- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Troubleshooting

Thanks for your response.

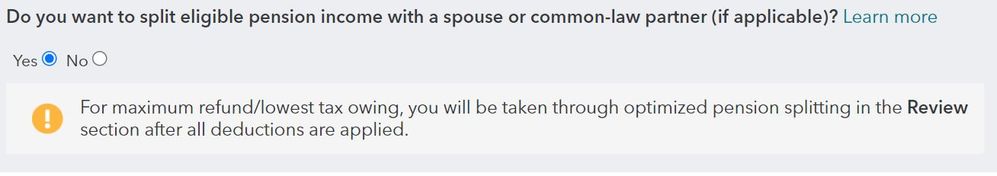

I'd forgotten that, for my wife, I did answer yes to the following question assuming that TurboTax would make the correct decision regarding splitting based on it's understanding of what's allowable.

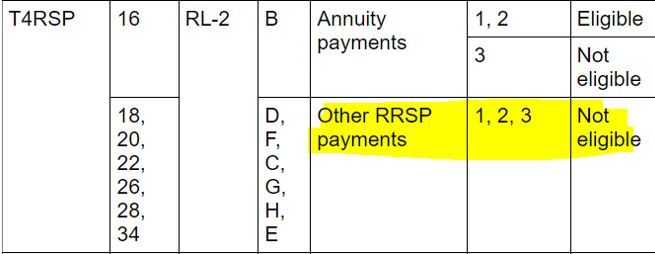

However, now looking at the CRA's rules below, I see that this RRSP income is not considered eligible. So I'm unclear on why, in the TurboTax income summary, I see 58% of the RRSP withdrawal applied to my income. From a tax perspective, this is what I want because I have a smaller income this year, but it seems like TurboTax is splitting the income regardless of whether I'm actually eligible to do so. (continued below).

What I'm hoping to hear is that TurboTax is legitimately moving some of the income over to my column because it was originally my income, I'm now 60 years old, and there's some reasonable CRA rule that says if it was originally my income and it's allowable to move some of that income back over to me in a year where my wife is actually earning more and it beneficial from a tax perspective.

What I assume, however is this:

1) If you specify that you want to split RRSP income, then TurboTax is going to do that whether you're actually eligible or not, and it's up to the taxpayer to know if that income is eligible or not.

2) I need to go back and answer "No" to the question above about whether I want to split the income.

If my assumptions are correct, I find it unfortunate that the CRA does not allow a husband and wife to rebalance contributions (i.e, no allowance for mistakes in balancing retirement). The problem I have is that I over contributed to my wife's spousal RRSP for several years, and the lion's share of our retirement is in her name. It's a self-induced wound from which the government will not allow us to recover from. We'll just stuck withdrawing in her name and paying a higher tax rate.