- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

We moved to our rental property after the sale of our home. After 2 years we sold the rental and moved to a rental house/ How to repot this in my tax refund this year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

It would be a good idea to contact the Canada Revenue Agency (CRA) and see how they want you to report this sale.

If you are in Canada or the United States, you can call the CRA at 1-800-959-8281. If you are elsewhere, you can call 613-940-8495. This page has more ways to contact the CRA: Contact the Canada Revenue Agency

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

Thank you.

I called CRA they told me I missed reporting the change of property from rental to principal but I wonder why. I followed Turbo Tax steps, how could Turbo Tax of missed that? What is the option to report the change in Turbo Tax? How can I speak to Turbo Tax about this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

In order to help you with this situation, we believe your best option is to contact our telephone support team for further assistance, as they have the option to view your screen to see what was missed. To contact them, please follow this link: Contact Us.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

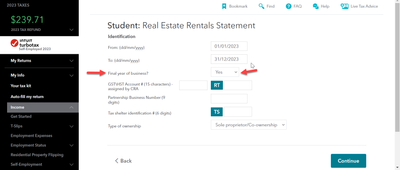

The final year that you had a rental unit you would have had to enter it as shown below, on your income tax return: