- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

FHSA Carryforward Amount Available to deduct

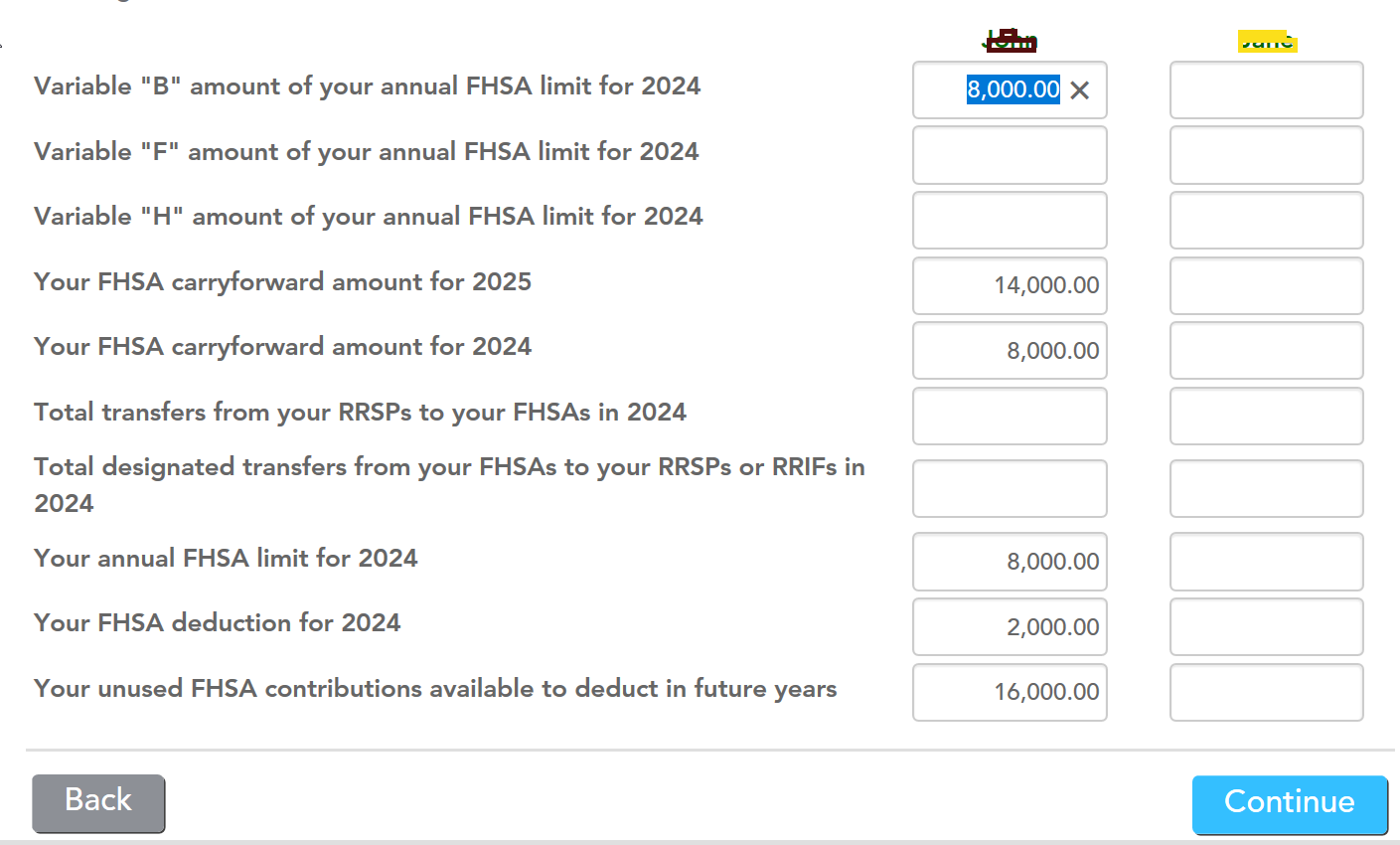

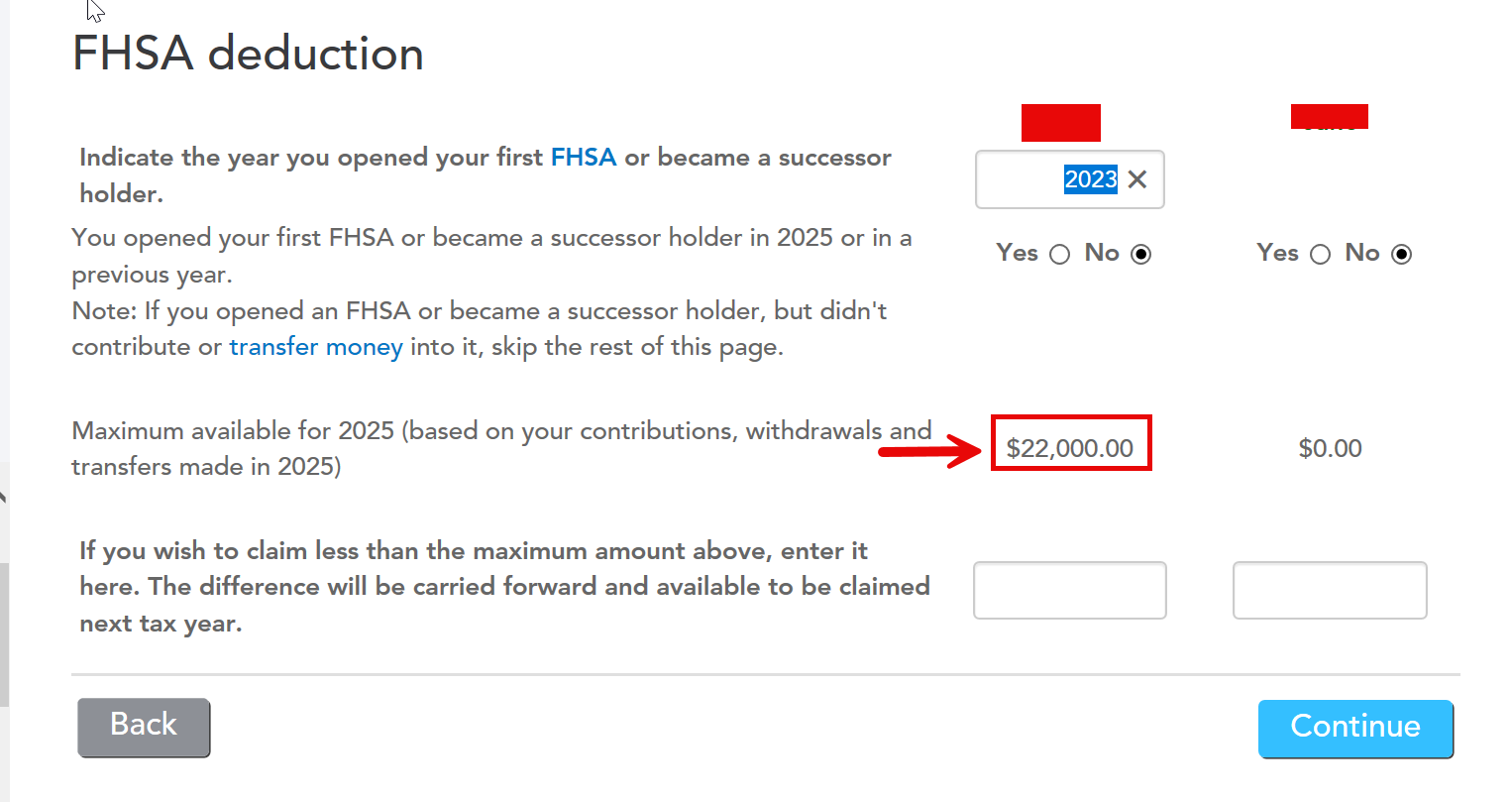

I have an FHSA opened in 2023. Have contributed $8000 each year since then, so working with $24,000 (2023, 2024, 2025). In 2024 I used $2000 of it and carried forward the rest. So now doing 2025 taxes and I can't seem to get the system to show $22,000 that I would like to deduct for 2025. (It will only allow me $14,000) And yes I did input my $8000 2025 contribution on the previous step by step page. I have attached screenshots of the Turbotax FHSA pages. The only way I can make it work is input $8000 on the line "Variable "B" amount of your FHSA limit for 2024". So what am I missing, and/or where do I input my 2025 $8000 contribution to equal $22,000?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credits and deductions

I know that CRA Autofill is not available yet for TY 2025. I want to make sure that you have correctly added all the information from your TY2024 NOA.

I have replicated and am getting the same results.

If the software still shows $14,000, you can manually enter $8,000 into "Variable B." This field represents the sum of previous years' participation room; entering $8,000 here manually causes the software to recognize the total available room of $22,000.

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credits and deductions

Following further investigation, I'd like to confirm that you added T4FHSA first. When you reach the "Amounts from Notice of Assessment or Reassessment" section, double-check that you've entered the correct amounts for each year.

I tried it using the information you provided, and the calculations were correct. I've attached a screenshot for reference.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credits and deductions

