Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Filing, printing, post-filing

- :

- After you file

- :

- Tax transfer amount for Quebec resident working in Ontario.

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax transfer amount for Quebec resident working in Ontario.

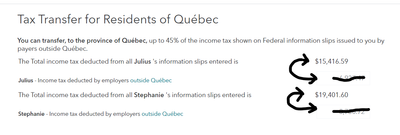

I selected to transfer my taxes up to 45% but entered the wrong amount to be transferred. I was supposed to enter the total amount of taxes taken off but instead entered 45% of it not realizing the program would do the math for me. This left me with a bigger return from the Federal and a bigger "owed" amount for Quebec. (which is fine) but would this error have caused any other errors? Meaning is this line being pulled for something else?

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax transfer amount for Quebec resident working in Ontario.

No, it should be ok.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax transfer amount for Quebec resident working in Ontario.

Are you using TurboTax CD/Download or TurboTax Online?

If you have TurboTax Live Assist & Review, you can select Live Help or Expert Help to connect with a TurboTax specialist.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax transfer amount for Quebec resident working in Ontario.

HI Susan, it was Turbo Tax Online Live Assist & Review. I did review it with an employee including this section but was overlooked and everything looked good. Basically where it says "tax transfer for Quebec residents" you are suppose to add total amount of taxes. I entered 45% of the total. Then the program did 45% of that that amount resulting in less being transferred. So in the end, I will receive more in Federal and pay more to Quebec since less was transferred. What I'm unsure about is did that mess up anything else?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax transfer amount for Quebec resident working in Ontario.

No, it should be ok.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax transfer amount for Quebec resident working in Ontario.

Thank you 🙂

Related Content

Hofstra0514

New Member

julius toltesi

Level 2

e-c-o

Returning Member

taxidweather2-

New Member

brodyonekenobi

New Member