- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

Sure, I have attached 4 screenshots.

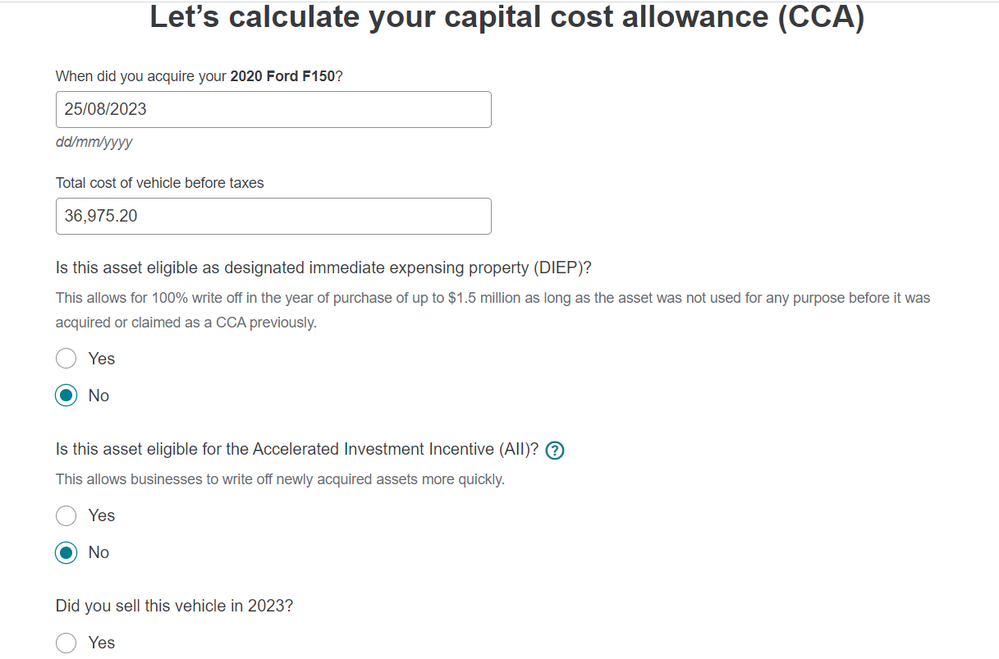

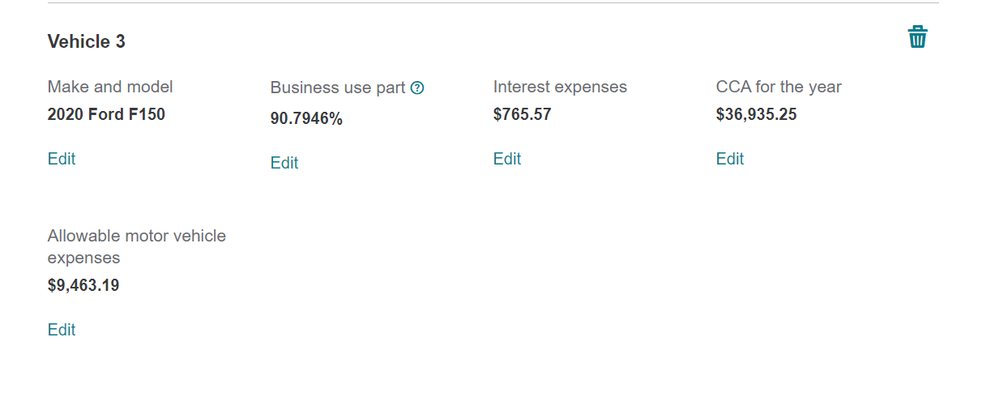

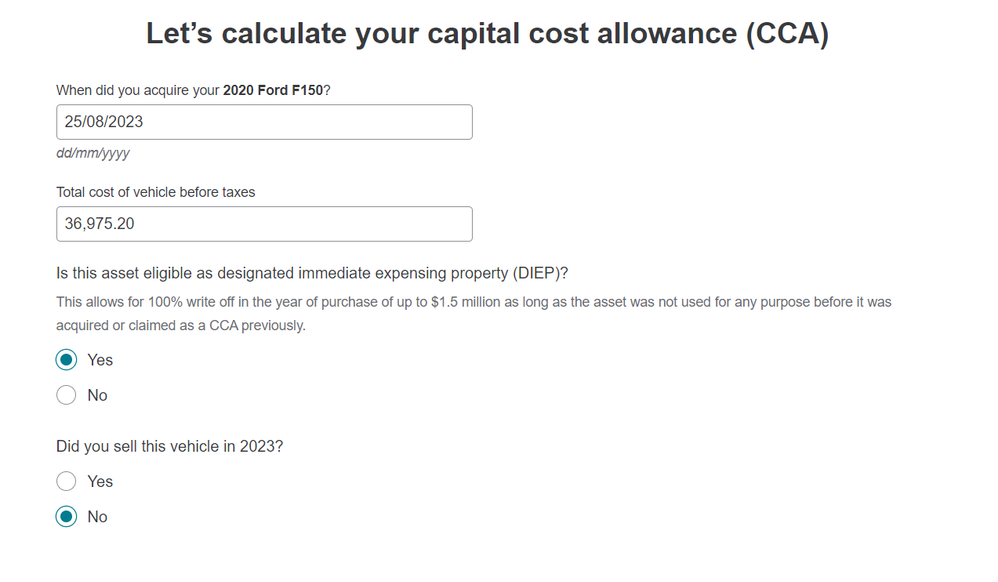

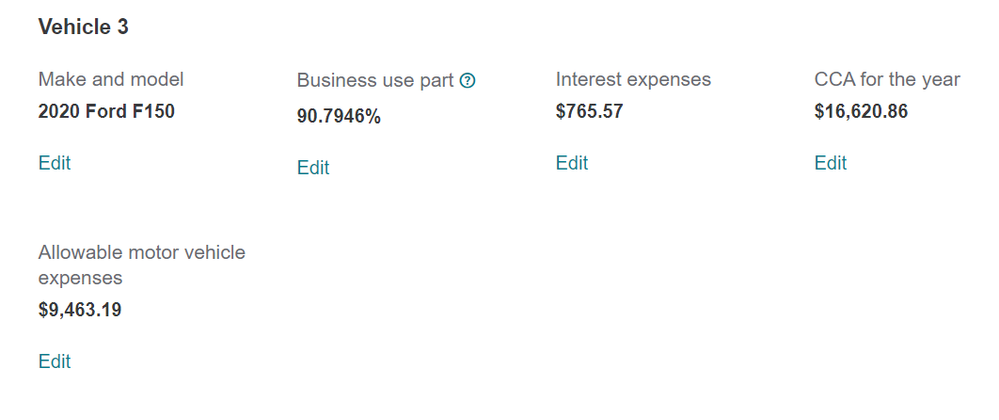

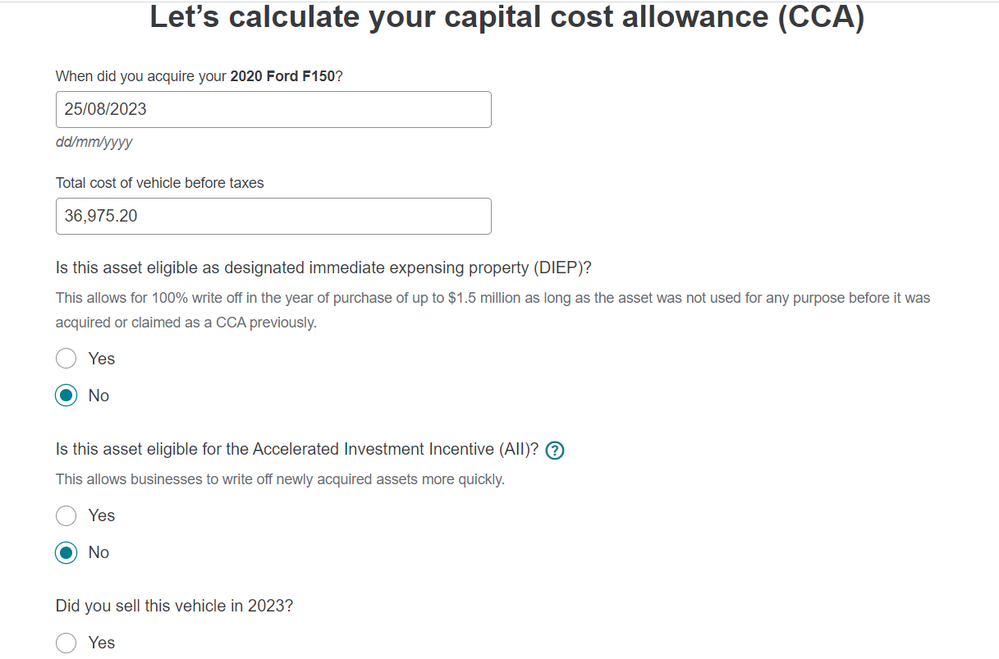

