- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Difficulties reporting net capital loss from previous years to claim against 2023 capital gains.

Hello,

On my 20022 notice of assessment I have about $5683 of capital losses which can be used. However, TurboTax shows I have 0 to apply in Line 25300.

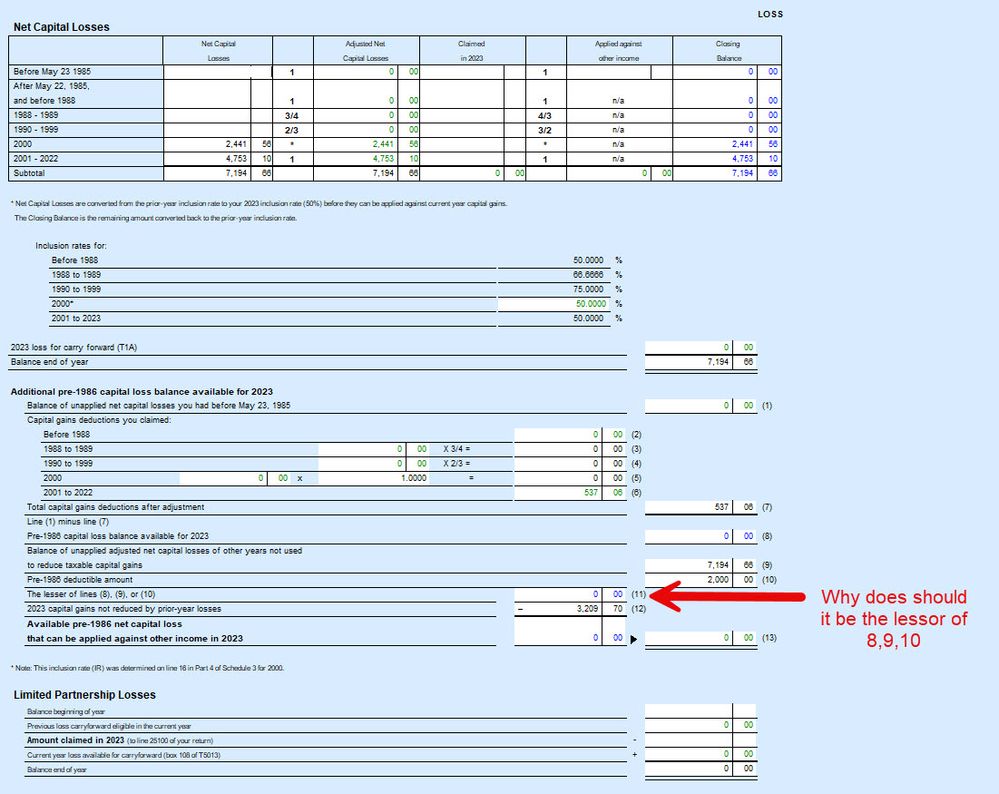

I attach the LOSS form for your reference.

In summary:

- In line 25300 has 0, when I click it takes me to the LOSS form

- The form in the Net Capital Losses shows I have a closing balance of 7195.66 (9) "Balance of unapplied adjusted net captial losses of other years not used to reduce taxable gains".

- Pre-1986 capital loss balance available for 2023 is 0 (8).

- Pre-1986 deductible is 2000 (10).

- The lessor of 8 [0], 9 [7195.66], 10 [0] goes into (11) which is 0

The next line results in a negative amount that can be applied 0 - $3207 = 0

I have 0 to apply, but revenue canada says I have $5683 available as capital losses.

I don't understand why (8), (10) matters. How can I correct 8 & 10 as it will block me from using the capital losses.

Do I need to override the 25300 and enter an amout equal to the capital gains I am offsetting and file manually? Please advise.

Thanks

Pat

Topics:

March 19, 2024

8:32 PM