- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to remove the work from home tax credit in the online version

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credits and deductions

Hello -

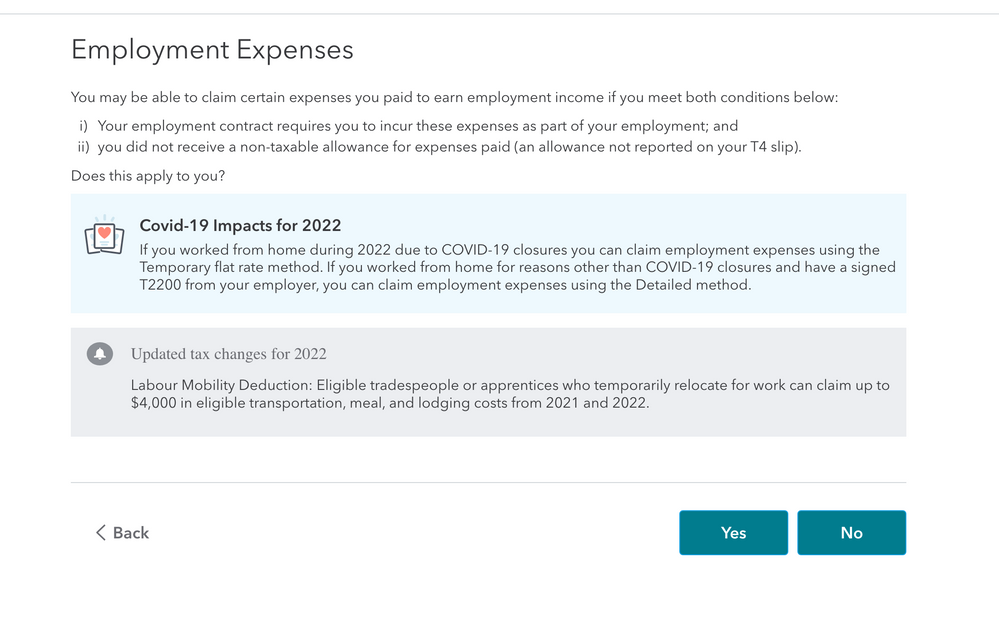

In the "Employment Expenses" section in Turbotax Online product, you will see the following screen asking if you had any Employment expenses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credits and deductions

Thank you, but I have not selected any options to be entitled to the credit. Everything is set to No. I cannot find a way to remove it from my allowed credits.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credits and deductions

Hello @rowleez,

You might be able to find "t4 employment income" on the left side of the screen, under T-slips, and if you scroll down that page there is the question "Will you claim employment expenses for working at home due to COVID-19 for income on this T4?", can you change that to "NO" ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credits and deductions

Thank you for your response, I did find that, and had not originally selected an option. I selected No, but the credit is still sitting there even with the change and re-saving it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credits and deductions

@rowleez If you are still not able to resolve this issue, please contact our phone support team at 1-888-829-8608.