- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Education

- :

- Re: The reason for not qualifying for the American Opportunity Credit is that " Education institu...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The reason for not qualifying for the American Opportunity Credit is that " Education institution employer ID number (EIN) not entered", which I have. How do I fix this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The reason for not qualifying for the American Opportunity Credit is that " Education institution employer ID number (EIN) not entered", which I have. How do I fix this?

Please revisit the screen that says " Type in the info from your 1098-T."

- The box that is labeled Filer's federal ID no. is the (EIN) for the school, not the student's social security number.

- This sometimes may cause the error.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The reason for not qualifying for the American Opportunity Credit is that " Education institution employer ID number (EIN) not entered", which I have. How do I fix this?

I brought over my 2018 tax return that has the same college EIN number as my 2019 but I keep getting the error that it is not entered. I have deleted the form and redone it numerous times. I also can see it listed on the 1098-T form and it is correct. How do I fix this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The reason for not qualifying for the American Opportunity Credit is that " Education institution employer ID number (EIN) not entered", which I have. How do I fix this?

Please go through the Education Interview. There may be an answer regarding the school or degree answered incorrectly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The reason for not qualifying for the American Opportunity Credit is that " Education institution employer ID number (EIN) not entered", which I have. How do I fix this?

I am having the same problem

i entered the Federal id number and rechecked all answers and it still has same Error

thanks Ken

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The reason for not qualifying for the American Opportunity Credit is that " Education institution employer ID number (EIN) not entered", which I have. How do I fix this?

You would have to print out your required tax forms and submit them by mail.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The reason for not qualifying for the American Opportunity Credit is that " Education institution employer ID number (EIN) not entered", which I have. How do I fix this?

I do not think we're getting accurate information and updates to Federal and State affecting the form.

- Foreign Exchange students that have filed 2018 and prior were fine till 2019.

- You can no longer submit your taxes electronically unless you enter a correct EIN for the school.

- Foreign school, many do not have EIN numbers compared to US Based.

Families supporting kids that go to a International Accredited school throughout the world are left with short end of the stick.

Trying to enter any of the following 99-999999 or 00-000000 will not yield any positive results.

Leaving it blank and entering a foreign address with blank EIN will still yield or flag it for corrections.

This can be a difference of paying back quite a bit of taxes, or receiving a small amount. I think we need Intuit/TurboTax to be more clear and fix the bug. If there is proof needed I'm sure the families are able to provide. Many are stuck and unsure how to proceed.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The reason for not qualifying for the American Opportunity Credit is that " Education institution employer ID number (EIN) not entered", which I have. How do I fix this?

I am having the exact same issue. Is there a solution to this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The reason for not qualifying for the American Opportunity Credit is that " Education institution employer ID number (EIN) not entered", which I have. How do I fix this?

Try deleting and re-entering the 1098-T.

Click this link for more info on EIN not entered.

This link has instructions on How to Enter a 1098-T.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The reason for not qualifying for the American Opportunity Credit is that " Education institution employer ID number (EIN) not entered", which I have. How do I fix this?

I am having the same issue. Has someone found a fix for this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The reason for not qualifying for the American Opportunity Credit is that " Education institution employer ID number (EIN) not entered", which I have. How do I fix this?

Try deleting the 1098-T and re-entering it. How to delete forms in TurboTax

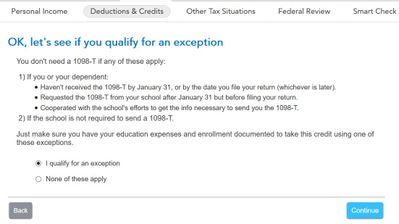

Go back through the Education section and re-enter the 1098-T. If you have an actual 1098-T with the correct US issued 9 digit EIN, answer Yes to the Did you get a 1098-T? question. If you are using anything else, answer NO to the Did you get a 1098-T? question. The next screen allows you to indicate if you have an exception to the 1098-T requirement.

Some important tips about entering this form:

- Enter your 1098-T exactly as is, even if the amounts are wrong (this is common). You'll get a chance to correct this info and enter additional expenses later on

- Leave blank boxes blank. Don't enter 0 for any blank boxes on the form, as this generates errors

- Parents: If the student listed on the 1098-T is your dependent, enter the 1098-T on your return, even if your dependent paid the tuition

- Students: If you're not being claimed as a dependent, enter the 1098-T on your return regardless of who paid the tuition, unless it was your employer. In that case, just keep the 1098-T with your tax records

- TurboTax Free Edition doesn't support Form 1098-T

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

The reason for not qualifying for the American Opportunity Credit is that " Education institution employer ID number (EIN) not entered", which I have. How do I fix this?

I believe this is a genuine technical error on TurboTax. I was able to get my AOTC when I revised my form in the "Federal Review" stage and was able to enter my EIN after the 3rd time I "reviewed" the form. Then I was prompted to "Relaunch my Deduction Calculator" (or something of that nature) and then my AOTC appeared affective.

I made a Discussion Post myself and posted the above here. I thought I'd reply here so the answer is more findable.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

larockmanhere

Returning Member

adrian_moore100

New Member

rudolfolt63

New Member

aigranias18

New Member

taxi11

New Member