- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Self-employed

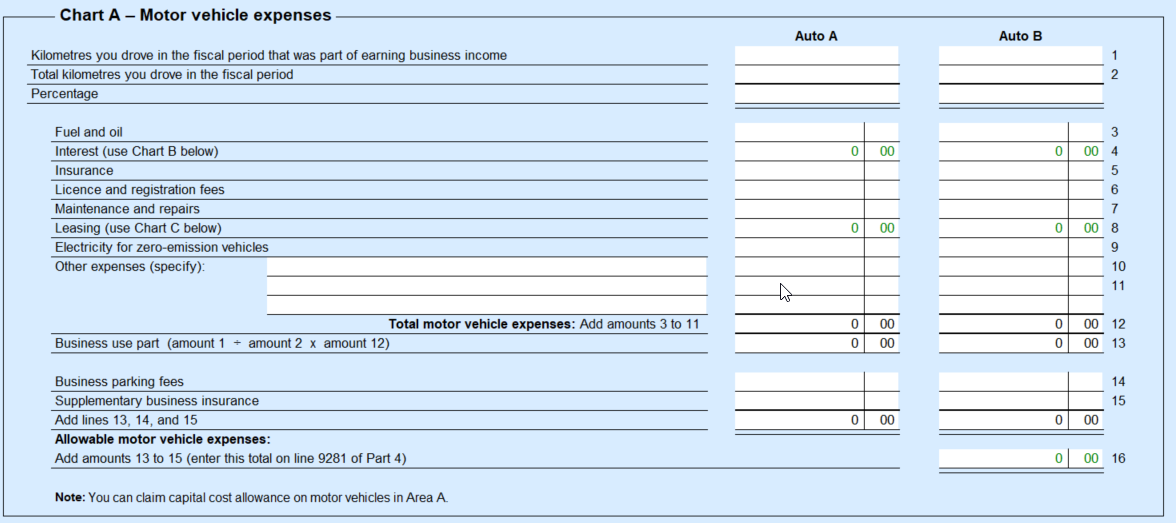

If you are using TurboTax Desktop, you should be able to enter all information about vehicle expenses in the T2125 form, page 9, under the Chart A section.

In TurboTax Online, in Self-employment section, after you entered all information about your business and income, you will have the expenses section. You will need to add all expenses type you have , like car expenses.

All you have selected, will show on the page (like a summary) of expenses type. You just have to click start and enter the information.

Thank you for choosing TurboTax.

April 13, 2025

2:06 PM