Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Navigating TurboTax

- :

- Credits & deductions

- :

- How do I choose the spouse who claims the DTC?

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I choose the spouse who claims the DTC?

Hi We tried all these spouse is not listed as dependent the issue is the credit for DTC and caregiver credit are not showing on any of us return even we answered the questions correctly. Like I mentioned before if you look at the call log I have spent twice 1h30 mins and couldn’t resolve the issue and that to repeat same process without any solution each time and was promised a call back for a solution to this issue unfortunately no one did.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I choose the spouse who claims the DTC?

@ghausia As my colleague Susan asked previously, are you claiming it for a Dependent or a spouse? The steps she gave you, are if you are claiming DTC and caregiver for a dependent.

If the spouse is the one with a handicap or limitations, it's true, you should not have their info under Dependent, but you can easily apply all this in your TurboTax Desktop, when you are doing a joint return. Here are the steps for each spouse (the one who claim - NO handicap and the one WITH a handicap):

In Forms mode - for the person who claim the credit (NO handicap):

Click on Forms tab (at the bottom of the screen) // select INFOWS // page 1 - under Tax payer Information, select YES to the related questions.

After INFOWS, click on Forms tab (at the bottom of the screen) // select DTC form // at the top of this form, make sure ALL questions are NO.

In Forms mode - for the person WITH a handicap:

Click on Forms tab (at the bottom of the screen) // select INFOWS // page 1 - under Tax payer Information, select NO to the related questions.

