- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

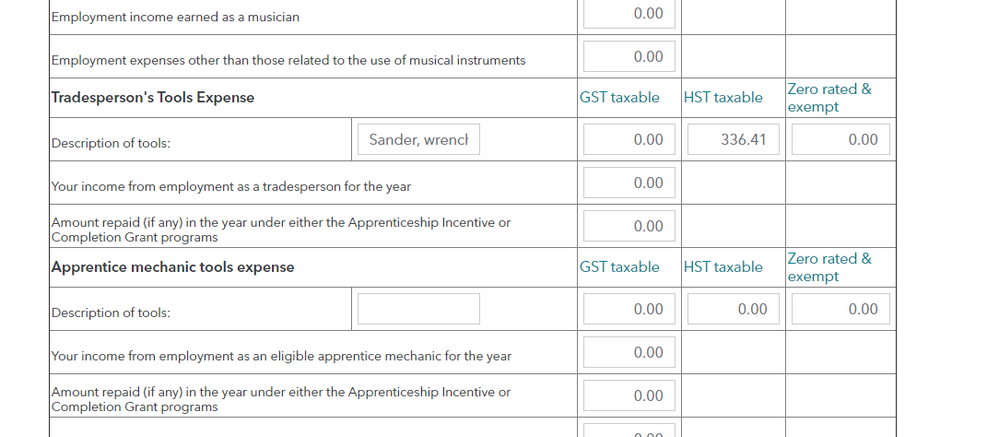

Claiming Trade Tools on TurboTax

On the "Other Employment Expenses" page under "HST taxable" should I enter just the amount I spent on HST on my tools, or the total cost of the tools? I have entered an amount of $336.41 (the HST only) and nothing has changed on my return. If it is supposed to be just the HST entered on this line, is there somewhere else I am supposed to enter the full value of the tools? If not, would there be another reason that I am not seeing a change?

Thankyou for your time.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Filing

In my experience all HST rebates and such are done separate from the tax return, so not sure why they are asking you for the HST...

My guess is only tools that you were charged HST on qualify to be entered there.

I understand them to be asking for the total amount that is taxable with sales tax, so the $100, not the $13.

But I don't know!

Also most of my 'tools' go through the CCA process (depreciated over time), but I'm not a tradesperson so it seems to be different for you!