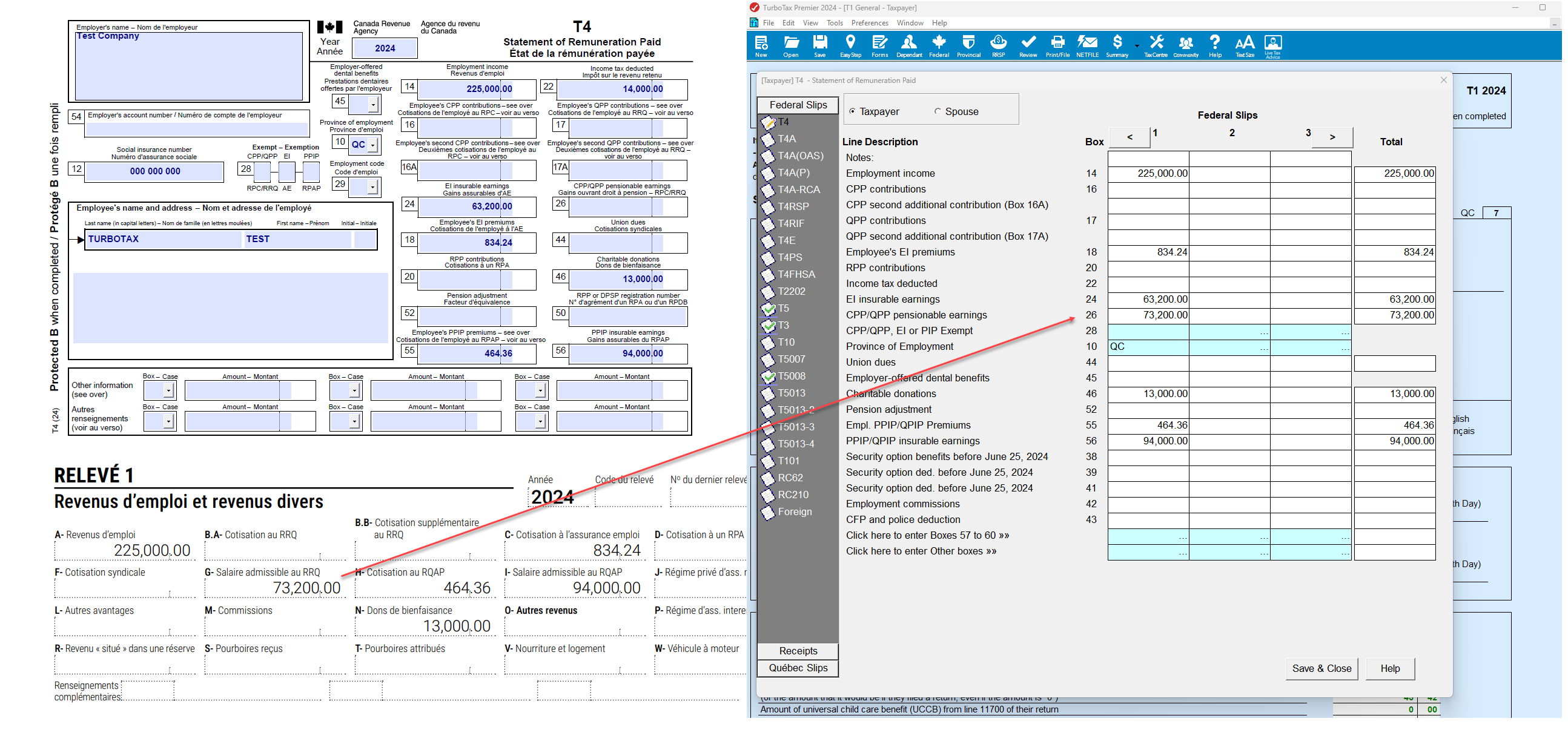

Québec scenarios (box 10 on your T4 shows "QC")

