- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

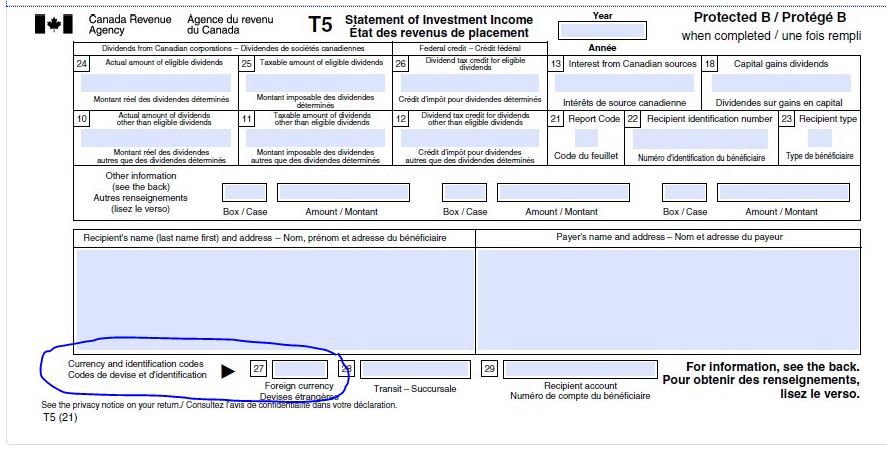

Box 24 Foreign Currency is not present on T5 page. Should it be entered elsewhere?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

As per this Canada Revenue Agency (CRA) webpage - T5 Statement of Investment Income – slip information for individuals Box 24 on the T5 is "Actual amount of eligible dividends". There is no box for Foreign Currency on the T5.

Please double check what slip you have.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

TurboTax doesn't do currency conversions. So instead of a Box 27, you would enter the country in the box labeled "Source country of foreign income" at the bottom, but then then you would enter your amounts in Canadian dollars. You can get the exchange rate from this Bank Of Canada webpage: Exchange Rates

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

Source country of Foreign income is n/a, as this is US dollar saving account in Canadian Bank. Please advise also which exchange rate should be used? Daily? Monthly? Annual?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

Annual would be the easiest to use, but you can use the one of the other rates if it is more favorable to you. Ex: If you have interest from a US dollar bank account, you might want to use the daily rate for the actual day you received the interest, if that results in a smaller number.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

"Box 24 Foreign Currency is not present on T5 page" -- Not sure if this is a bug or a feature. The fact that TurboTax provides the user with no warning that TurboTax is not reading in the correct values when a T5 issuer has set box 27 to "USD" is a bug. At least it should warn users that they need to do a currency conversion themselves due to a (bug or missing feature) in TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

You will see foreign currency on the bottom right of the T5 in TurboTax - It doesn't say box 27 but says Source country of foreign income. This is where you will enter the country code.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

This is clearly inadequate on the part of Turbo Tax programming. The T5 slip is one mandated by Revenue Canada for use in reporting interest income. It does have a box 27 that denotes the currency if not Canadian. Proper programming would have a line indicating the exchange rate used as opposed to using Source Country (mickey mouse solution here) when in fact it is not issued by a foreign country but instead is Foreign Currency income issued by a Canadian bank. Saying TT does not convert is inaccurate since TT does convert US$ income on a true foreign slip (ie: US Social Security) where both the US$ amount is entered as well as the exchange rate used. TT then does convert to Cdn$. So to on a T5, TurboTax should convert on the basis of the exchange rate entered.

Your instructions do not clarify whether the income should be recorded in Cdn$ (US$ divided by Exch rate) or in the foreign currency dollar amount. I have chosen to record in the converted Cdn amount and hope i don't have to explain this shortcoming by TT to CRA.

Please escalate this issue to the proper department and hopefully TT will perform better in the future.