- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Ontario Staycation Tax Credit - Not included in Turbo Tax Current Version

I'm ready to e-file and received a message in the application saying don't, the Ontario Staycation Tax Credit has changed and Turbotax will update in the next release. This impacts many Ontarians, what is the release date of the Staycation Tax Credit update so that we can e-file returns with this credit?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

Further to my previous message, I spoke to an agent at Turbo Tax who informed me CRA has not released their forms and for me to contact CRA to ask when that would be so that Turbo Tax can update date their software. I contacted CRA on this matter and they said the tax package has been finalized and released for tax software providers, it's on Turbo Tax to update their software so everyone can file. My question remains, when will your software be updated so everyone claiming the Staycation Tax credit can e-file their returns?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

Have there been any updates from TurboTax on this manner. I tried talking to someone today at TurboTax and they pretty much told me they do not know what is going on and their system is not working right now at customer service.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

Which TurboTax software are you using. I have verified my Online software and the Ontario Staycation is available and working as seen in the image below. Could you send us an image of what you see?

Thank you for choosing TurboTax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

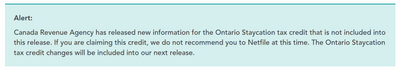

I am using the Downloaded TurboTax 2022 Standard and it allows me to enter in all the information for the Staycation Tax Credit and does the max perfectly but when I am on the NETFILE page at the end I get the following ALERT at the top of the Page

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

I get the exact same error. I purchased / downloaded Standard from your website and running Version 00.01.41 Build 4004 068G18. it needs a software fix applied as we can't e-file. Your Dev team needs to send out an update for us to install so we can file returns. At this point it's a complete fail.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

It should also be noted, do not e-file your return with this error. CRA advised it will be rejected, you will have to refile and it's a long ugly process to resubmit, months before you will see a refund, been there done that.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

Thank you very much for letting me know before I go ahead a try. I will wait for the update.

TurboTax please submit this update as soon as you can so we can submit our taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

Agreed, CRA's response was find different software to submit a return. Here's my response, I spent $50 for the application and invested several hours of my time preparing my tax return. Not doing that, just need a software fix. So much for getting ahead with the game, it's a shame.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content