- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

if cra slips are downloaded online, do i need to manually split 50% combined income for spouse

I have my own mutual fund and i have joint/combined mutual fund with my wife.

when I download T-slips from CRA website, I get all T-slips, my own and joint T-slips.

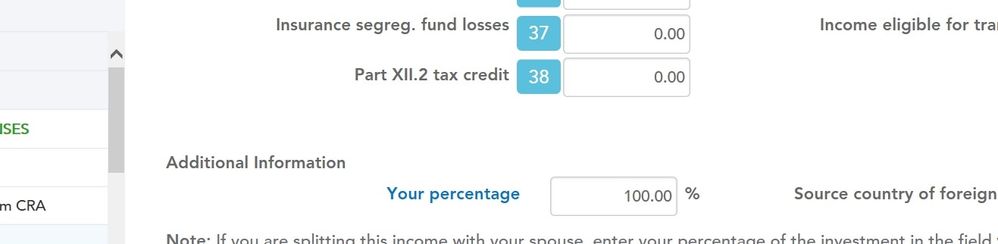

1. Do I need to go and manually show 50% in your percentage.

2. There are many slips automatically downloaded from CRA, how do I know which one is comined

and which on is individual.

Topics:

March 31, 2024

5:42 PM