Open TurboTax

Open TurboTax

Why sign in to the Community?

- Submit a question

- Check your notifications

- TurboTax Support

- :

- Discussions

- :

- Filing, printing, post-filing

- :

- Filing

- :

- Resident of Québec who works in Ontario with RL-1 with limited information

- Subscribe to RSS Feed

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Resident of Québec who works in Ontario with RL-1 with limited information

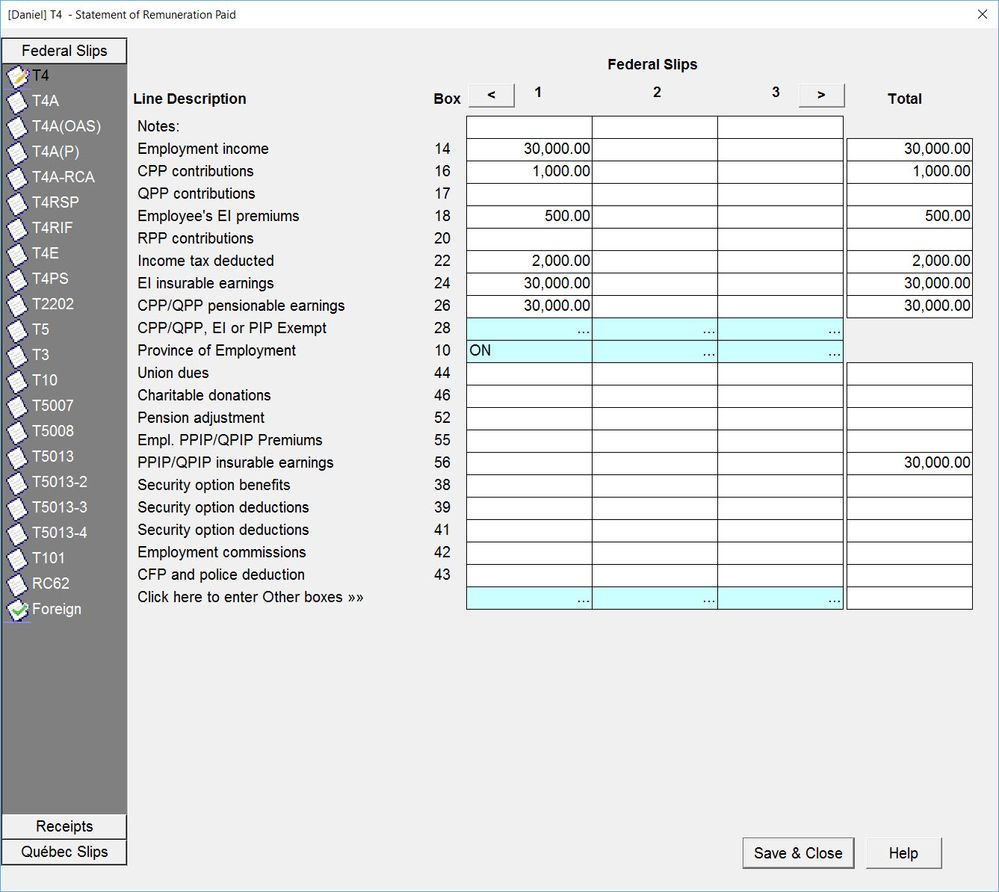

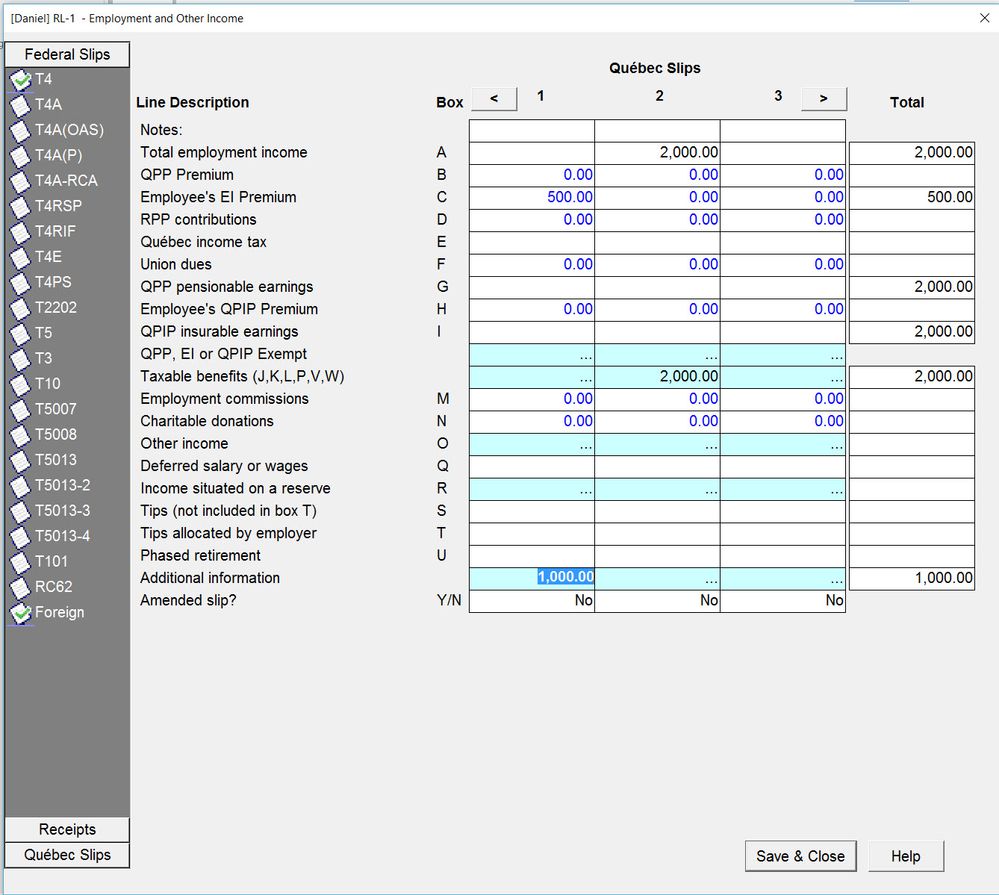

I am a Québec resident, but I work in Ontario. I have received both a T4 and a RL-1 from my employer. However, my RL-1 only has amounts in the A and J (they're the same amount, as J is the contribution to a private health insurance).

According to Revenu Québec (https://www.revenuquebec.ca/documents/fr/formulaires/tp/2019-12/TP-1.G%282019-12%29.pdf), I need to take add case 14 of my T4 to my total revenue. I don't see directives for other fields.

When I fill in the T4 in TurboTax, it auto-completes some fields from the T4 to the RL-1. In my case, these fields don't correspond at all. Should I overwrite these fields to make them be the same as my actual RL-1, or just add case 14 of my T4 to case A of my RL-1 and let TurboTax do the rest?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Resident of Québec who works in Ontario with RL-1 with limited information

Hello! Enter your T4 in the first column (part of the RL-1 will be filled but leave as is) and then enter your RL-1 (contribution to a private health insurance) in the second column.