Thanks for the suggestions. I checked with CRA and there is not anything regarding my FHSA on my 2024 NOA, CRA did verify that I did have $22,000 available to deduct for my 2025 taxes. Now it's just a matter of getting the boxes correct in Turbotax for the FHSA. I have attached screenshots showing that I input the $8000.00 contribution for 2025. I have also attached the main Turbotax FHSA page the way it stands now after Turbotax auto populated it. So as mentioned I have contributed $8000 each year of 2023, 2024, 2025 ($24,000), minus $2000 deducted in 2024, equals $22,000 that should be available to deduct for 2025. Is there a certain way the numbers S/B input so the bottom line shows $22,000? Or do I input $8000 in "Variable B" to force a total of $22,000 at the bottom? (As you have mentioned, entering in his field manually causes the software to recognize the total available room of $22,000?) Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credits and deductions

Thanks for all the details. I recommend contacting our phone support so they can screenshare and investigate this for you.

They are open Monday to Friday, 9 AM to 6 PM ET.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credits and deductions

Were you able to find a solution for this. I am having issues as well. It won't calculate deductions for much the same situation as yours as well as for a new FHSA in 2025 (no carryforward info)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credits and deductions

I have much the same issue and called today. Did the screenshare and their solution was to pay for the expert assist or hire an accountant. Not a lot of help!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credits and deductions

Yeah it seems the Turbotax Easystep doesn't work, so not sure if they will fix that in time for filing. There's no way anyone will help you further if you decide to pay for their support, as it's a software problem. Personally I'm just going to make it work by putting my $8000 amount into the Variable B box.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Credits and deductions

@Gerbear111 We're aware of the situation, and our team is working to resolve it. We sincerely appreciate your patience.