- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

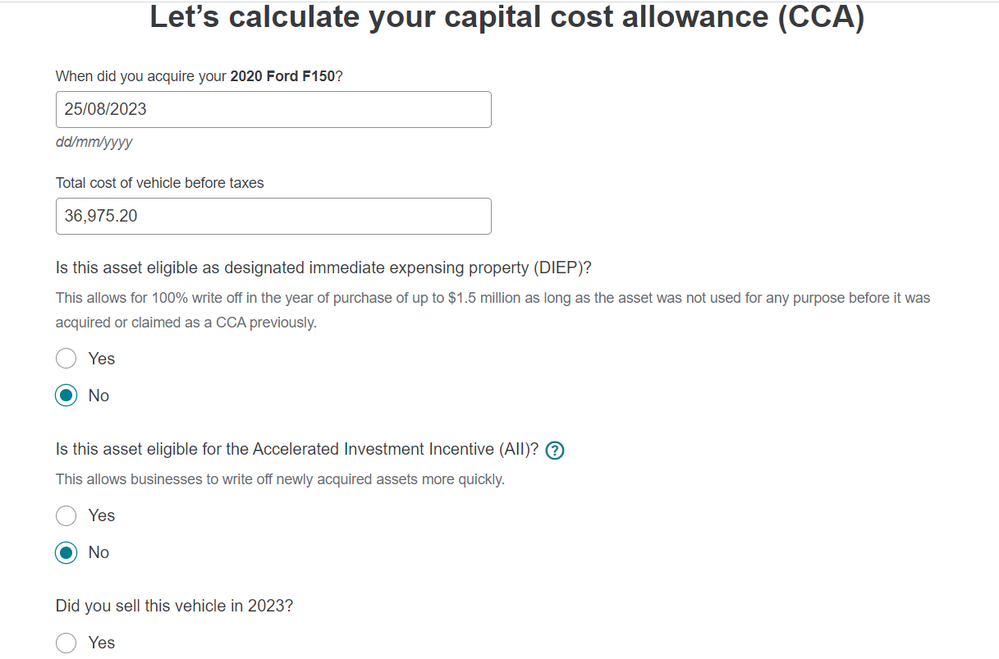

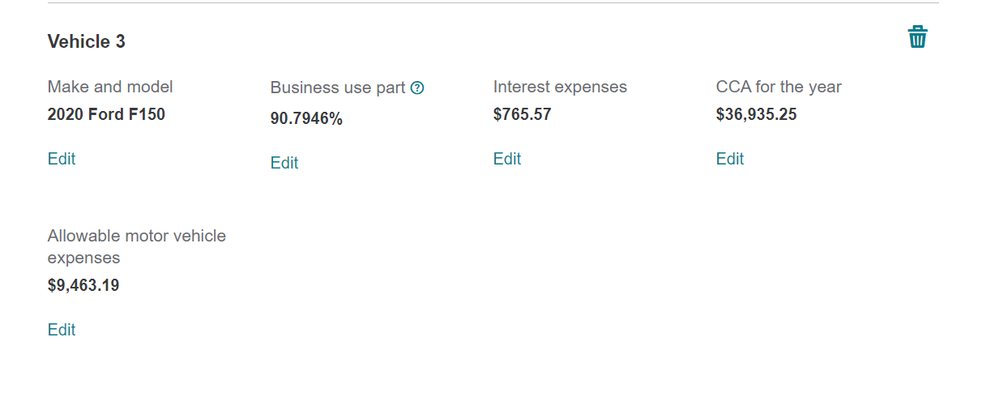

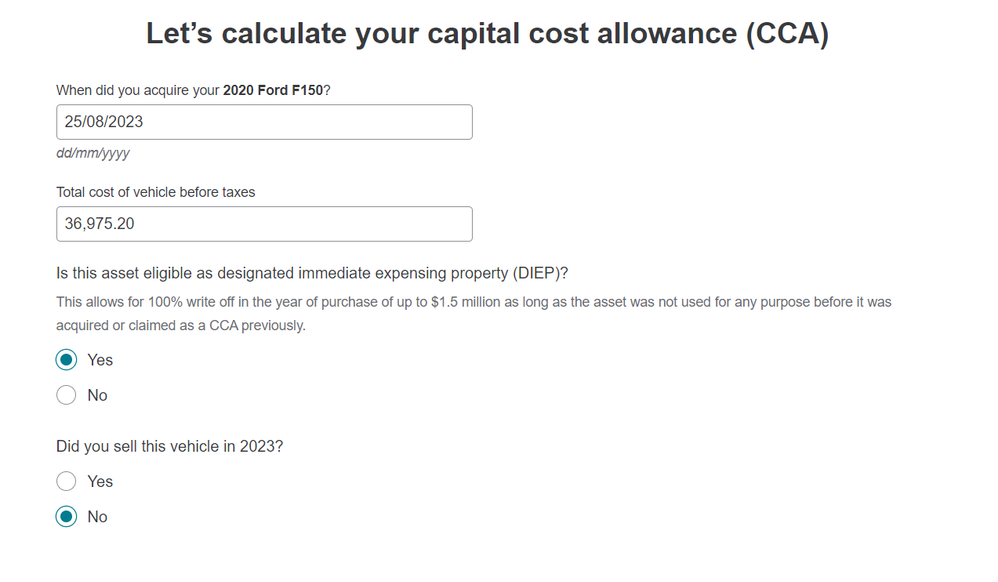

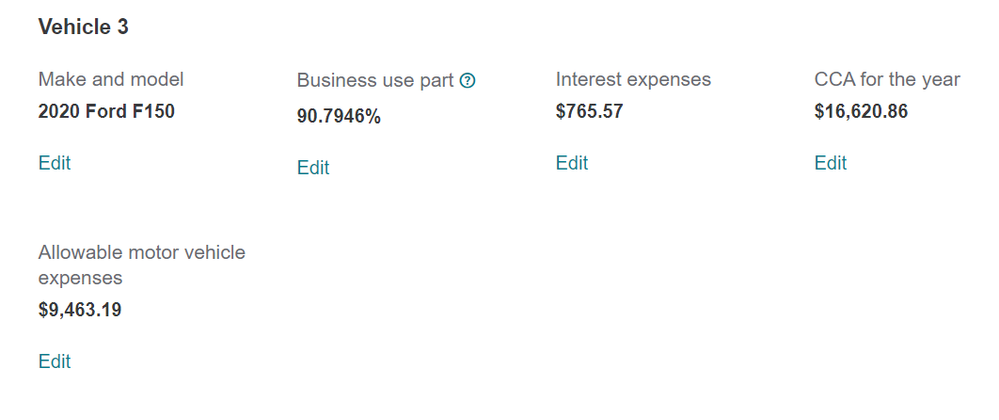

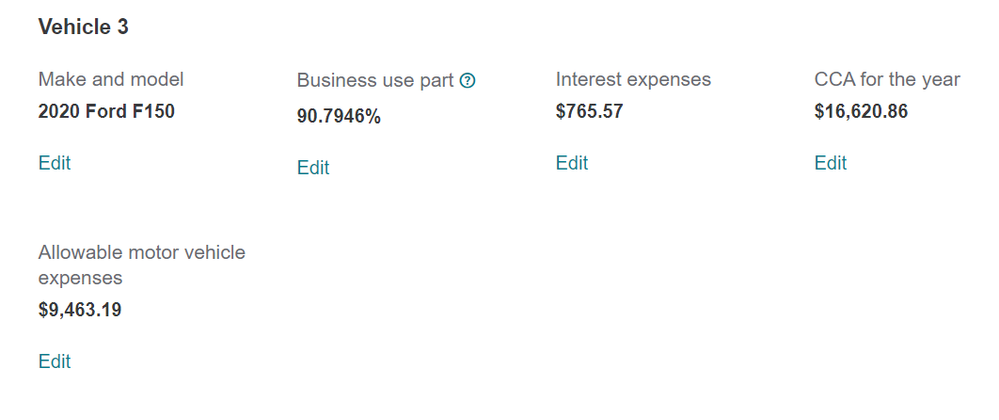

In CCA for a new vehicle, in the section "Is this asset eligible as Designated Immediate Expensing Property (DIEP), the Yes and No are working in reverse?

If I choose No (the correct answer), I am given a CCA of $36,000. If I choose Yes (the wrong answer) I am given a CCA of $16,000.

February 20, 2024

8:01 PM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

Can you please send us pictures of exactly what happened and amounts seen as when we tried on our end it seemed to work.

Thank you for choosing TurboTax.

February 21, 2024

8:09 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

Sure, I have attached 4 screenshots.