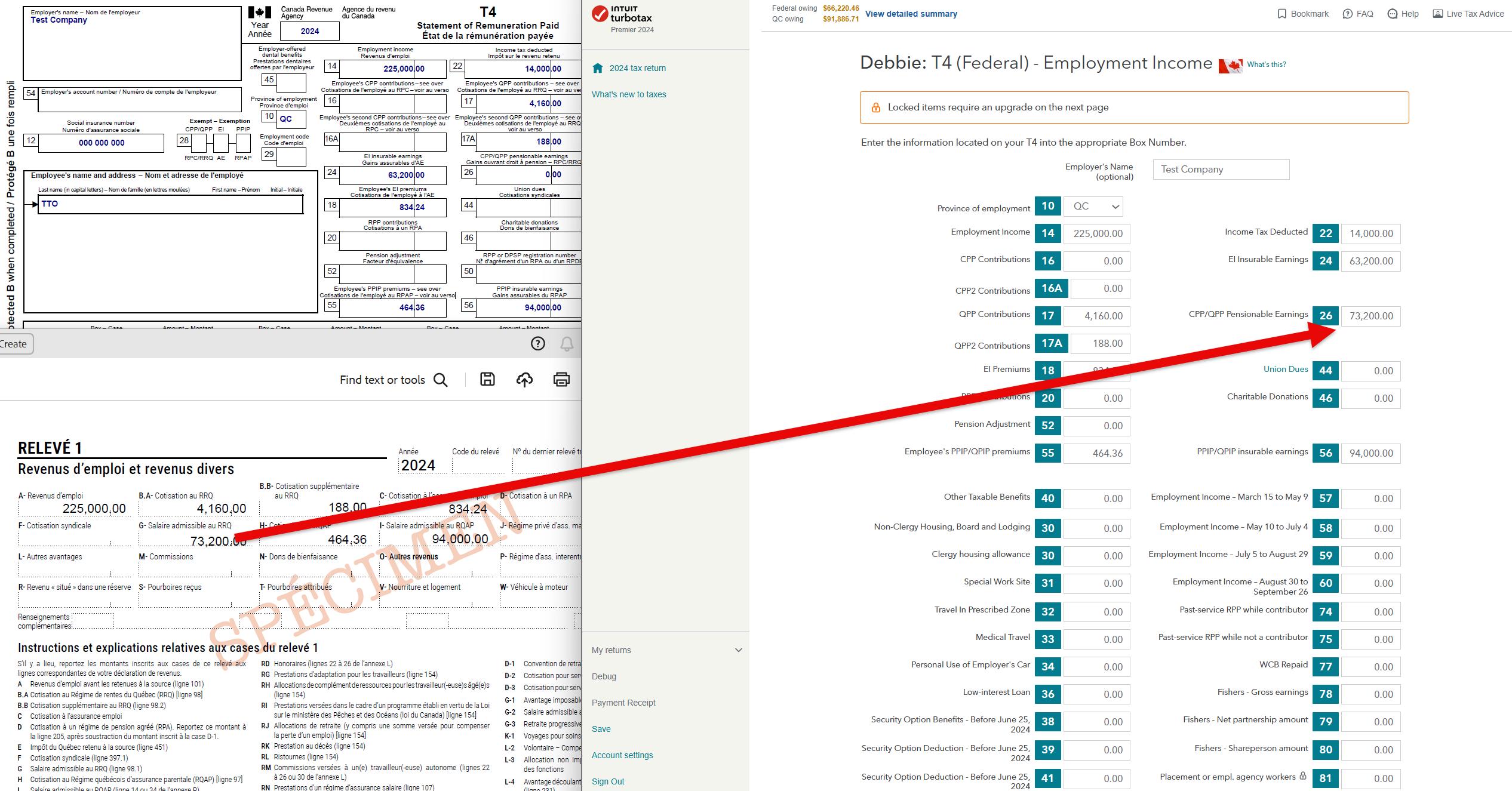

Scenario 1: Boxes 17 or 17A have amounts, box 26 shows "0", and box 28 is blank (no "X" for CPP).

What this means: QPP contributions were taken from your employment income (as shown in boxes 17 or 17A), but your employer put “0” in box 26.

What to do: Enter the same amount that’s in RL-1 box G into box 26 (up to the maximum $73,200). If your box G amount is higher than $73,200, you should only enter $73,200 in box 26.

Scenario 1 in TurboTax Online

Scenario 1 in TurboTax Desktop EasyStep

Scenario 1 in TurboTax Desktop Forms

Scenario 2: Boxes 17 or 17A have amounts and box 26 is empty (no "0").

What this means: QPP contributions were taken from your employment income (as shown in boxes 17 or 17A), but box 26, which should show your pensionable earnings, is empty.

What to do: Enter the same amount that’s in RL-1 box G into box 26 (up to the maximum $73,200). If your box G amount is higher than $73,200, you should only enter $73,200 in box 26.

Scenario 2 in TurboTax Online

Scenario 2 in TurboTax Desktop EasyStep

Scenario 2 in TurboTax Desktop Forms

Scenario 3: Boxes 17 or 17A are empty and box 26 shows "0".

What this means: No QPP contributions were taken from your employment income (boxes 17 or 17A are empty), and box 26 also shows "0."

What to do: Enter the same amount that’s in RL-1 box G into box 26 (up to the maximum $73,200). If your box G amount is higher than $73,200, you should only enter $73,200 in box 26.

Scenario 3 in TurboTax Online

Scenario 3 in TurboTax Desktop EasyStep

Scenario 3 in TurboTax Desktop Forms

Scenario 4: Boxes 17 or 17A are empty, box 26 is empty (no "0"), and box 28 is blank (no "X" for QPP).

What this means: QPP contributions were taken (boxes 17 or 17A are empty) and box 26 is also empty.

What to do: Enter the same amount that’s in RL-1 box G into box 26 (up to the maximum $73,200). If your box G amount is higher than $73,200, you should only enter $73,200 in box 26.

Scenario 4 in TurboTax Online

Scenario 4 in TurboTax Desktop EasyStep

Scenario 4 in TurboTax Desktop Forms

Scenario 5: Box 17A has an amount, box 17 is empty, and box 26 is empty (no “0”) or has an amount.

What this means: QPP contributions were taken and only Box 17A has an amount.

What to do: Remove the amount that’s in box 17A and enter that amount in box 17 instead.