- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing

Never did fix it.

Spent many hours on the phone with Turbotax - nothing.

In the end, I had to manually override a bunch of values in Schedule 15 (FHSA) and print out the entire tax return and mail it in as you can no longer use NetFile if you override values.

Completely disappointed in lack of effort by Turbotax to fix this.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing

@Buchi14 We invite you to visit this FAQ article about the subject:

How do I defer my FHSA deduction?

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing

Still not fixed and super frustrating. I've been having the same issue and Turbo tax has not resolved it

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing

On April 21 I too am having the same problem. Both 2023 and 2024 Turbo Tax editions are up to date. FHSA opened in 2023 but first contribution in 2024. Turbo Tax gives me no contribution room carry over from 2023 and Turbo Tax blocks me from claiming more than an $8,000 contribution in 2024.

How do I restore my 2023 contribution carry over room of $8,000 please?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing

That article only addresses the flaw in 2024 TurboTax’s ability to defer to a future year.

How do I obtain my carryover from my 2023 tax return which Turbo Tax denied last year and which Turbo Tax isn’t showing my full $16,000 of contribution room in 2024?

Doug.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing

Re: "How do I defer my FHSA deduction?"

Thanks for the workaround @Anonymous. However, this is an obvious error in TT and it should be fixed ASAP! Your customer shouldn't be required to perform a convoluted override on a Schedule for a common request. User Bob273 said the override caused a problem with Netfile, which I want to avoid.

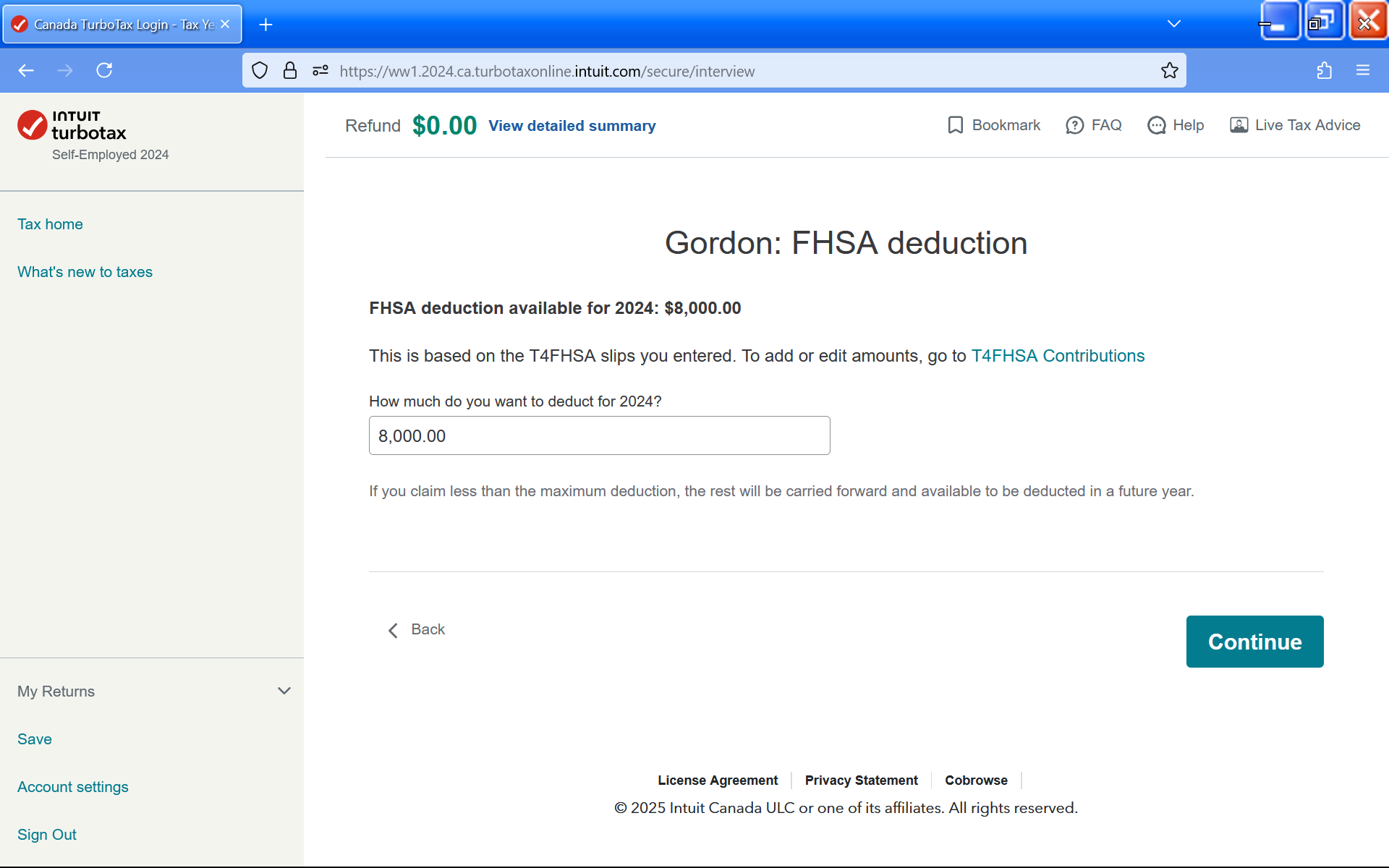

I have this problem in TT-2024 Desktop, which says: "Maximum available for 2024 (based on your contributions, withdrawals and transfers made in 2024) $8,000.00 If you wish to claim less than the maximum amount above, enter it here. The difference will be carried forward and available to be claimed next tax year."

I want to defer all, but TT won't accept a $0 claim for 2024; it's just ignored and total amount is deducted, no deferral. However, ANY non-zero number seems to work correctly. Even a $0.01 claim for 2024 results in $7999.99 carried forward.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing

What a crappy situation on T4 FHSA , Turbo charges money and it glitches on the amount to enter, Tubo is a ripoff ,they knew months ago the T4FHBSA DID NOT WORK ,but they charge before they tell you