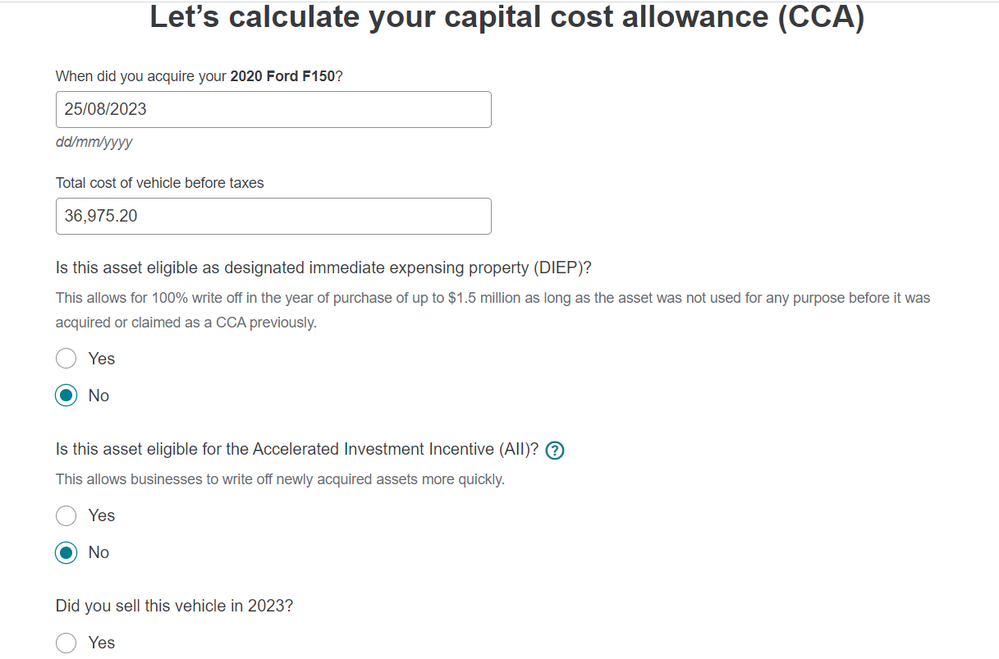

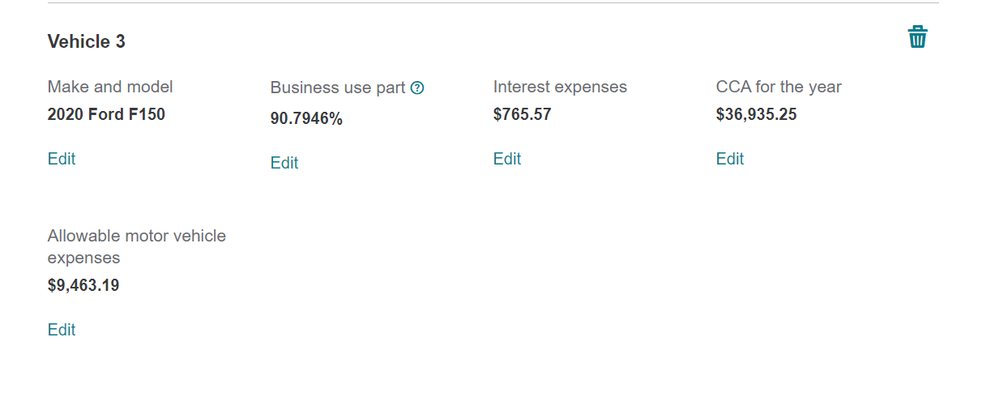

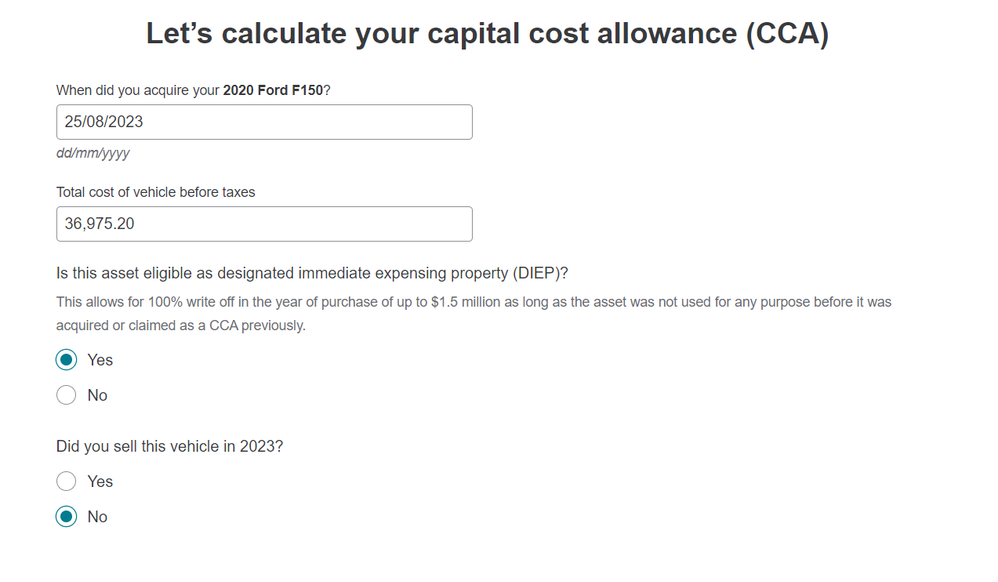

In Vehicle Expenses, CCA for the Year, after choosing Class 10.1, on the page "Let's Calculate Your Capital Cost Allowance (CCA)", under the question "Is This Asset Eligible As Designated Immediate Expensing Property", if I choose No it gives a CCA of $36,935.25; if I choose Yes, it gives a CCA of $16,620.86. This seems reversed. The higher amount should be for property eligible for immediate expensing. The lower number allows you to expense it over time.

February 23, 2024

11:46 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

Thank you for the information- can you also let us know which TurboTax software you are using so that we verify the correct one- Download or Online?

February 26, 2024

6:52 AM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

Thank you, this is a known issue and the team is working hard at getting it resolved. We will be back to update as soon as its complete.

Thank you for your patience in this matter.

February 26, 2024

9:23 AM