- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Importing your data

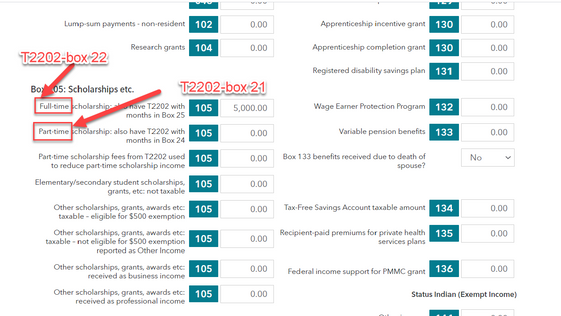

If you received a grant (box 105 of a T4A), report it as scholarship income in one of the first two options (full-time or part-time whichever the case may be). On your T2202, Box 21 will specify if you were a part-time student, and Box 22 will specify if you were a full-time student. Since you were considered a full-time student, you would enter the Box 105 amount in the spot for full-time students on the T4A screen (Full-time scholarship: also have T2202 with months in Box 25).

The attached photo below will indicate where to input the amount:

March 25, 2021

11:20 AM