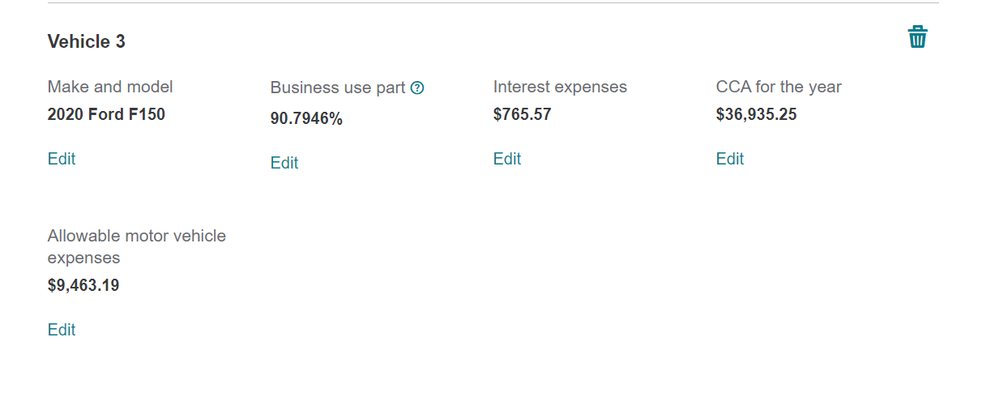

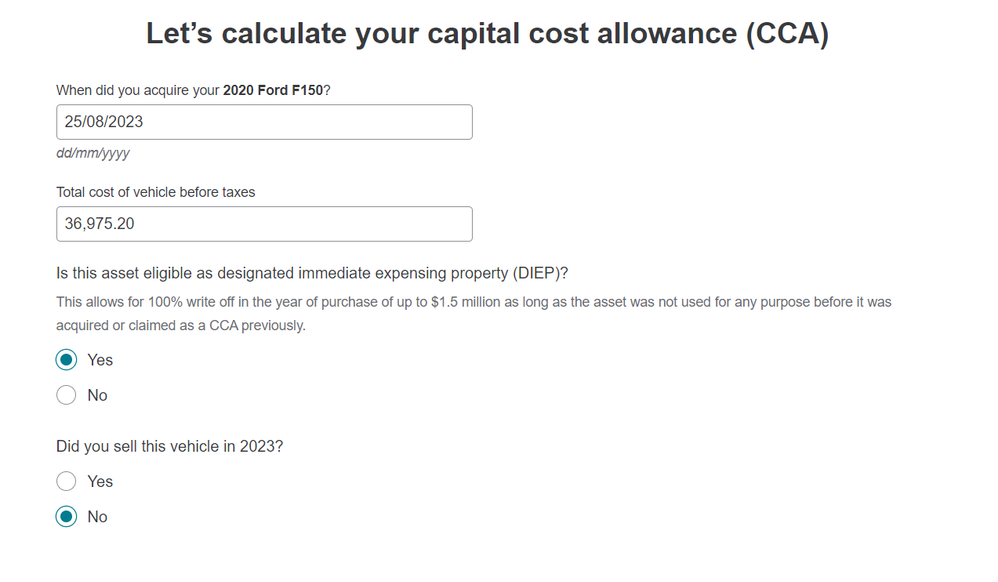

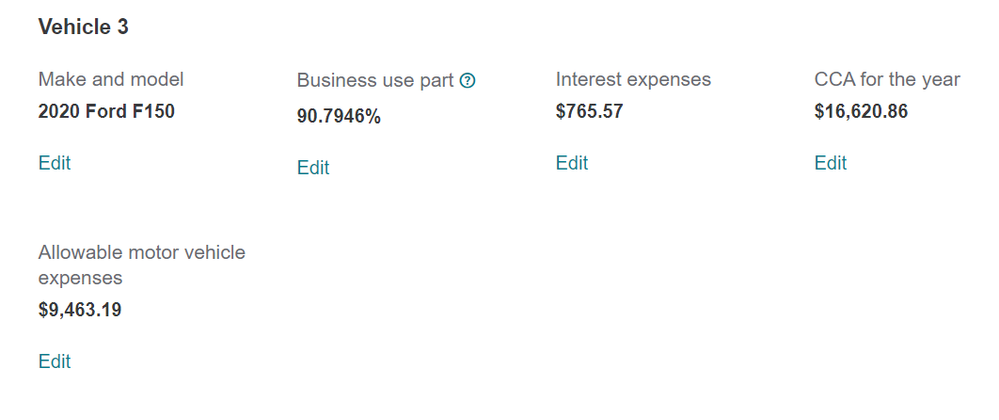

In Vehicle Expenses, CCA for the Year, after choosing Class 10.1, on the page "Let's Calculate Your Capital Cost Allowance (CCA)", under the question "Is This Asset Eligible As Designated Immediate Expensing Property", if I choose No it gives a CCA of $36,935.25; if I choose Yes, it gives a CCA of $16,620.86. This seems reversed. The higher amount should be for property eligible for immediate expensing. The lower number allows you to expense it over time.

February 23, 2024

11:46 AM