- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I want to transfer unused tuition credit to my parent. I indicated as such in my return. Do I need to also submit a Schedule 11? What documentation does my parent need?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Seniors and students

Yes, you need to fill out a schedule 11.

Here are some FAQs that you might find useful:

How much of my child’s or spouse’s unused tuition credits can be transferred to me?

How do I claim my tuition fees?

How do I transfer my unused tuition credits to someone else?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Seniors and students

I see now that TurboTax had attached and automatically filled out a Schedule 11 for me in my tax return.

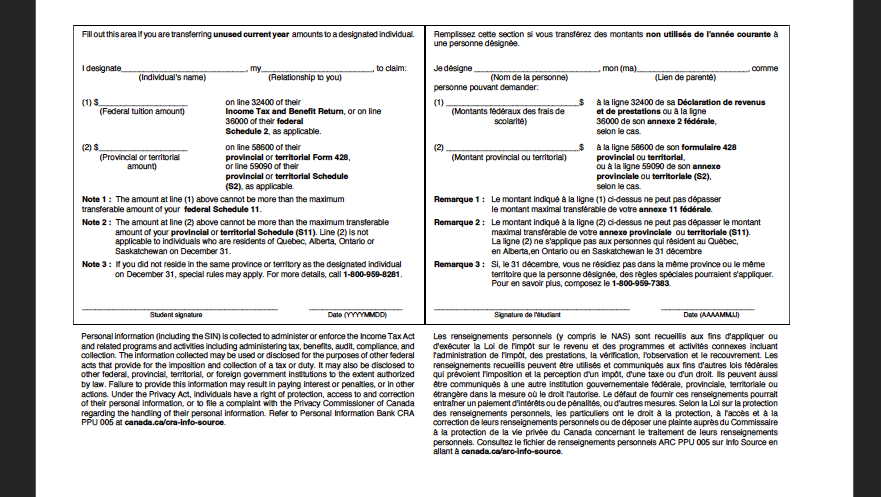

Now... there is a box about transferring to a parent on the back of the T2202s (image attached). Can I just fill out that box and send that page to my parent or do I need to also send my Schedule 11 to my parent for their return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Seniors and students

In order to transfer your unused tuition credits to someone else, you'll first need to inform them of the precise amount(s) so that they can claim them on their own tax return. The first step is to enter your income information into TurboTax, then claim your tuition fees. TurboTax will then automatically calculate the maximum amount of credits you may transfer to another party.

Refer to the following steps for instructions on how to transfer your unused tuition credits in TurboTax: How do I transfer my unused tuition credits to someone else?

Thank you for choosing TurboTax.