- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I record capital gains for 50% co-ownership of rental property?

I need to know where I add the 50% co ownership in the capital gains of a sold property

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

You would use Schedule 3. You would only put in your share of the amounts, so that you only report your share of the capital gains.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

So, I am looking at filing in 2020 capital gains for 2019 on the co-ownership sale of a rental property. When I test it in the 2018 software, on schedule 3, it only allows you to type in the Proceeds of deposition value, Adjusted Cost Base and Outlays. We are 50/50 co-owners and have reported that since we had the rental. The final sale value was $275K, initial value was $250K and outlays of $3500. So, if I do what you say, I would report Adjust Cost Base of $250K, Proceeds of deposition of $262,500 (half the gains) and outlays of $1750 (half) for each of us?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

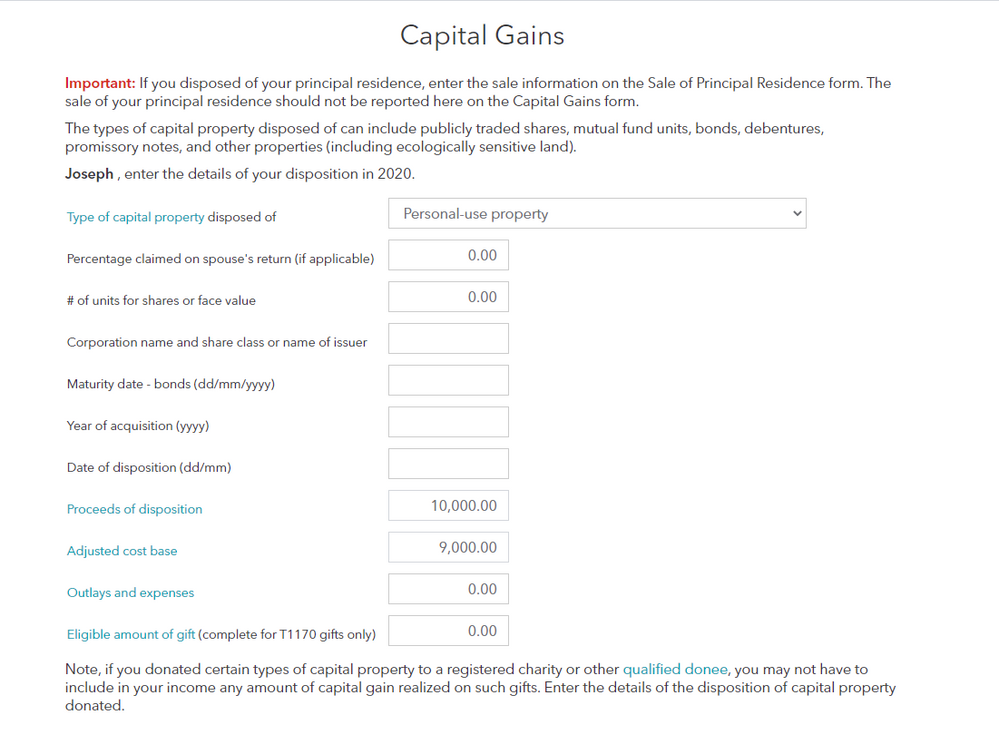

just to confirm... you will do this on the capital gains page?

For example: I own 10% of the property, and my parents own the remaining 90%. The property sold for $100,000, and the adjusted cost base is $90,000.

I would put $10,000 as my disposition and $9,000 as my adjusted cost base right? like what I have below?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Investors and rental owners

Yes, you got it. You only report your share.

I hope this was helpful