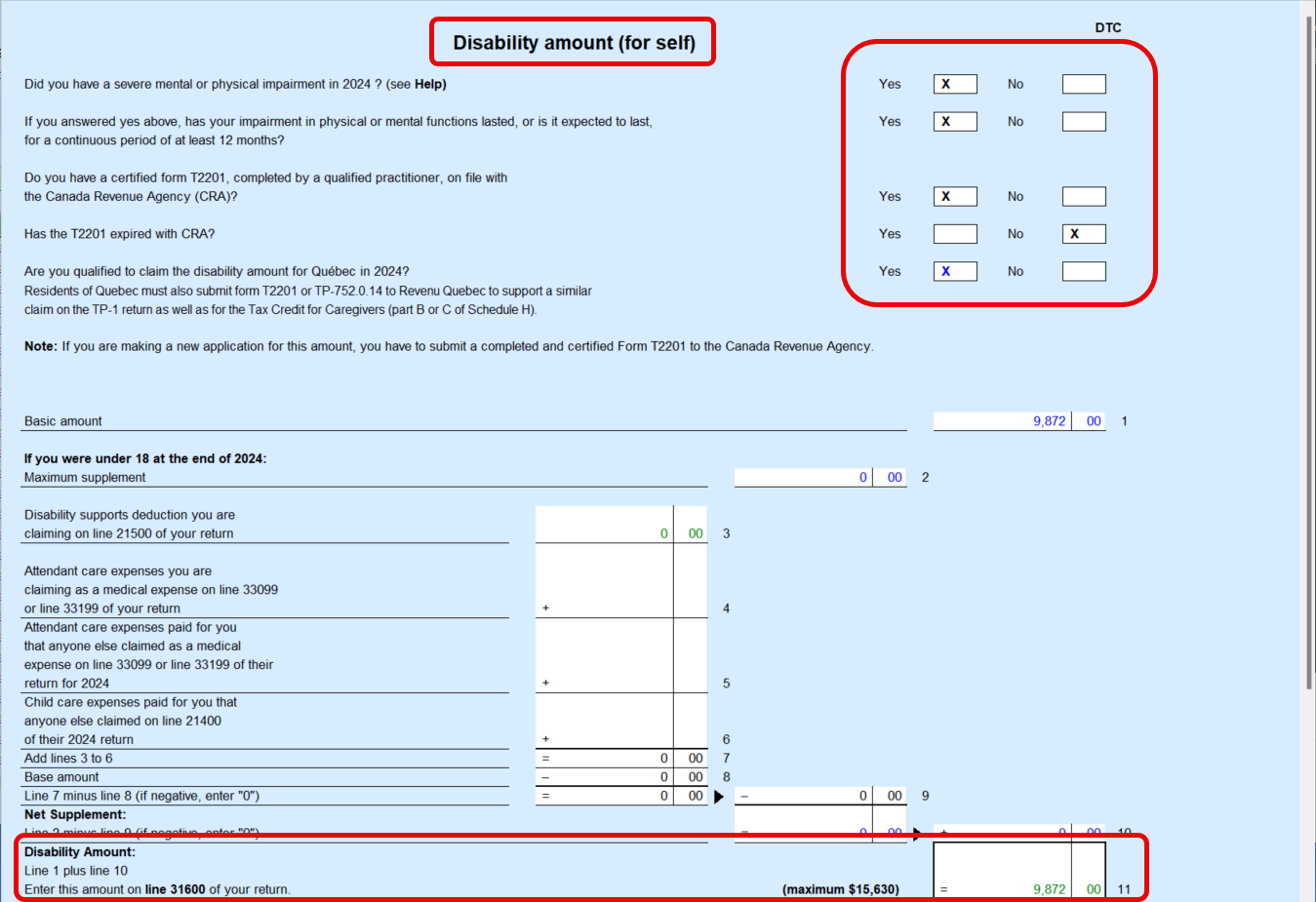

After INFOWS, click on Forms tab (at the bottom of the screen) // select DTC form // at the top of this form, make sure ALL questions are YES, EXCEPT the one asking if T2201 expired with CRA (should be NO)

After these steps are done, you can confirm DTC was transferred from the handicap spouse to the claimer on line 32600.

Caregiver amount will be on line 30425 of the claimer T1.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I choose the spouse who claims the DTC?

Hello

Thank you as i explained before these steps have been followed and this is not for the dependent transfer but for spouse.

Here is the screen shot of the person with or the person who claim the credit (NO handicap)

Here is the T1 general from for the spouse claiming the credit, you can not see these credit on line 326000 for DTC transfer and no caregiver credit on 30425 either.

In Forms mode - for the person WITH a handicap: i have followed same steps and you can not see the credit there either.

This is the issue i am facing and is still waiting for an update for the Turbo Tax Team

Thank you.

Ghausia

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I choose the spouse who claims the DTC?

@ghausia As per CRA, if you are eligible for the Canada caregiver amount for your spouse, their net income needs to be between $8,397 and $28,041. You must first claim $2,616 when calculating the spouse amount on line 30300 of your Schedule 5 and their net income from line 23600 of their return (or the amount that it would be if your spouse filed a return) was less than your basic personal amount plus $2,616 if your spouse was dependent on you because of an impairment in physical or mental functions.

We recommend you to verify all of the above and contact CRA for more details and confirm your eligibility to this non-refundable credit.

Here is the link to contact CRA

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I choose the spouse who claims the DTC?

Hi Veronique,

ok I can do that for the caregiver credit no problem but can you at least answer why the DTC is not showing it’s been a while now and frustrating for a client for not getting a call back or a solution on this. Below I clearly showed you that I answer all questions but still not showing the DTC on line.

Let’s focus please on the DTC for now please

thank you

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I choose the spouse who claims the DTC?

Any update please i realy need your help to fix this DTC credit transfer and it has been weeks now and it is not resolved.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I choose the spouse who claims the DTC?

@ghausia did you have a look at DTC form under your spouse?

DTC form of your husband should look like this:

And yours should look like this:

Then the amount will show on line 31600.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I choose the spouse who claims the DTC?

But Veronique I am the one with the Disability and If you look at my previous email and screenshot I share here I did the same thing and the amount is not showing up this is the issue I am facing and no one is really resolving this issue. Please kindly look at my previous screenshot and email shared

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I choose the spouse who claims the DTC?

can I do that? Like answering the question incorrect so the credit is transferring to the spouse?

If not how do I transfer the DTC to the spouse correct

secondly the person with disability has an income of 20k only so spouse should get caregiver credit so why it’s not coming up automatically on the turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I choose the spouse who claims the DTC?

@ghausia Sorry, I misunderstood, I though your husband was the one with a disability.

But it will be the same but reversed. I just want to clarify, DTC and Caregiver credit are not the same.

Your DTC form should look like this - and the amount for your disability credit will show on your T1 line 31600.

If you didn't use this amount or you used a portion of it, the balance can be transferred to your husband on his T1 on line 32600. It is automatically done by the software, if you selected YES in INFOWS form of your husband, to both questions about transfer

and your INFOWS form should be NO to both questions.

If you still experiencing issues with all this, I invite you to send me a private message and it will be easier for us to find the reason why you are unable to apply your DTC and/or transfer it to your husband.

To send me a private message, click on my name and select send a message.

Unlock tailored help options in your account.

Related Content

andremichaud25

New Member

Raheel77

New Member

noelhaliski

New Member

whatisthiscrud

New Member

Bellacat

New Member